From December 2022 to February 2023, the National Apartment Association (NAA) commissioned ndp | analytics to conduct interviews with housing providers and developers from three different markets impacted by rent control policies and proposals: St. Paul, Minn; Santa Ana/Santa Barbara; Calif; and Portland/Eugene, Ore. The interviewees ranged from large firms operating thousands of units and having properties across the country to small mom-and-pop businesses with a handful of units and, often, invested in real estate as part of a retirement plan or second source of income.

The housing provider research was supplemented with an online public opinion poll across the United States in February 2023. The poll questions focused on housing availability, residential construction and policy perspectives. Below are the key findings from the interviews and public opinion poll.

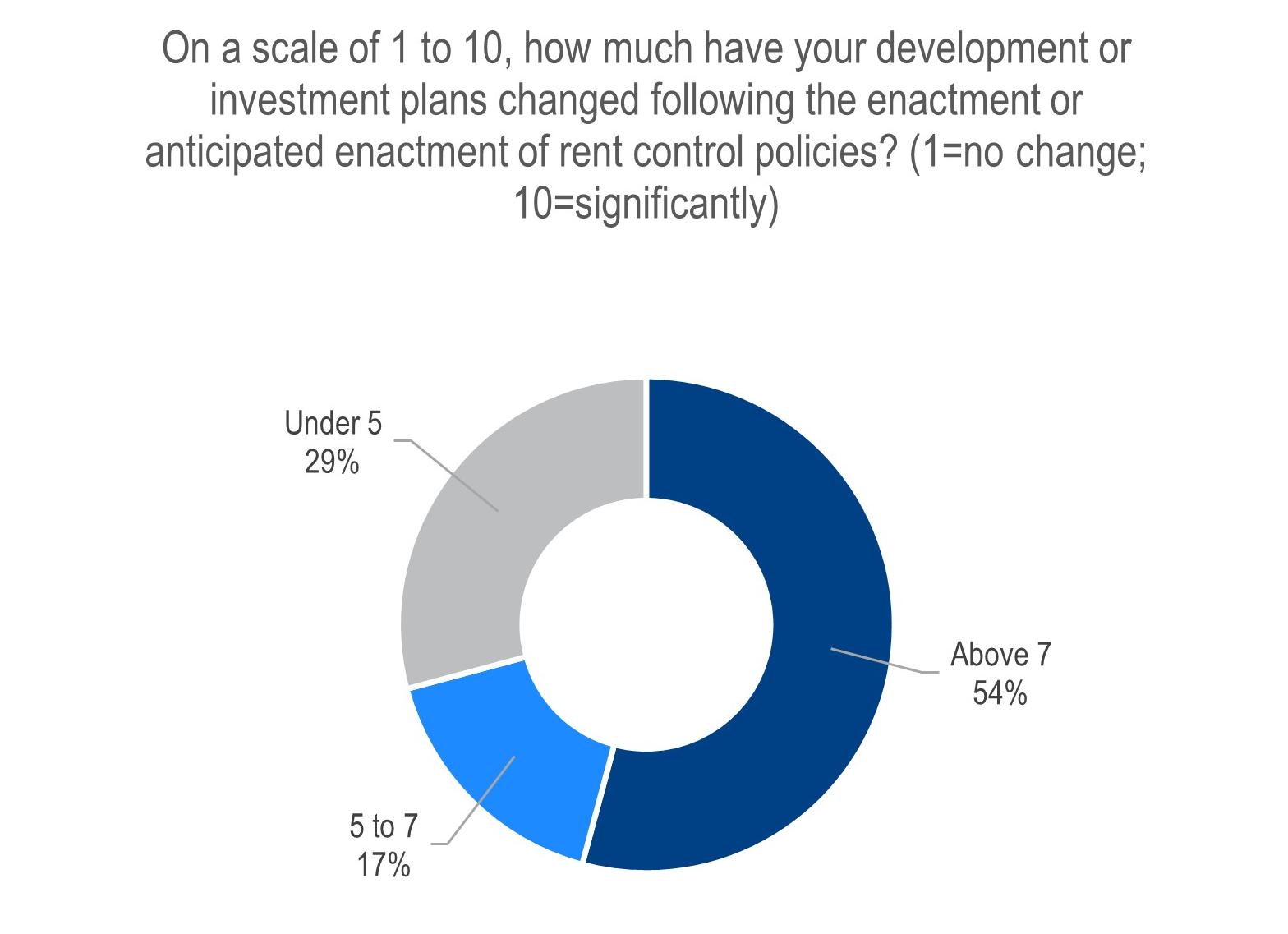

Rent control policies reduce investment and development.

