U.S. Apartment Market

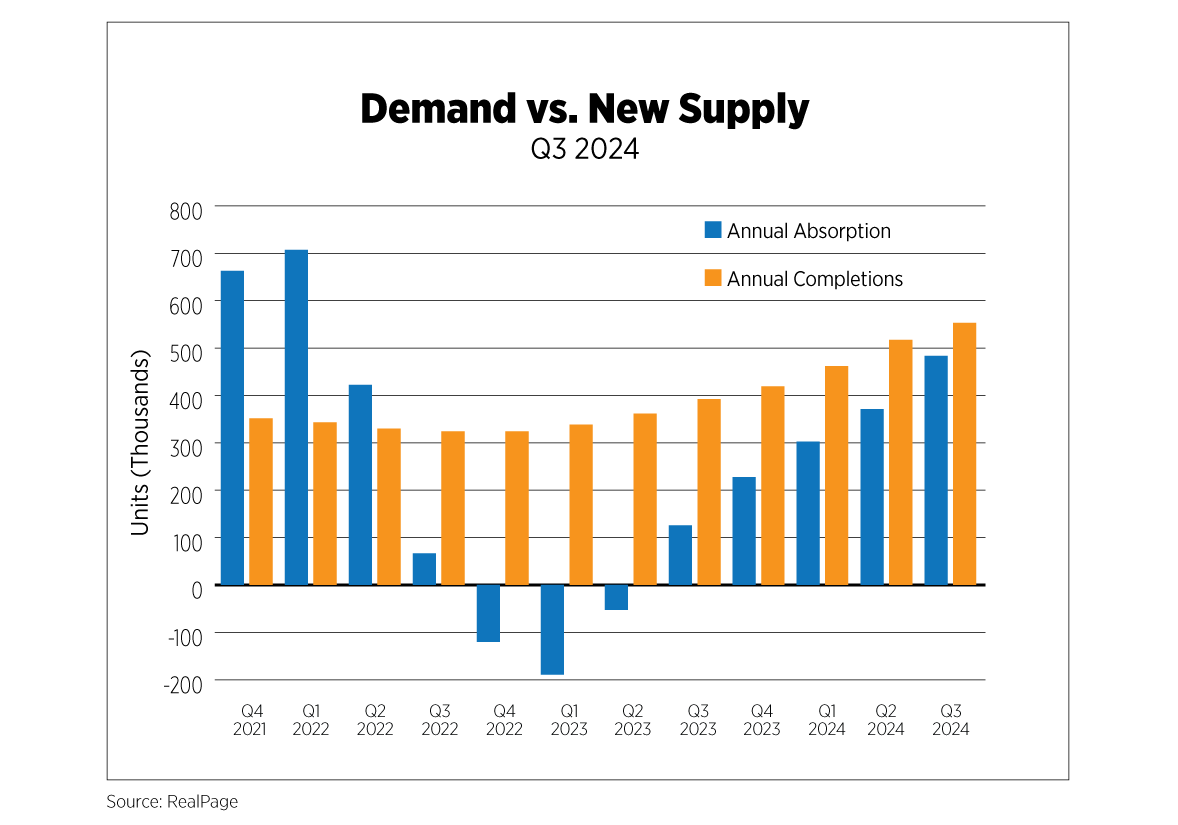

Since the third quarter of last year, annual absorptions have seen a significant and consistent increase, reaching 488,773 units by the end of Q3 2024, according to RealPage. This marks a strong acceleration in demand, with a 29.2% increase from Q2 to Q3 2024. Year-over-year (YOY) analysis shows that demand has more than tripled, signaling a robust recovery and healthier market conditions.

At the same time, the supply of new apartments has surged. By Q3 2024, the market saw 557,842 completed units (annualized), reflecting a 42.6% YOY increase. This figure surpasses the previous peak of nearly 550,000 units recorded in 1986. Although supply has experienced astronomical growth during the past several years, demand is beginning to catch up.

The quarterly supply-demand gap has narrowed by 57.8% from Q1 to Q3, suggesting that the market is gradually finding a balance between new completions and absorption rates. However, some markets still have an overhang of supply, so monitoring these trends remains essential to gauge the sustainability of this momentum and anticipate any economic shifts that could impact the market.

