The year 2023 was one of ups and downs for the U.S. economy. By most measures, and certainly official ones, the U.S. did not slide into a recession. Growth slowed then accelerated, the labor market cooled but stayed hot, inflationary pressures eased but stayed elevated. High interest rates were just about the only facet of the economy that were consistent after the Fed stopped their tightening process in July 2023.

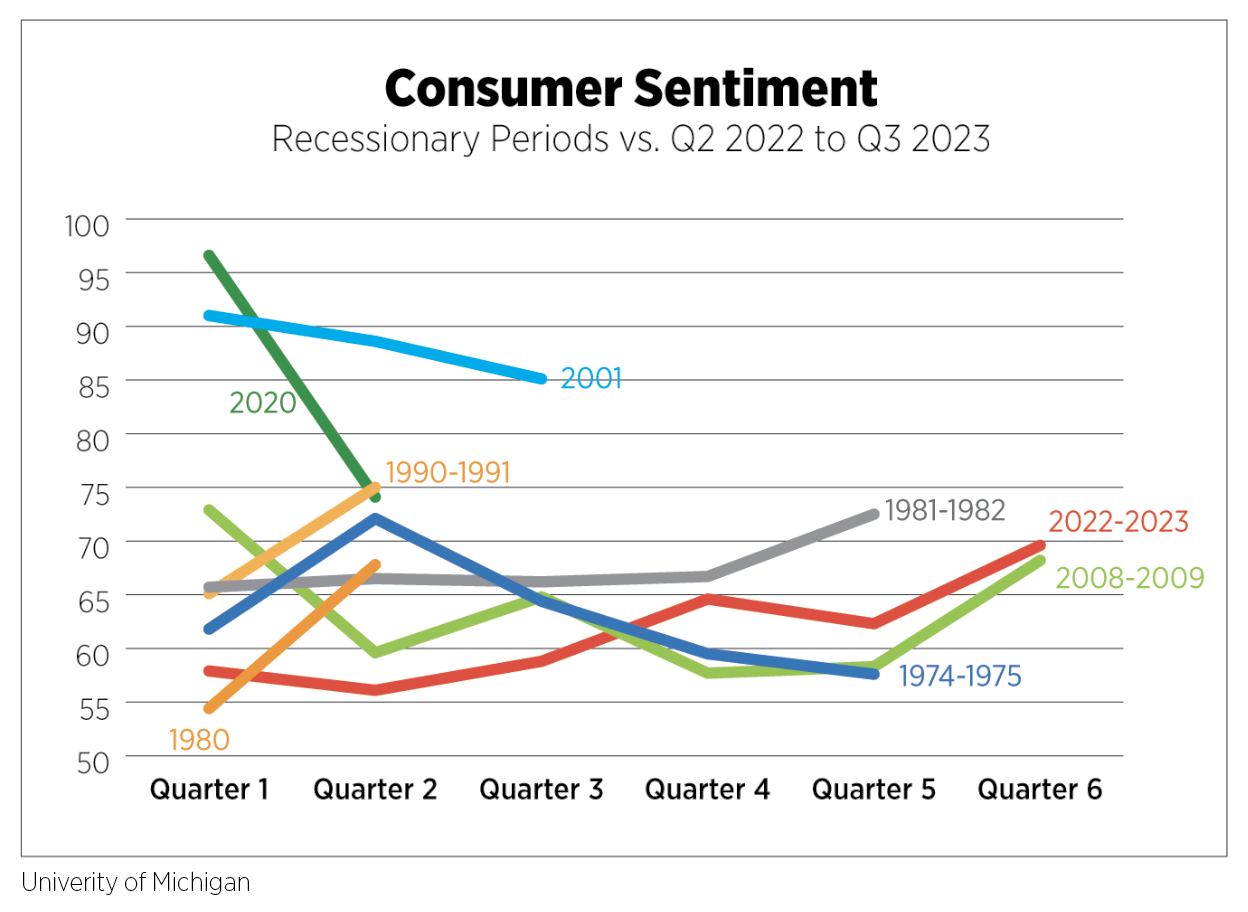

Inflation and high interest rates, particularly for those looking to buy a home, put a damper on sentiment. Both consumer and business sentiment remained at levels very indicative of recessionary periods, although consumers kept spending thanks largely to wage growth, drawing down savings and credit card usage. Another dynamic at play in consumers’ persistent spending was revealed in the Fed’s recently published triennial Survey of Consumer Finance, which found that family finances broadly increased from 2019-2022, particularly as it relates to net worth.