Over 70% of housing providers say rent control impacts their investment and development plans; actions include reducing investments, shifting plans to other markets, and canceling plans altogether.

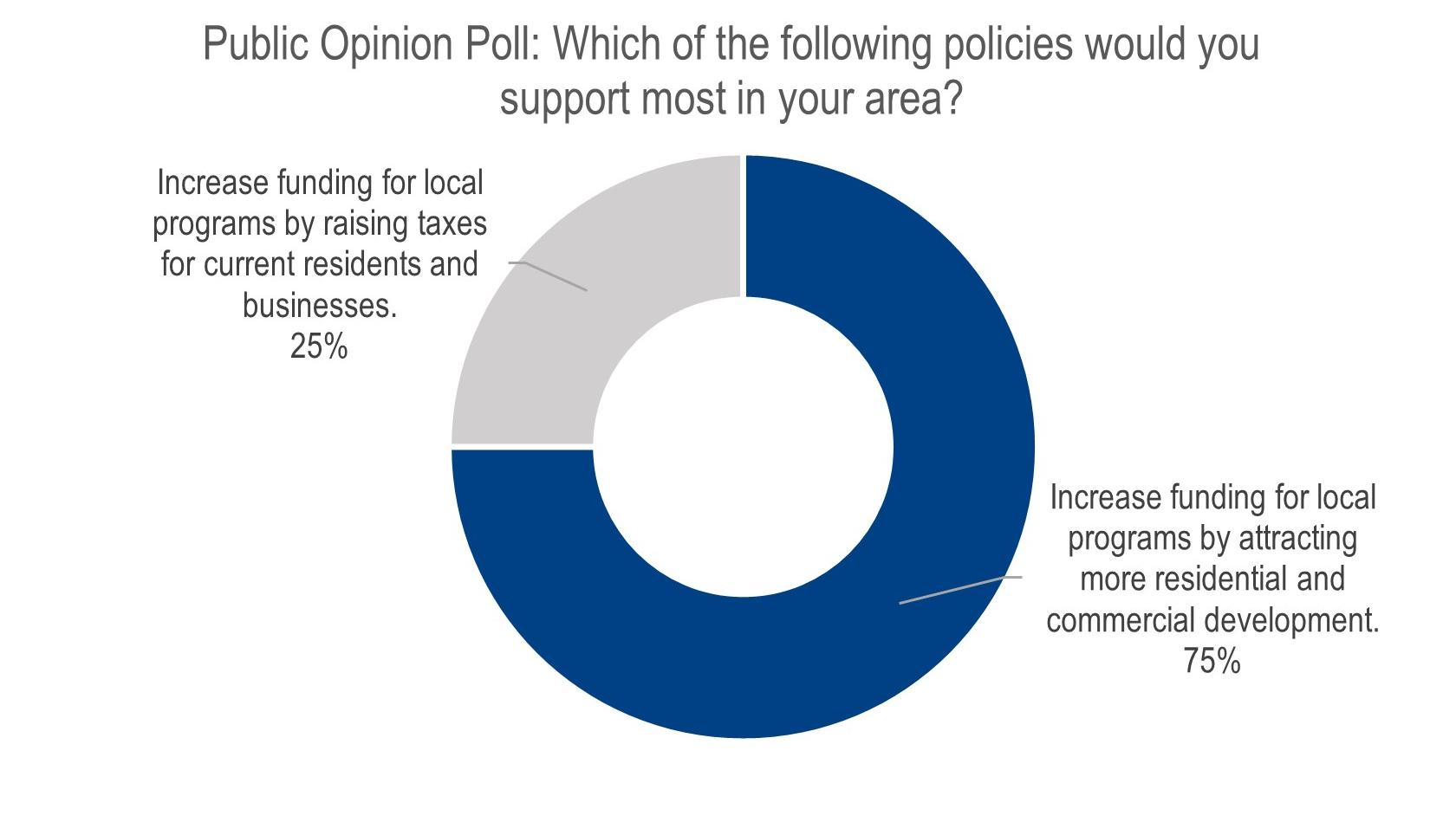

Americans prefer policies that increase funding for local programs by attracting more business, but rent control deters investment and reduces potential tax revenue.

Seventy-five percent of Americans want policies that increase funding for local programs by attracting more residential and commercial development. However, rent control drives away investments and reduces potential tax revenue contributed by rental housing providers. Two-thirds of housing providers said they would absolutely not consider investing in markets with strict rent control policies.

