While the debate continues concerning the future of work, two things are clear for the apartment industry: The prospect of remote work will affect an organization’s recruitment and retention efforts as well as the way communities are marketed and managed long after the pandemic.

According to KPMG’s Q1 2021 “CEO Pulse Survey,” 24% of CEOs said their businesses have changed forever, while 16% said they have plans to downsize their office footprints, down from 69% in August 2020. While at first blush these findings may seem contradictory, the reality is that they reflect the rapid pace of disruption caused by the pandemic and the attendant uncertainty in the marketplace.

Teleworking Takes Off

In May 2020, the Bureau of Labor Statistics began tracking telework in its Current Population Survey. At its peak that month, nearly 50 million employees, or 35.4% of the workforce, were working from home. Aside from an uptick during the winter months, that figure has been steadily declining and in April 2021 measured 27.6 million employees (18.3%).

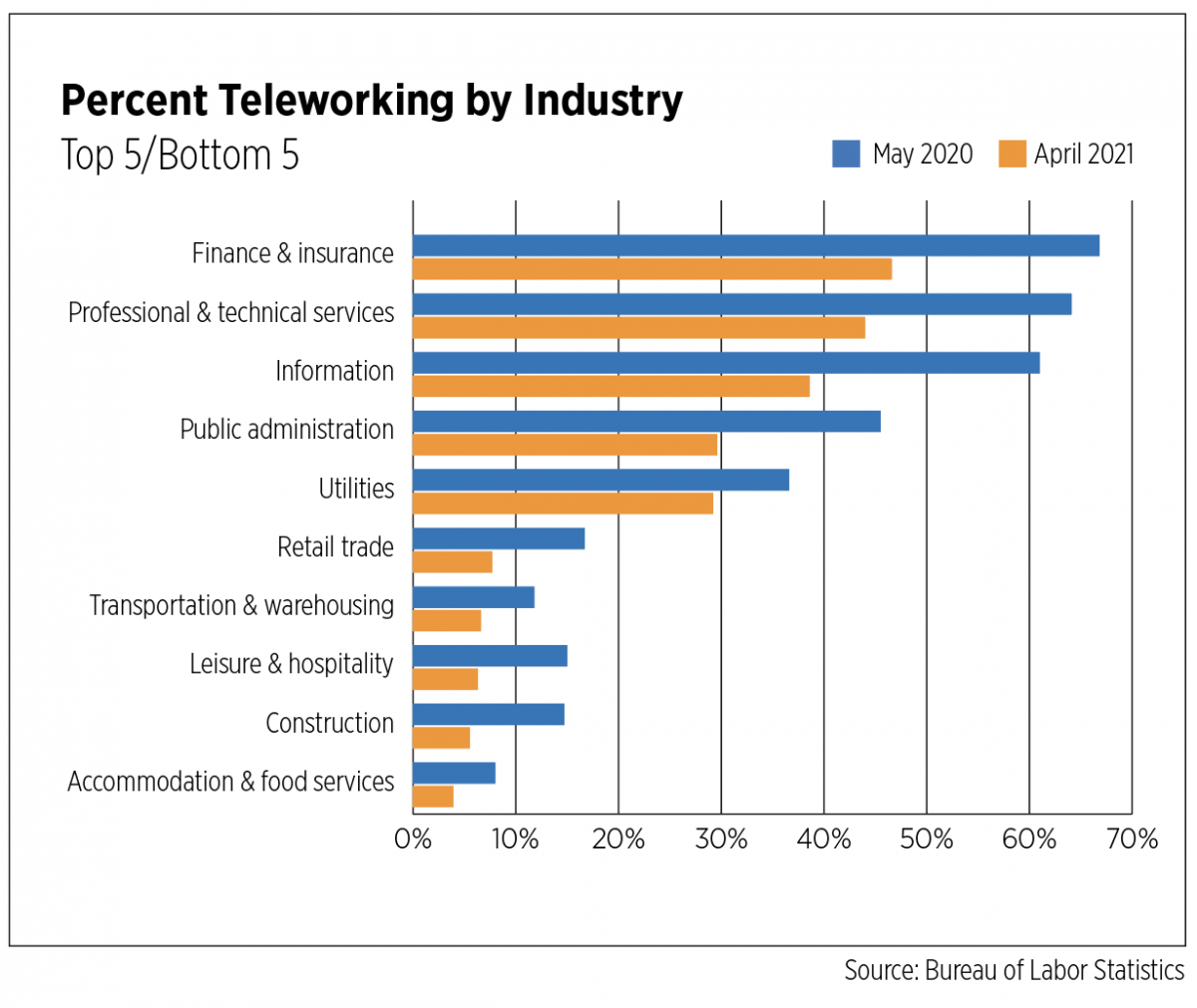

Experiences with telework vary greatly depending on level of education and industry. In May 2020, only 15.3% of high school graduates were working remotely, compared to 68.9% of those with advanced degrees. Eleven months later, those figures had dropped to 6.2% and 40.6%, respectively. Industry sectors disproportionately affected by the pandemic have been well-documented. Those same industries—leisure/hospitality, restaurants and brick-and-mortar retail, which rely on face-to-face interactions—obviously have fewer options for remote work. In the same vein, occupations that require use of special equipment or are intrinsically tied to a physical place, such as a construction site, also have fewer options for remote work. On the other hand, finance, professional services and the like witnessed more than 60% of their workforces working remotely at the height of the pandemic. 1