Image

Third quarter GDP was the highest it’s been in two years at 4.9%, with consumer spending contributing 2.7 percentage points. A potentially troubling sign was the complete lack of business investment as a contributor to GDP growth. Businesses also remained sour on the economy, with the National Federation of Independent Business recording the 22nd consecutive month that the Small Business Optimism Index was below long-term norms. Quality of labor came out on top as the single-most important problem in the October survey, beating inflation by one point.

Job openings remained high, with 1.5 jobs available per unemployed person. Quit rates were actually back to pre-pandemic levels, a signal that employees aren’t quite confident in their ability to land a better job. Initial claims for unemployment have been ticking up for the past few weeks but remain at levels largely consistent with economic growth.

The labor market has been steadily cooling throughout 2023, with just 150,000 jobs added in October. The unemployment rate is at its highest level in nearly two years at 3.9%. The overall labor force participation rate has yet to return to pre-2020 levels, but the good news is that the rate for the prime age workforce (ages 25-54) has now surpassed those levels.

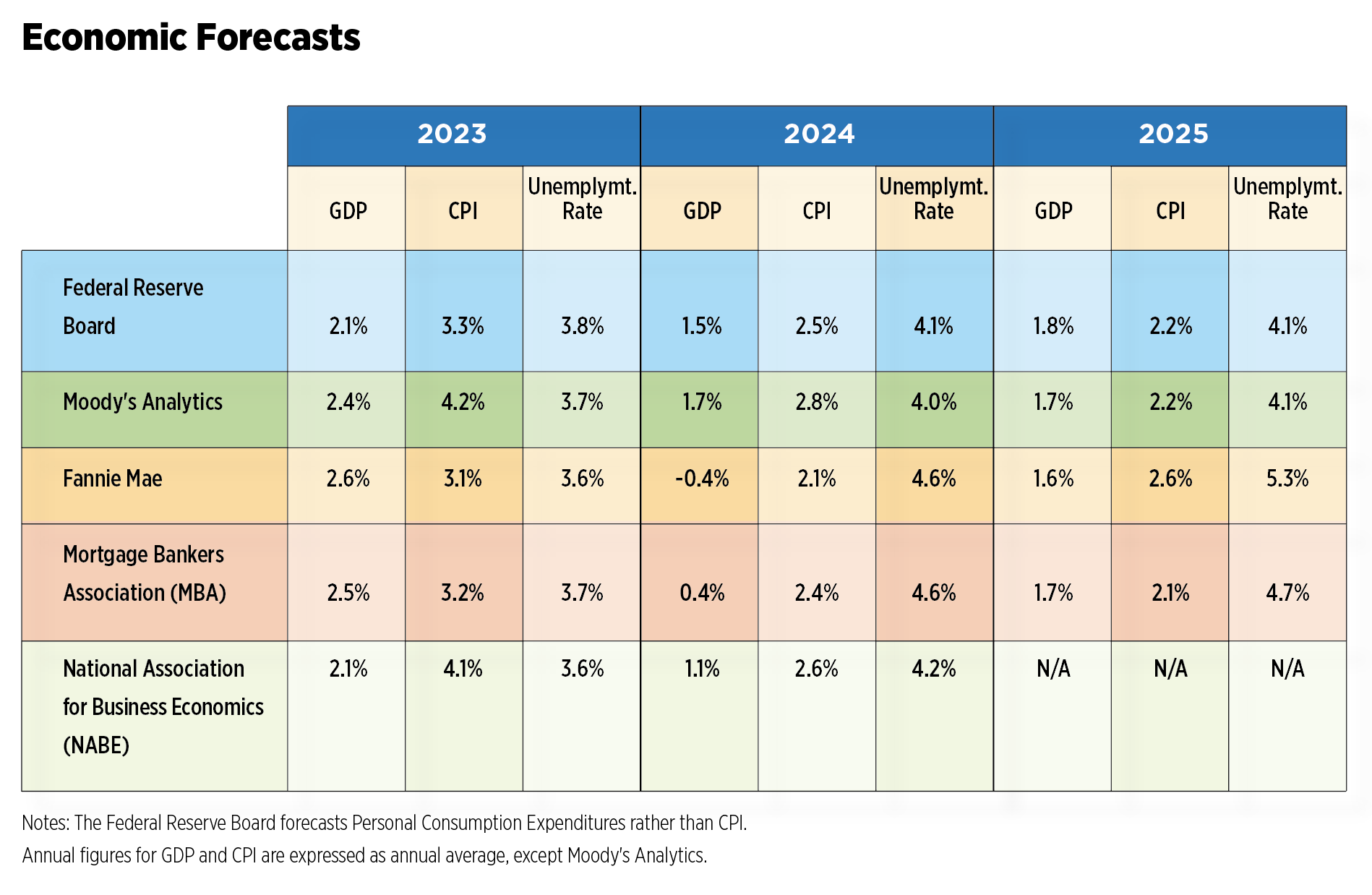

Forecasts for the unemployment rate range from an uptick of 30 basis points in 2024 to 100 basis points. Most analysts expect unemployment to stay flat in 2025 with the exception of Fannie Mae, which is forecasting a significant increase. Fannie Mae is also the only organization included in the chart above that is forecasting negative GDP growth in 2024. The others are still grim, all below the long-term growth potential of 2.0%, as higher-for-longer interest rates wreak havoc on the economy. On the plus side, most forecasters have reduced risks for recession, instead calling for slow growth at best or a very brief downturn at worst. All forecasts expect an average inflation rate below 3.0% next year before settling near the Fed’s long-term target of 2.0% in 2025.

The for-sale housing market has also been erratic, with only a brief easing in prices before reverting to steady increases. The trough for the median price of an existing home came in January 2023 at $361,200, not seasonally adjusted, according to the National Association of Realtors (NAR). Prices then rose each month through June and almost reached 2022 highs before taking a dip once again. Still, as of October 2023, median prices for an existing home were up 2.8% year-over-year. Coupled with high mortgage rates, homeownership remained out of reach for many in 2023.

After peaking at a 6.6-million-unit annual rate in early 2021 and staying elevated for a full year, existing home sales continued to trend downward, falling below 4.0 million in September. New home sales have also come off peaks, but are in line with 2019 levels, averaging 684,000 annually this year. With mortgage rates likely at peak, NAR is forecasting new home sales to increase by 19% next year while existing home sales accelerate by 13%.