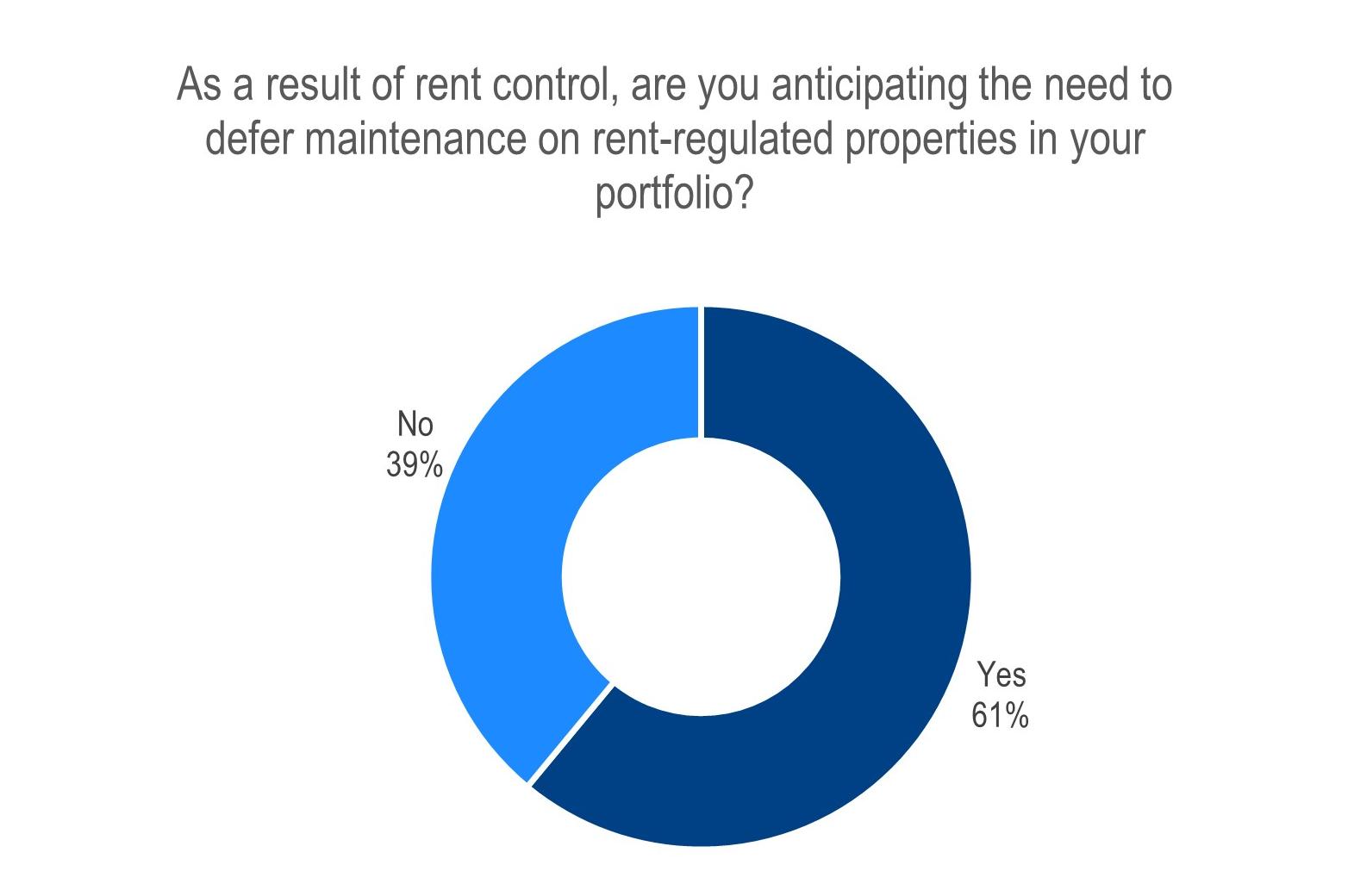

Housing providers absorb the cost of essential maintenance and reduce investments in improvements and nonessential work due to rent control.

With rent control in effect, housing providers are faced with the difficult financial strain of absorbing essential maintenance costs and are forced to reduce investments in improvements and nonessential maintenance. As a result, 54% said they expect to or would consider selling some assets.