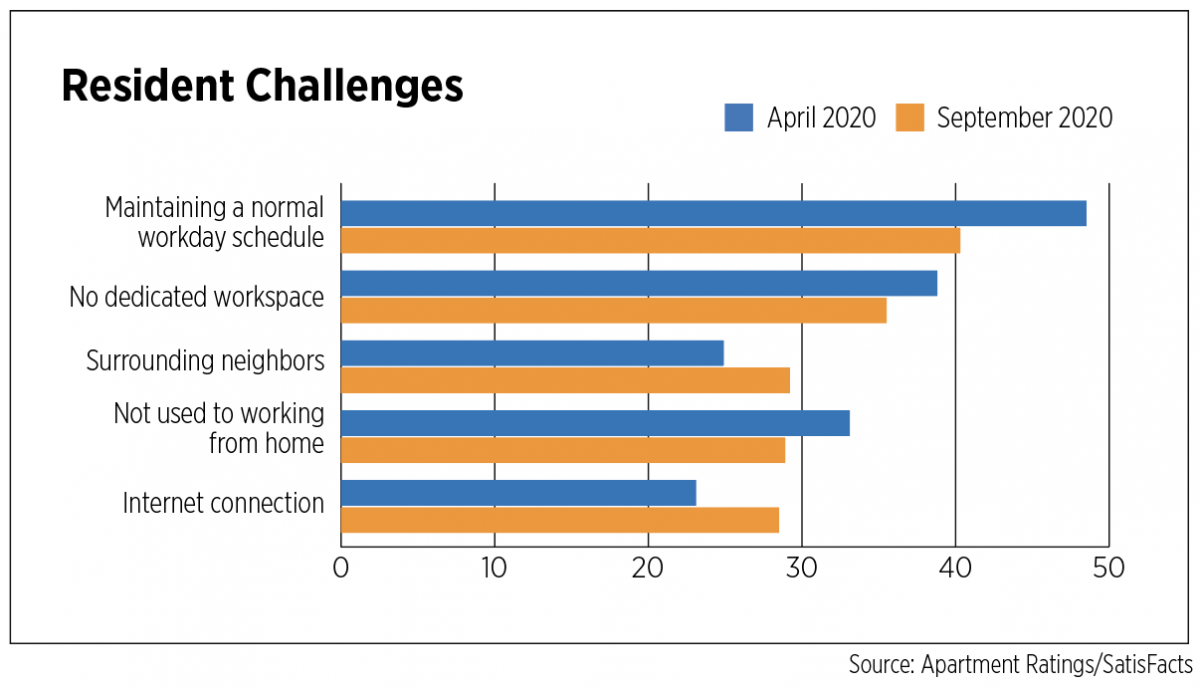

Apartment residents across the country who had the ability to work remotely were suddenly faced with outfitting their homes to make space for an office as well as learning spaces for their children. ApartmentRatings/SatisFacts conducted monthly surveys of more than 150,000 renters between April and September 2020, and one of the many questions measuring the impacts of the COVID-19 crisis on apartment residents centered on the challenges of working from home. As a whole, the top five challenges did not change much between the first and last survey, but there was some movement of rankings within those five. Maintaining a normal work schedule, a lack of dedicated workspace and surrounding neighbors were the top challenges by September. These challenges become very important when considering motivations for moving residences during the pandemic. 2

Telework Impacts Everything

Remote work clearly has profound impacts on office space, but its effects on the built environment are far-reaching. Retail establishments in urban cores that rely on 9-to-5 foot traffic of office workers and commuters saw sales plummet, even after lockdowns were lifted. According to an Ernst & Young study commissioned by the Greater Washington Partnership, a shift toward more flexible working in the D.C. metro area could result in a decline of up to 29% in consumer spending around their workplaces.