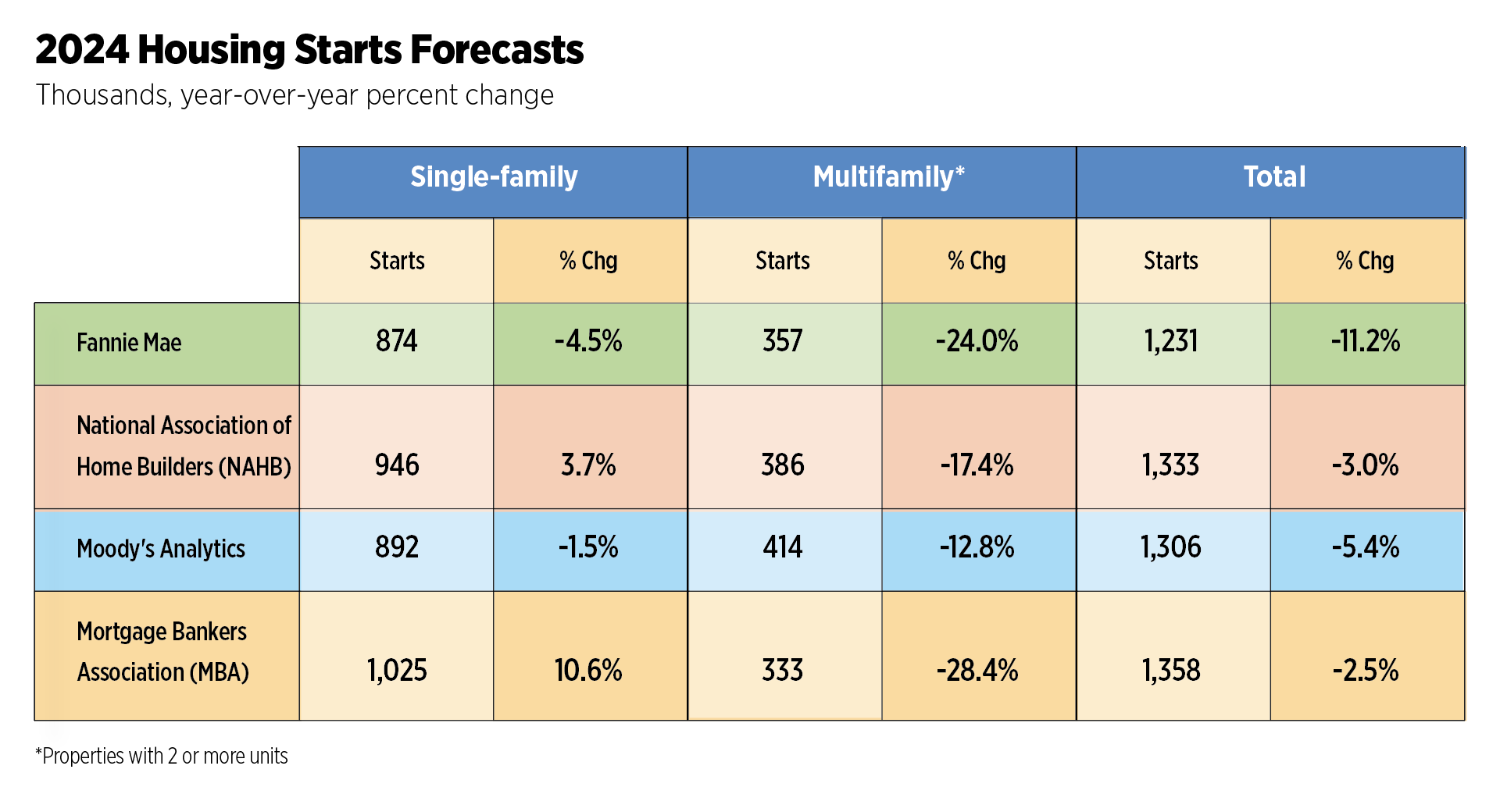

Starts for both single-family and multifamily units have started to come in, as expected, given 2021 and 2022’s feverish pace. Forecasts for single-family starts range from a 4.5% decline to 10.6% growth next year, generally following the trajectory of other economic indicators. With new apartments at multi-decade highs, leading to saturation in some markets, it is no surprise that starts are forecasted to fall in 2024 ranging between 12.8% (Moody’s Analytics) to 28.4% (MBA).