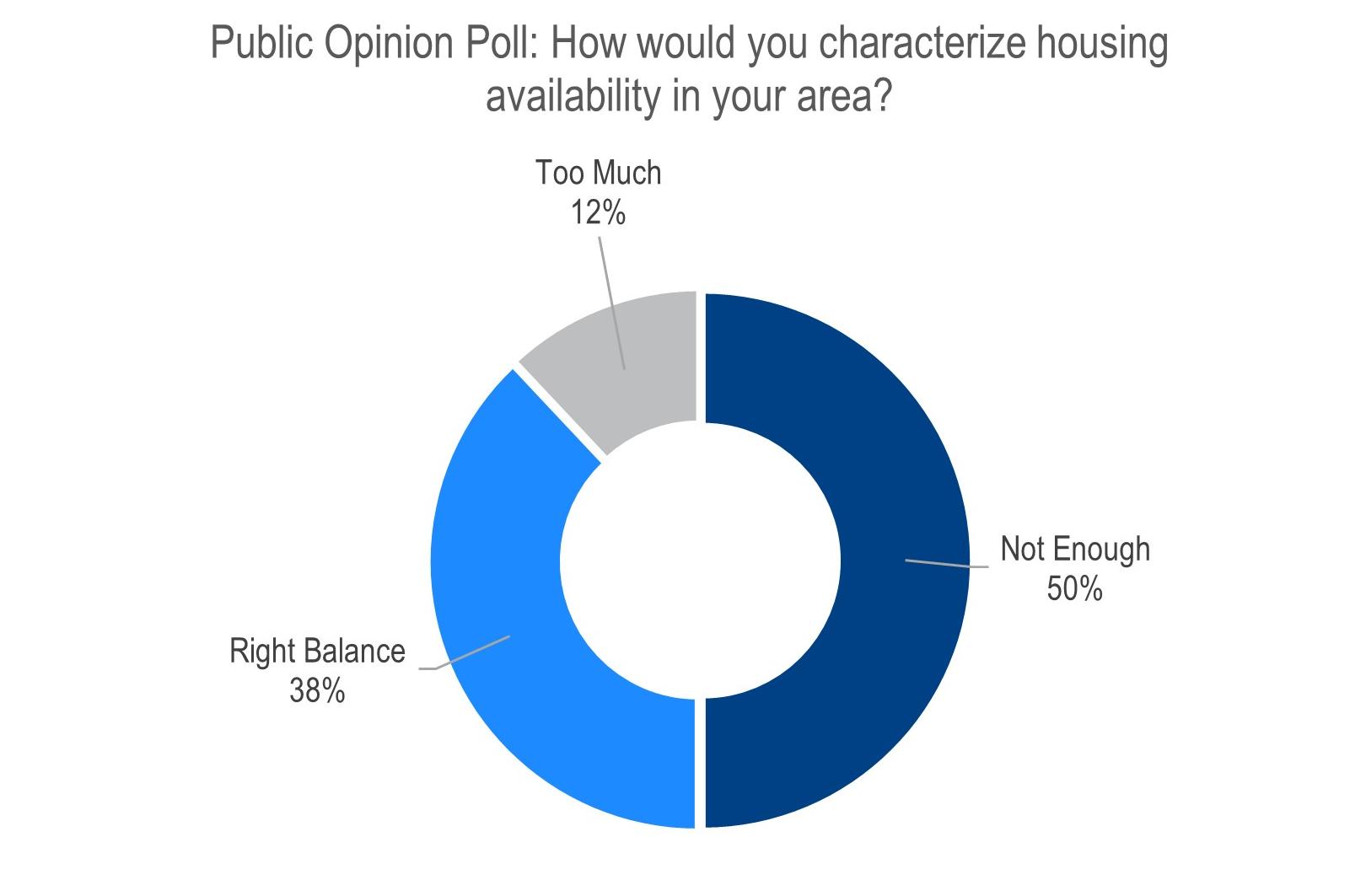

Americans are looking for more housing options.

Half of the poll respondents said there are not enough options for buyers and renters looking for homes; 35% want more residential development. However, rent control drives away investments and reduces potential tax revenue contributed by rental housing providers.