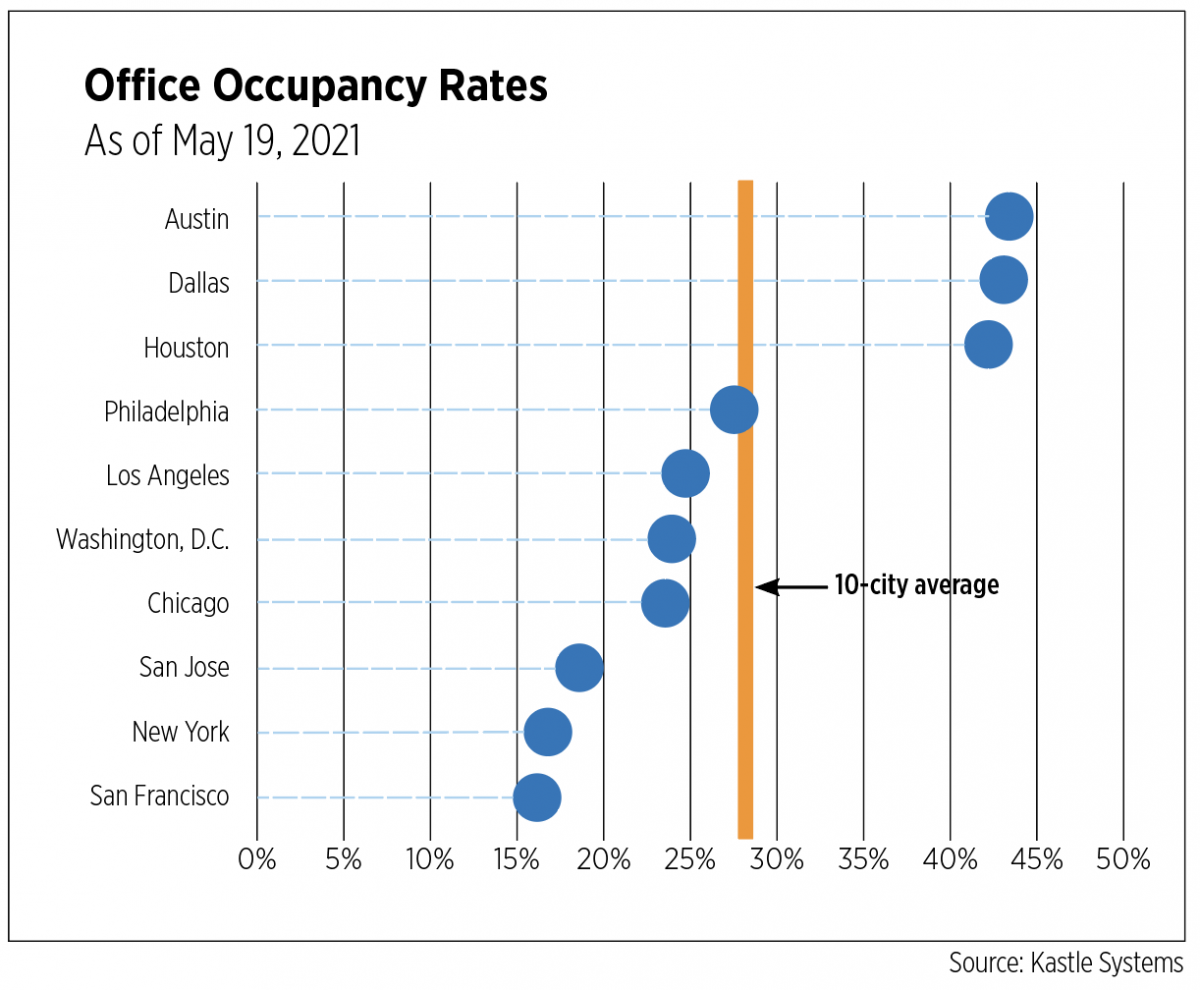

The office sector continues to feel the pain inflicted by remote work. According to Colliers, office absorption across the country broke a quarterly record in Q1 2021, at negative 46 million square feet. But conditions vary across markets, which can be plainly seen in occupancy data collected by Kastle Systems. Occupancy rates as of May 19, 2021, were above 40% in Texas cities but remained below 20% in New York City and the Bay Area. In addition to the type of work and whether it can be conducted remotely, local restrictions certainly play a role in workers’ mobility. Kastle Systems data most recently show occupancy rates averaging 28.1%, a troubling sign for the office sector amid strong vaccination rates and lapsing restrictions, and an indication of just how long a recovery could take. 3

Comparatively speaking, the apartment sector has held up well, particularly for larger, institutionally-owned properties outside of a few urban core areas. CBRE reported net positive absorption of 191,400 units for Q1 2021, a decline from the prior year but firmly in positive territory.