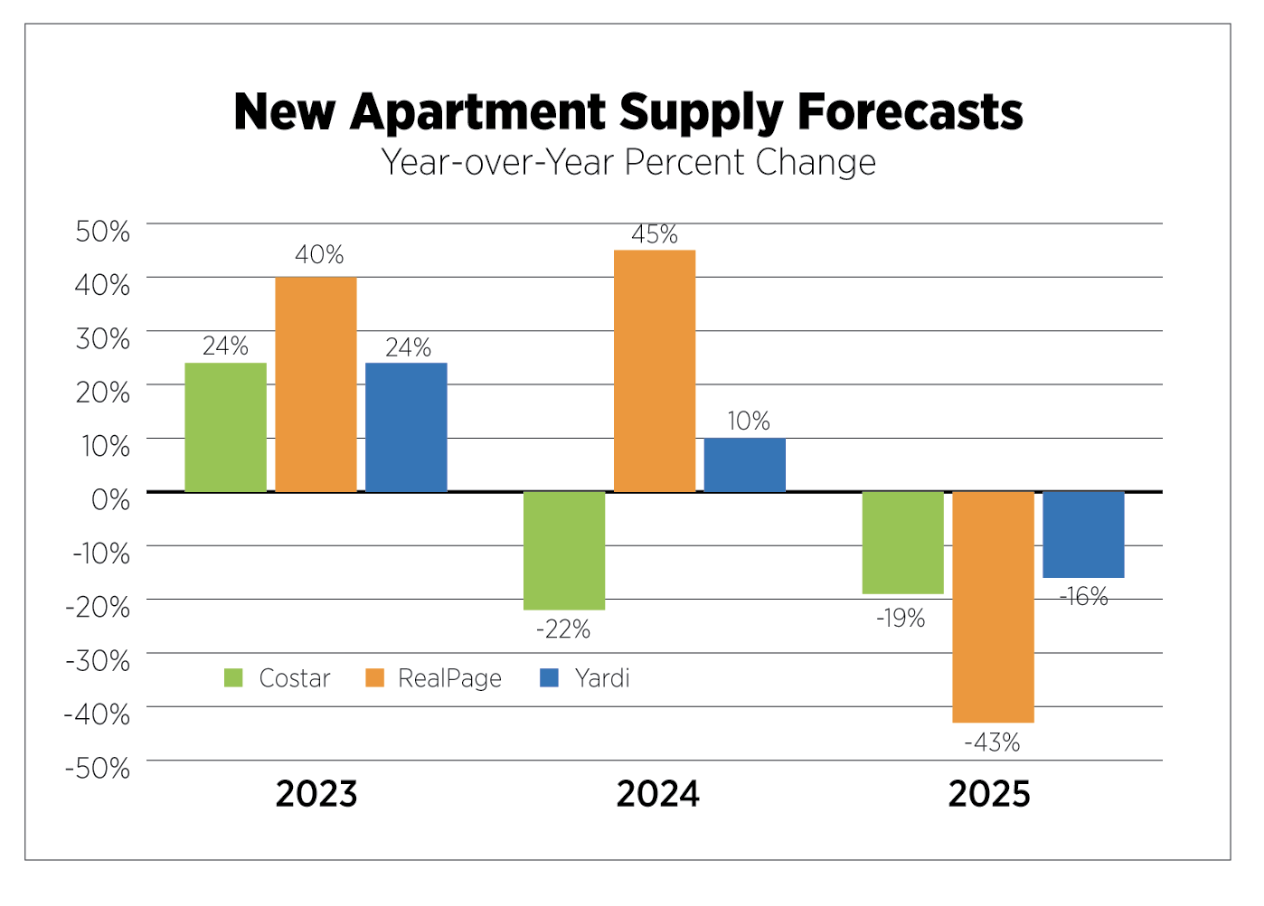

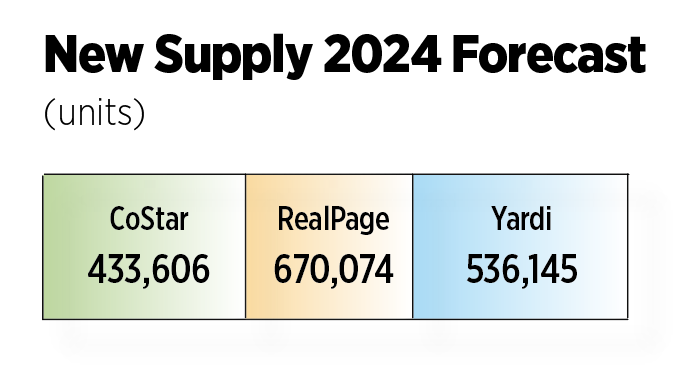

Apartment data from the private sector also varies widely, with CoStar showing 2023 as the peak year for new apartment construction during this cycle while RealPage and Yardi expect even more units to be delivered in 2024 before scaling back in 2025. There is no doubt deliveries are on the verge of slowing, based on what we know about permits and starts from the Census Bureau. Year-to-date, average permits were down 20% from the same period a year ago while starts were down 12%. On a three-month moving average, starts have been declining for seven months, and with starts to completions averaging 17 months for properties with 5 or more units, we could start seeing completions decline in Q3 2024. As for 2023, they are up 26% and are set to finish the year at the highest level in 35 years.