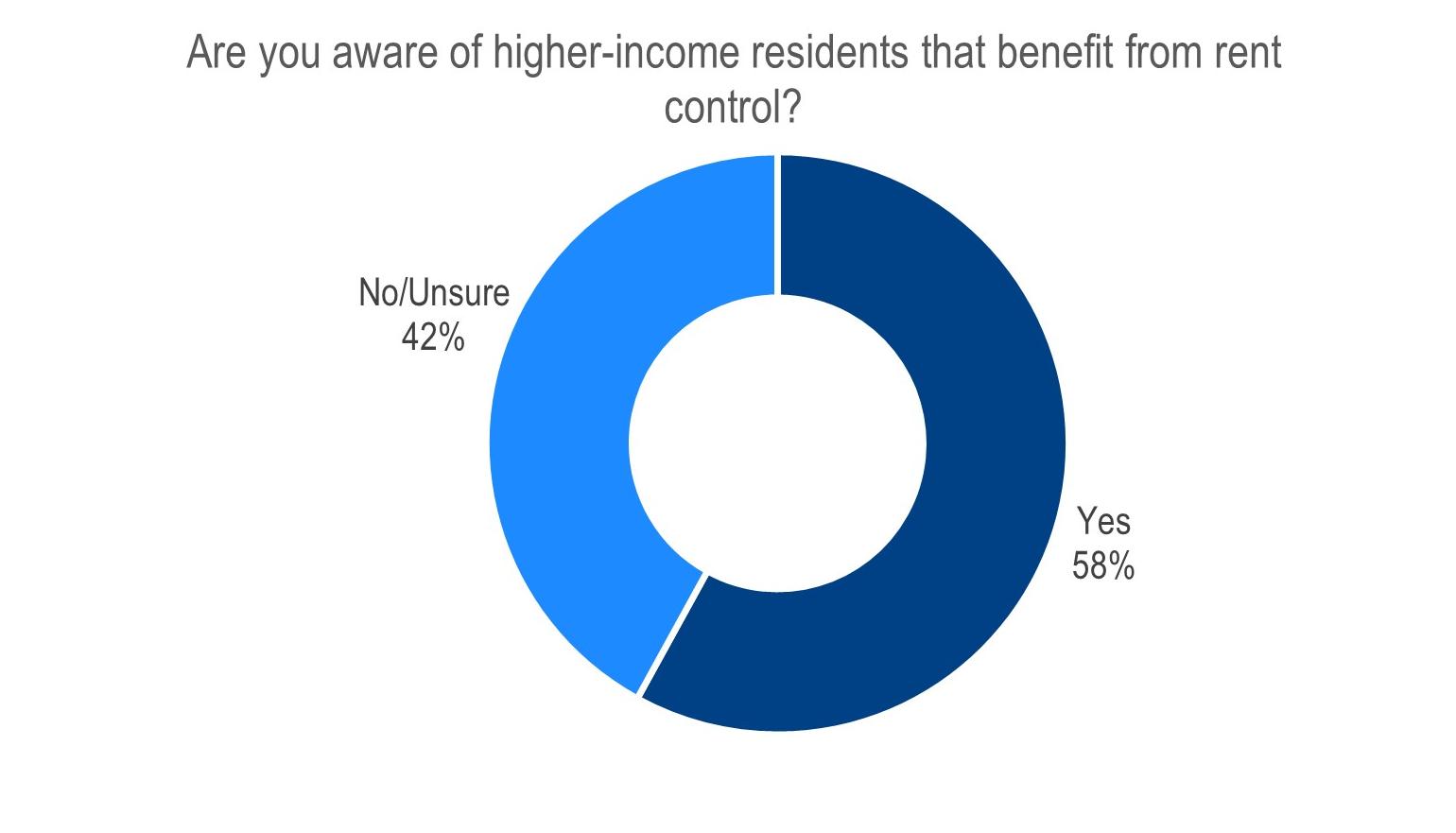

Rent control policies are often misunderstood as helping only lower-income households, but these policies also subsidize higher-income residents.

Nearly 60% of rental housing providers know of higher-income residents who benefit from these policies. Additionally, almost half of poll respondents incorrectly believe rent control only provides affordable housing to low- and moderate-income households.

In Conclusion

While the notion of rent control policies may appear as an appealing solution to housing affordability, it is critical to acknowledge their potentially counterproductive and damaging consequences. Rent control has been proven to negatively impact renters, housing providers and even entire communities. This research shows that rent control policies can inadvertently lead to reduced housing supply, lower property values and decreased quality of available properties. Additionally, rent control disincentivize new construction, which could exacerbate the housing affordability crisis.

As we work towards long-term solutions for ensuring housing security across our nation, it is essential to consider the harmful impacts of rent control and develop alternative strategies that will promote affordability without compromising the stability and wellbeing of our communities. Policymakers must look beyond regulations and develop proactive strategies to provide affordable housing. Some of the ways policymakers can achieve this is by reducing barriers to new construction and rehabilitation, expanding tax policy that encourages multifamily investment and increasing investments in vouchers and program administration of the Section 8 Housing Choice Voucher Program.

For more information, contact Leah Cuffy.