Affordability and Space Rule

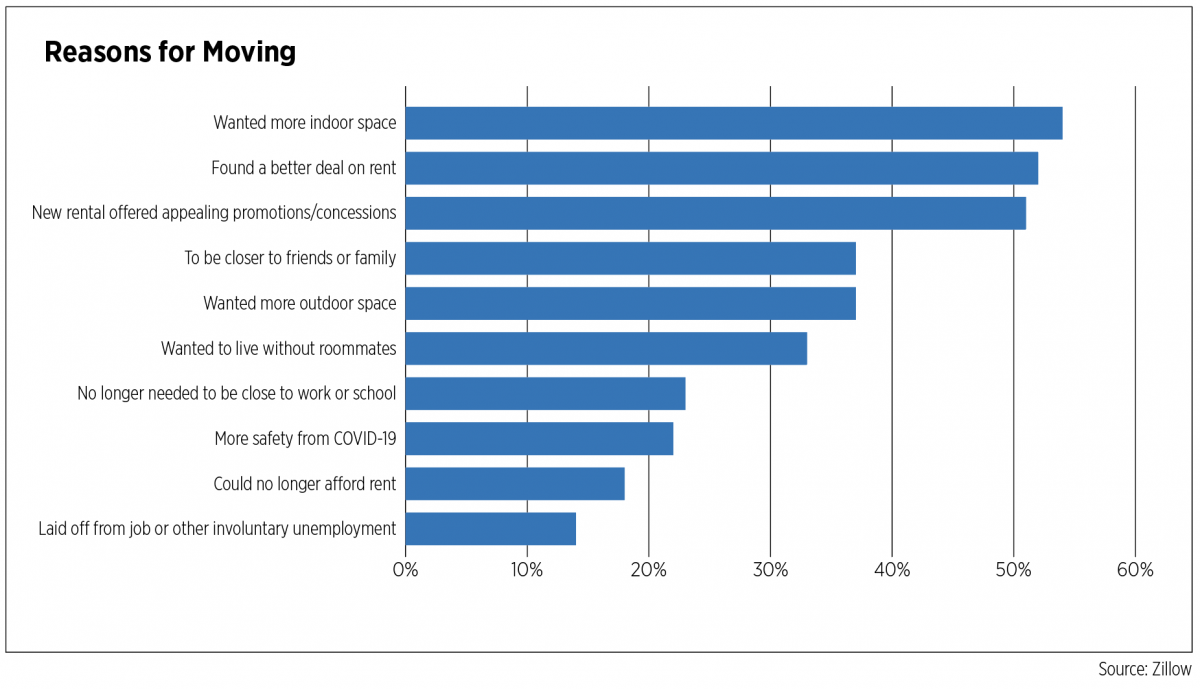

In survey after survey of renters, the top reasons given for moving during the pandemic were related to having more space or lowering costs. Zillow surveyed renters in December 2020, asking them the reason for moving during the past year. The top four reasons all had to do with either more space, both indoor and outdoor, or better pricing, either through concessions or simply lower rent.

A more recent survey from RENTCafé revealed the number one reason for moving during Q1 2021 was to find a better deal. While this might seem obvious, finding a better deal placed further down the list, tied for fifth, for those who moved during the pandemic. At that time, more movers cited their lease ending and needing a change of scenery. 4

Developers are already adjusting plans, according to “Nooks, Balconies and Beyond: Rethinking Multifamily Design Post-Pandemic,” published by Newmark in December 2020. The survey of apartment developers found that 14% of units in proposed projects had already been retooled to accommodate more space for working. The one-bedroom-plus-den design, which had fallen out of favor pre-COVID, is making its way back into designs as developers anticipate strong demand for this unit type, which offers workspace without the price tag of a two-bedroom unit. One developer is building balconies for 70% of their units compared to 50% prior to the pandemic. Finally, some developers are looking at 76-foot floor plates versus the standard 65 feet to accommodate larger and more flexible spaces.

The old adage, “Location, location, location,” loses its significance in a work from anywhere environment, particularly taken together with the loss of amenities in many urban locales. It should have come as no surprise to learn that month after month, Americans were on the move – some staying close enough to be able to get to the office when needed, but others moving clear across the country. There is no shortage of reports and studies documenting these moves, some of which were temporary, but most have one thing in common: Smaller cities and suburban locations gained population at the expense of larger downtown areas.