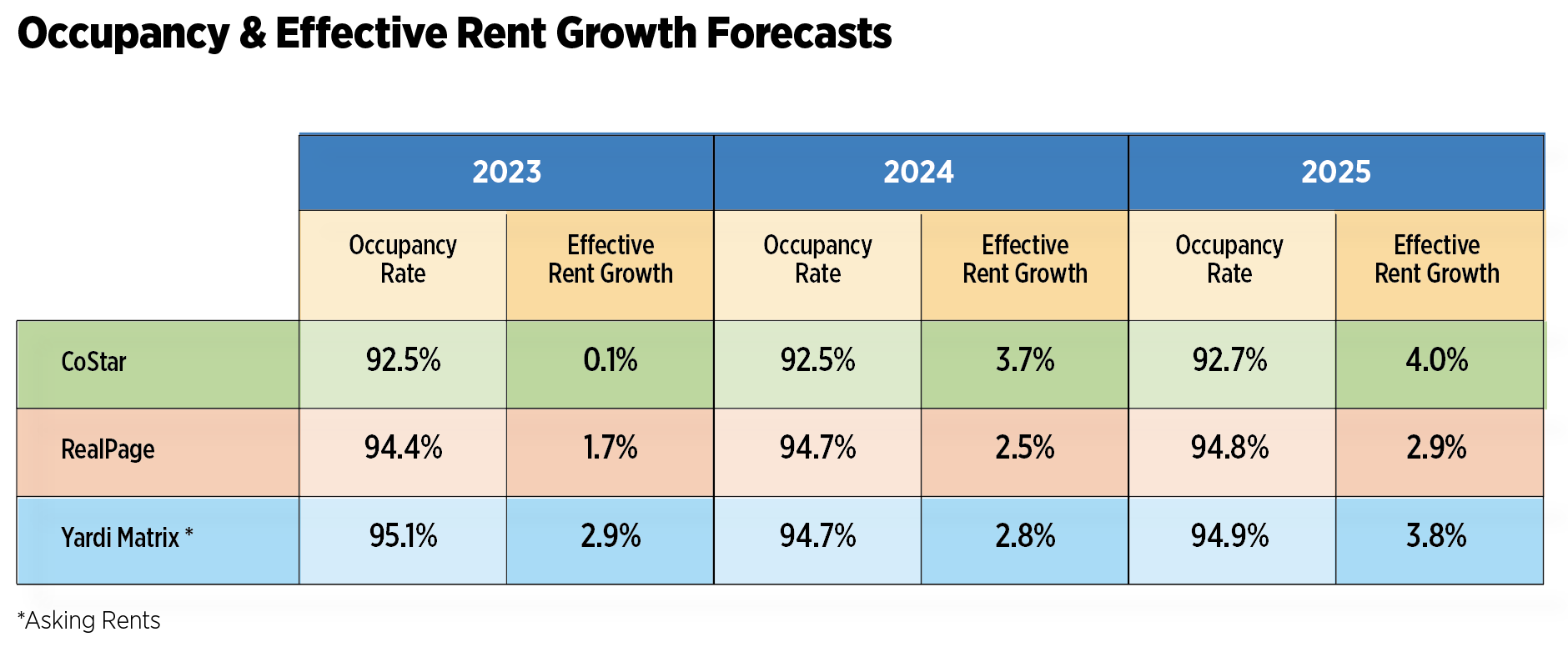

The lower range of forecasts calls for occupancy rates to drop by 40 basis points in 2024, while the higher range shows a 30-basis point increase, followed by a slight increase in 2025 – all at relatively healthy levels. After a below average performance in 2023, rent growth is forecast at 2.5% - 3.7% in 2024 with somewhat stronger growth in 2025.

Next year poses challenges for the economy with more risks weighted to the downside, some of which are already in place. Pandemic-era safety nets have all but disappeared, repayment on student loans has begun and credit availability will remain tight, all of which can adversely affect spending by already-gloomy consumers. The banking sector is still reeling from the crisis earlier this year. The debt ceiling, impacts from the growing federal deficit and potential government shutdowns will continue to threaten economic stability. Finally, the war in the Middle East may be drawn out, possibly derailing the global economy.

Although inflation is moderating and Treasury rates seem to be stabilizing, the high interest rate environment will weigh on the apartment sector. Even without a recession, the labor market is expected to weaken and wage growth will continue to contract, resulting in moderate demand that won’t be able to keep up with new supply. Rent concessions and rent cuts will need to be employed in those markets that see their occupancy rates slipping, faced with the double whammy of increased supply amid muted demand. Expenses and operating efficiencies will continue to pose challenges while regulations that will stymie the industry’s growth loom large.

Moody’s Analytics is forecasting rate cuts to begin in Q2 2024, ending the year at about 4.75 and approaching 3.75 by the end of 2025, which should provide some relief on the financing and capital fronts. Barring a deep recession, rental housing is expected to experience slow, steady growth in 2024, buoyed by its relative affordability compared to the for-sale housing market and a resilient, if diluted, labor market.

Paula Munger is NAA’s Vice President of Research.