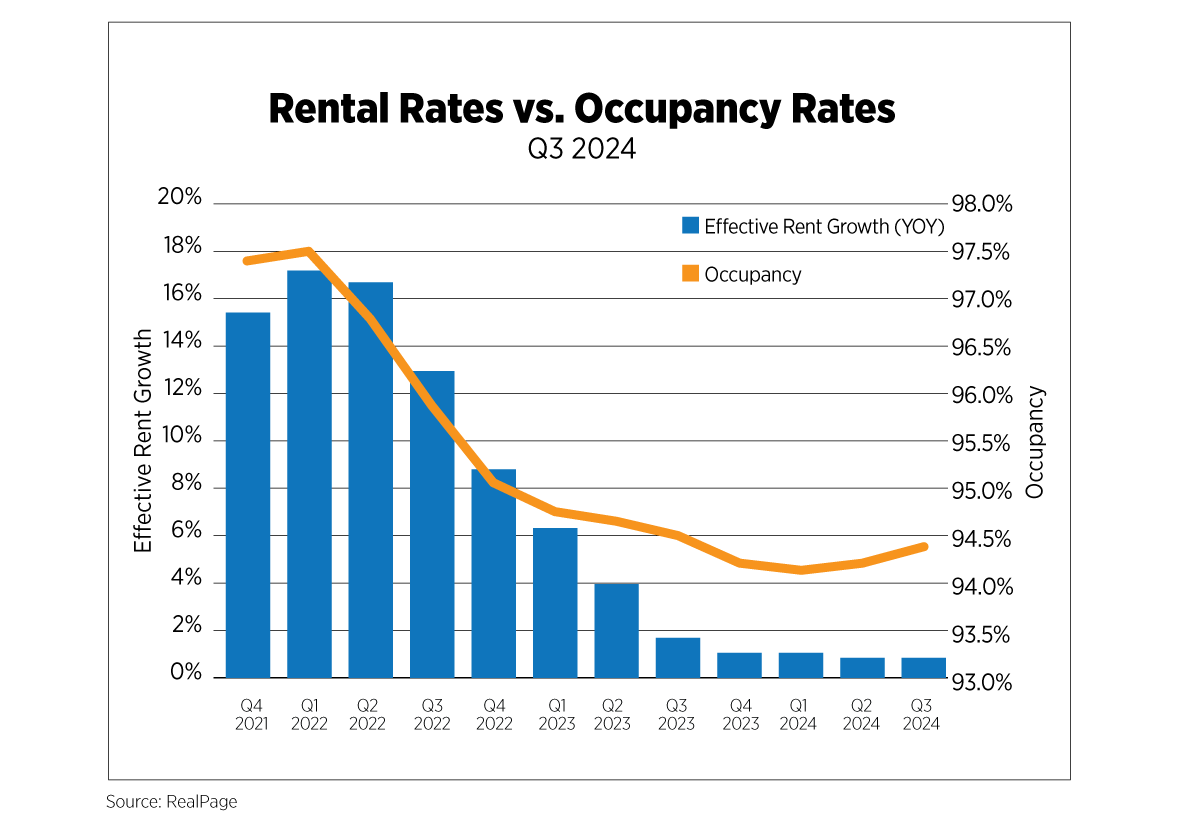

Nationally, there was a slight increase in effective rent during Q3 2024, reaching $1,841, up from $1,808 and $1,829 in Q1 2024 and Q2 2024, respectively. Despite this uptick, the national effective rent growth remained subdued at 0.9%, indicating minimal rent appreciation compared to past years. Similarly, occupancy rates showed slight stabilization, improving to 94.4%. The declining pace of effective rent growth and only marginal occupancy gains suggest a more competitive rental landscape, resulting in even more focus on resident retention strategies and investment in service enhancements to increase occupancy rates as demand rises.

On a metropolitan level, the year-over-year effective rent growth data from Moody’s Analytics REIS for Q3 2024 showed varied performances across 79 markets. Twenty-five markets exhibited positive trends with increases ranging from a modest 0.1% in Nashville, Tenn., and Houston, and 0.7% in suburban Maryland, St. Louis and San Jose, Calif., to as high as 6.0% in Wichita, Kan. The other top performers included Dayton, Ohio (2.6%); Syracuse, N.Y. (2.6%); Miami (2.8%); and Hartford, Conn. (3.1%).