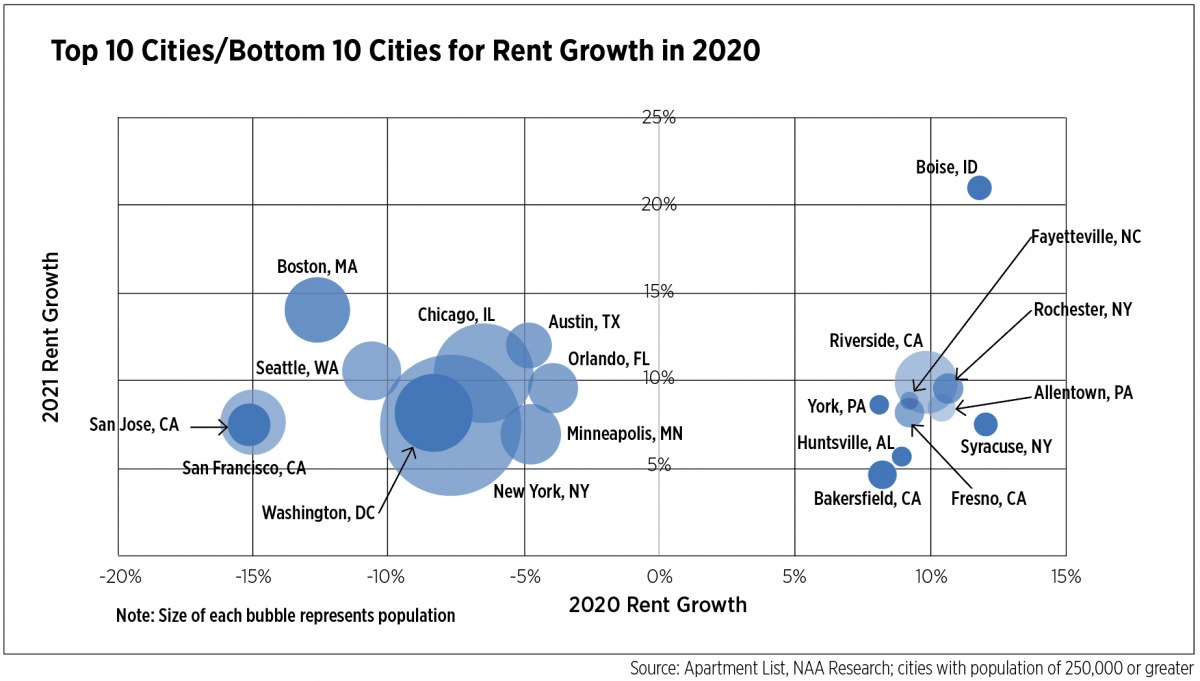

These trends were reflected in the apartment market. Analyzing monthly rent data from Apartment List revealed that the top 10 markets with the greatest rent growth in 2020 had a median pre-pandemic rent of $981 and a median population of 764,000 people. In contrast, the 10 markets to suffer the greatest rent declines had a median pre-pandemic rent of $1,753 and a median population of 4.2 million. It should be noted that in March 2020, the chart on the opposite page looked very different for the larger cities when comparing 12-month rent growth to three-month rent growth. The result was that all these cities appeared in a lower left quadrant, that is, negative over both the short- and longer-term time frames. But thus far in 2021, rent growth has been positive in all 20 of these markets, making it clear that larger cities are beginning to turn a corner. Still, for a market like Boise, Idaho, rent skyrocketed 33% from February 2020 to May 2021. 5

Winners and Losers

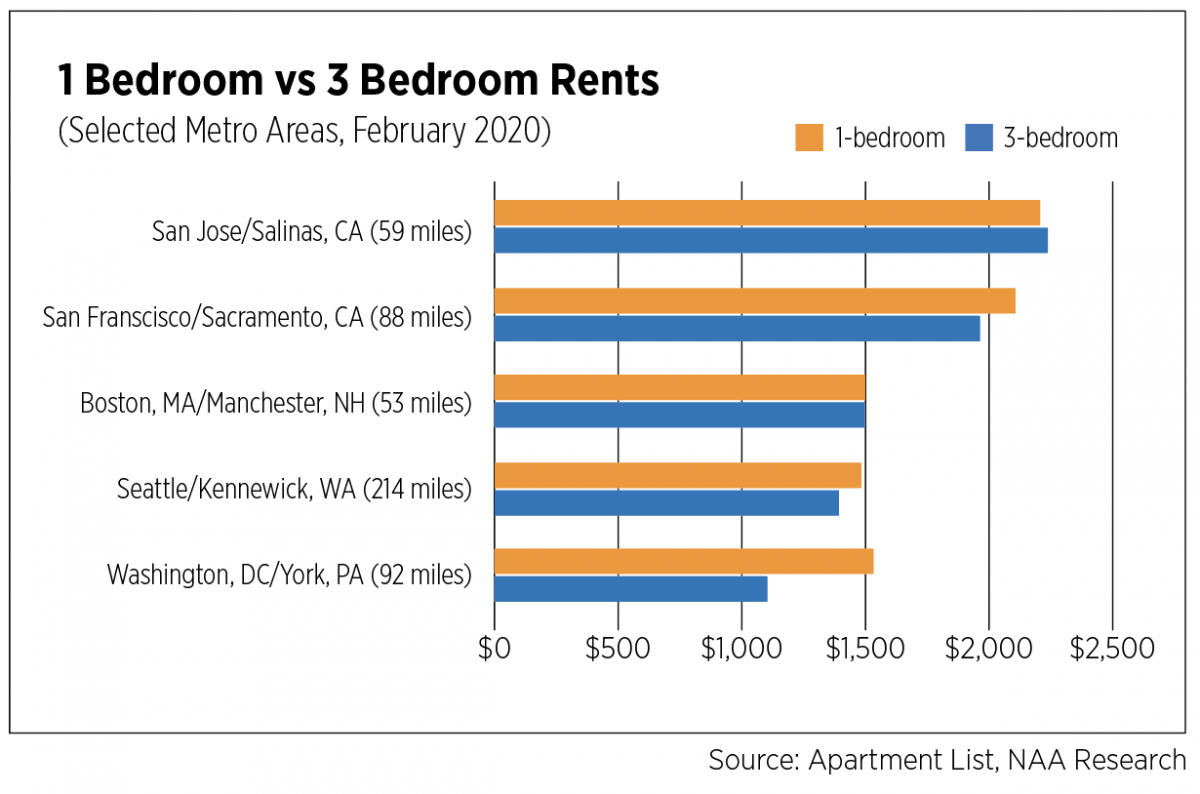

Tech workers moving from Silicon Valley to Idaho was a trend before the pandemic. A three-bedroom apartment in Boise, which has appeared on numerous “top” lists during the pandemic, rented for $1,146 in February 2020, while a one-bedroom in San Jose, Calif., was $2,206. But one did not have to make a 700-mile move to achieve lower rents. In some areas, a move of slightly more than 50 miles could get a resident two additional bedrooms for the same price. The chart to the right pairs the five markets with the greatest rent declines in 2020: San Jose, San Francisco, Boston, Seattle and Washington, D.C., with five nearby markets. With the exception of the Seattle example, a move of fewer than 100 miles could result in significantly more space for about the same or lower rent. These less expensive markets experienced healthy rent growth in 2020, ranging from 5%-8%. 6

Numerous reports have been published in recent months documenting moves out of larger cities and into smaller cities or suburbs. Both United Van Lines and North American Van Lines reported similar migration patterns compared to prior years, illustrating that the COVID-19 crisis was an accelerator rather than a catalyst, a phenomenon seen across demographic, economic and societal trends. Both moving companies’ surveys listed Arizona, Idaho and North Carolina in their top five for inbound migration while identifying California, Illinois, New Jersey and New York in the top five for outbound migration. The United Van Lines study found that a new job or job transfer remained the number one reason for moving, although the percentages of movers specifying it was down from prior years. The second reason for moving, to be closer to family, was chosen by 27% of respondents, a significant increase from prior years’ surveys.

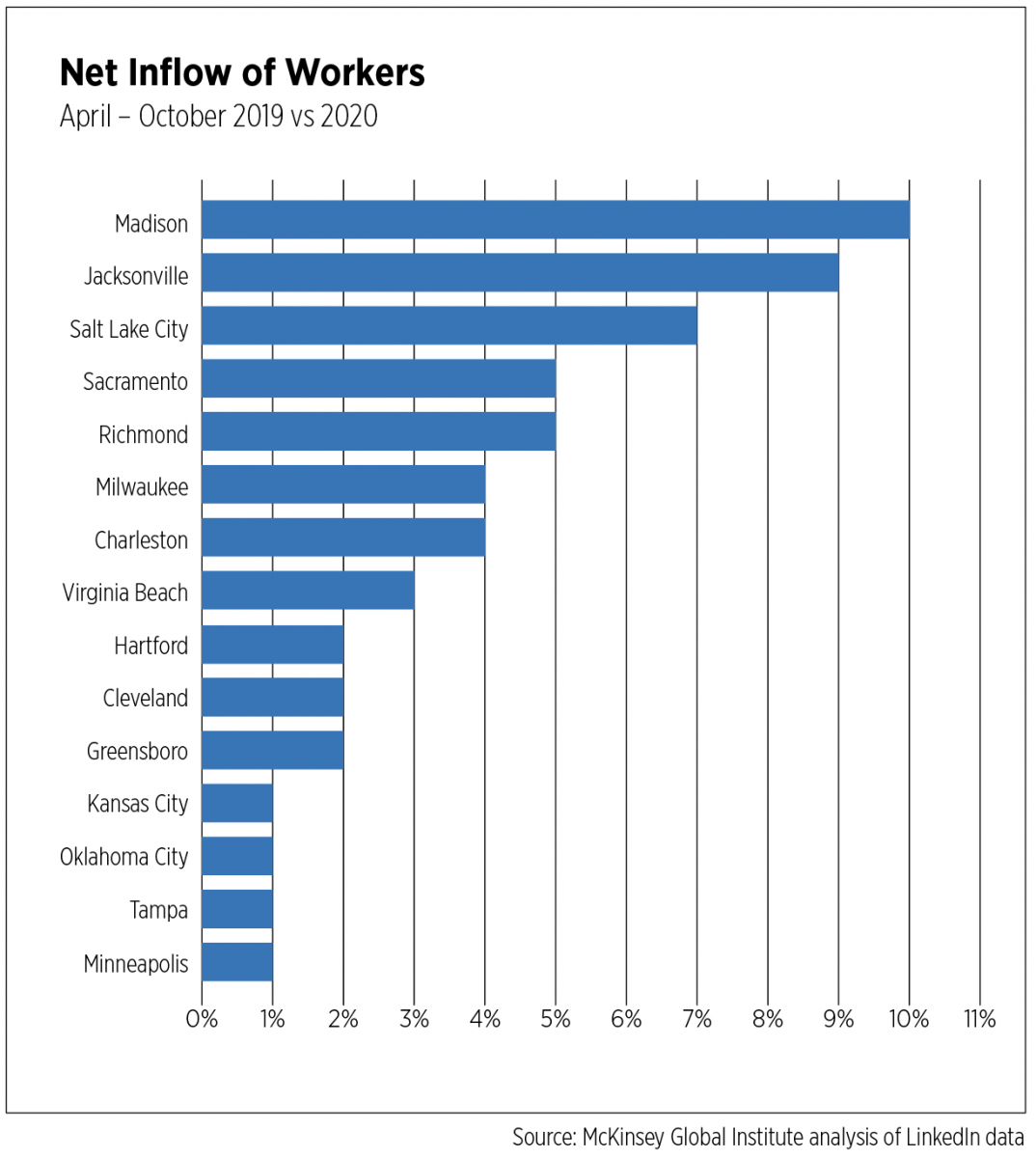

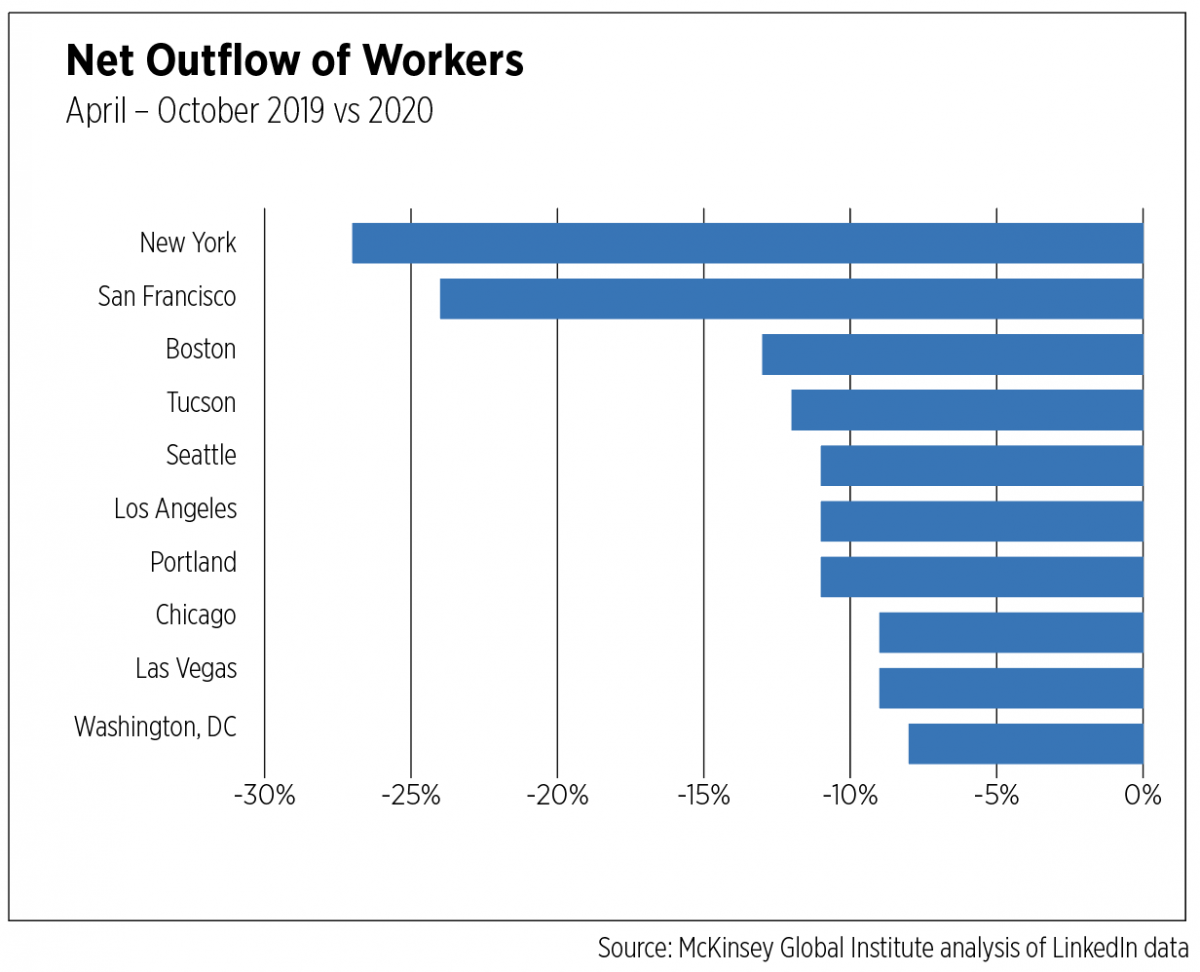

In their report, “The Future of Work after COVID-19,” the McKinsey Global Institute analyzed net inflow and outflow data of workers based on LinkedIn data. The inflow-outflow ratio represents the number of people moving to a market area compared to those moving out, based on the locations LinkedIn members list on their profiles. Rankings reflected metro areas that exceeded a threshold of 10,000 overall moves in the period (Apr.-Oct. 2019 vs. Apr.-Oct. 2020) and are presented in the charts to the left.7/8

One of the more interesting aspects of this data is the metros with high inflow ratios are not all the “usual suspects” – that is, Sunbelt or Western cities. In fact, they represent all regions of the country including the Northeast. This certainly fits with the motivation for a move being closer to family, more space or more affordable housing options rather than a job, as cities such as Hartford, Conn., and Sacramento, Calif., had some of the highest unemployment rates in the country throughout the pandemic.

The cities in the net outflow chart, on the other hand, match many other studies and data, with few exceptions: Large, expensive gateway cities on both the East and West Coasts, and Chicago—all experiencing pandemic out-migration and weaker economic and real estate market conditions, in general.

Investors still like the Sunbelt, as CBRE’s 2021 Investor Intentions Survey showed. For all types of property, Austin, Texas, Dallas, Los Angeles, Phoenix and Denver topped the list for investment preference in 2021. Phoenix and Miami moved up the most in rankings from the 2020 survey, up five places and three places, respectively. At the other end of the spectrum, Boston plummeted nine spots while Orlando, Fla., lost favor as well, slipping seven spots.

There is already evidence that some pandemic moves were temporary, and people are moving back home; many of those who moved permanently moved close to home. According to a Bloomberg analysis of U.S. Postal Service change of address forms in the 50 most populous cities, 84% of people who moved during the pandemic moved within the same metro area. While this will certainly have implications for a municipality’s coffers, the level of economic activity in the region remains unchanged.

As far as the oft-discussed urban exodus, the Bloomberg analysis as well as that of the Federal Reserve Bank of Cleveland found that this is largely isolated to two cities: New York and San Francisco. San Francisco’s rate of permanent moves increased 23% from March 2020 through February 2021, compared to a national average of 3%. In New York, 79% of those who moved permanently did not leave the metro area, but the city’s temporary move rate spiked 138% during the depths of the pandemic, providing plenty of fodder for the “urban exodus” discussion. The Fed study further found that the decline in inflows into cities almost always outweighed the increases in outflows, meaning that fewer people moved into cities during the pandemic than normally would have—which completely changes the exodus narrative.

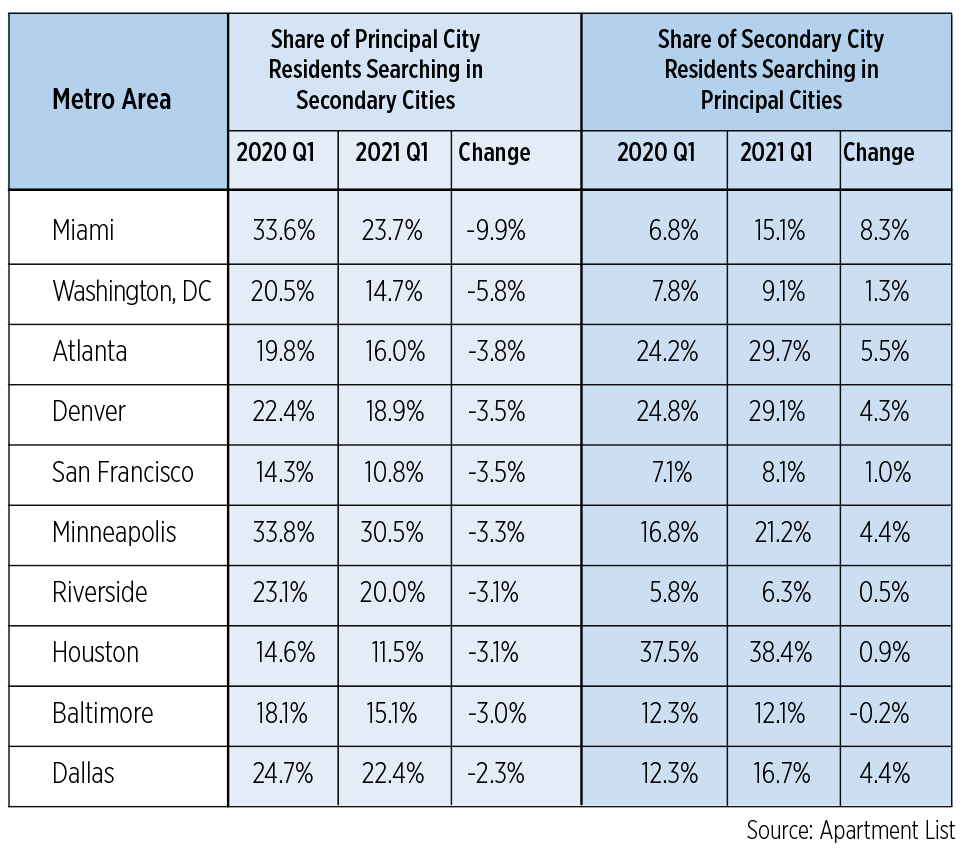

TabularChart

Apartment List’s most recent renter migration report, which analyzes apartment searches, found that on net, more renters are searching in larger cities in Q1 2021 compared to the same period last year. The table above shows the 10 cities that had the greatest declines in renters searching to move away from principal cities to secondary cities. The Census Bureau defines principal cities as the largest city within a metro area and secondary cities as all other cities within a metro area. While these data do not represent actual moves, they do show renewed interest in larger cities, some of which may be driven by pandemic-induced rent declines and concession packages, not to mention the return of amenities as restaurant, retail and entertainment options expand further throughout 2021.

What’s Next?

Remote work remains a fluid topic, like most everything else as the U.S. works its way through a global health crisis, an economic recession, an economic recovery and a decline in COVID-19 cases, hospitalizations and deaths. Recent data show that the movement of people across the country, much of it due to remote work, shows no signs of letting up. Property management software provider Entrata found in a recent survey that 56% of renters plan to move in 2021 while 22% moved last year, with the top reasons being cost savings and more space. Of those who have already moved, 61% said it will last more than a year while one-third said it was temporary.

Apartment List surveyed 5,000 employees in early April with similar findings. Two-fifths of respondents plan to continue remote work post-pandemic with 19% expecting a hybrid model and 21% fully remote. Forty-two percent of remote workers say they plan to move during the next 12 months compared to just 26% of onsite workers. Thirty-five percent of remote workers say they plan to relocate to a more affordable market. Whether or not employees’ and employers’ expectations line up is one of the overarching unknowns. And while anecdotes suggest few companies are adjusting pay scales to match employees’ home locations versus office locations, a shift in corporate practices could have dramatic impacts on the movement to more affordable locales.

The debate continues as to whether work from anywhere will be a lasting byproduct of the COVID-19 crisis. Conflicting data abounds. For every survey of employees citing a majority wanting to work from home most of the time, there exists another indicating employees are eager to be in the office most of the time. But these contradictions only reinforce the argument that hybrid approaches to work will likely be the new norm. One thing is certain: The percentage of employees working from home will be much greater than it was before the pandemic, estimated at 6%-7% of the workforce by the Census Bureau and Bureau of Labor Statistics, respectively. Employers who offer no flexible options at all for positions in which telework is possible will find themselves with a far smaller pool of available talent.

Paula Munger is AVP of Industry Research and Analysis for the National Apartment Association.