Conversely, several markets experienced declines in effective rent growth over the past year. Notable decreases were observed in Austin, Texas (-5.4%); Jacksonville, Fla. (-4.8%); Raleigh-Durham, N.C. (-4.4%); Charleston, S.C. (-3.9%); Minneapolis (-3.7%); and Phoenix (-3.4%). These declines suggest that certain regions are experiencing heightened competitive pressures, largely due to an influx of new supply.

U.S. Capital Markets

The apartment industry’s sales volume has experienced several fluctuations during this period of elevated interest rates. In Q1 2024, the sales volume declined to about $16.7 billion, but showed signs of recovery, increasing to $23.5 billion in Q2 2024 and $24.3 billion in Q3 2024. This pattern indicates potential stabilization and a gradual recovery in market activity. According to CoStar statistics, Q3 2024 still saw a 5.1% year-over-year decline, suggesting that while the market is improving, it has not yet returned to post-pandemic highs.

The national average price per unit is showing signs of gradual stabilization in 2024. Since Q1 2023, average prices have been on a modest upward trend, reaching $206,520 by Q3 2024. This reflects a quarterly increase of 2.7% and an annual increase of 1.9%, indicating a steady recovery in property values, although prices remain below the peak in Q2 2022. While fewer transactions are occurring, the deals that are closing often involve higher-quality assets or properties located mainly in higher-priced gateway markets.

Among markets with at least 20 transactions in Q3 2024, the highest sales price per unit ranged from $299,000 to $403,000 in areas such as San Diego, Boston, San Francisco, Orange County, Calif., and Washington, D.C. On the other hand, the markets recording the highest quarterly sales volume, in descending order, were Washington, D.C., Atlanta, Los Angeles, New York and Denver, with values ranging from about $1.3 billion to $1.8 billion.

The transaction market continues to face challenges because of elevated interest rates and persistent gaps in buyer-seller expectations. Further declines in interest rates and more price discovery should boost investor confidence, leading to more robust sales activity in the coming months.

U.S. Build-to-Rent Market

Comparing national build-to-rent (BTR) market trends to the same period last year suggests a period of market adjustment, characterized by slight rent increases, decreased new construction, higher completion rates and significantly lower sales activity.

By the end of the third quarter, effective national rent growth increased to $2,189, a 1.2% year-over-year growth. According to Yardi’s single-family BTR national trend report, while rent experienced a negligible drop from Q2 levels, it has shown consistent long-term growth, with a 4.1% increase over two years and a 34.9% rise over five years. Occupancy levels remained stable at approximately 92% since Q1 2024, despite a year-over-year decline of 0.9 percentage points, reflecting a lag compared to peak occupancy levels seen in 2022 and 2023. Quarter-ending data from Yardi highlights the top six markets with the lowest occupancy levels in BTR communities: Atlanta (58.7%), Huntsville, Ala. (75.6%), Hickory, N.C. (82.4%), Birmingham, Ala. (83.2%), Providence, R.I. (83.5%), and Dallas (84.1%). Atlanta’s low occupancy may stem from an oversupply of new BTR developments, with 836 completed units added, leading to temporarily elevated vacancy rates.

The sales volume saw a sharp decline, falling from over $522 million in Q2 to about $315 million, representing a quarter-over-quarter decline of 39.6% and a year-over-year decline of 58.6%. This substantial drop in transaction volumes is also due to higher interest rates and a lack of investor confidence. Similarly, new construction activity has slowed down considerably. Since Q3 2023, the number of housing units under construction has steadily declined by 28.7% year-over-year, indicating a significant slowdown in new build-to-rent projects. By Q3 2024, 71,081 units were under construction, marking the lowest development level since Q3 2021 as construction financing, while improving, remains difficult to secure, and some markets are saturated with new supply.

On the other hand, the number of completed units has been climbing consistently since the beginning of the year, reaching a multi-year peak of 6,356 units – an 8.8% rise and 2.8% rise year-over-year and quarter-over-quarter, respectively. The top markets for completed units were Phoenix (1,170), Atlanta (836), Dallas (400), San Antonio (371), west Houston (353) and southwest Florida (266).

U.S. Economy

Although downside risks to the economy remain more prevalent than upside risks, recently released indicators continued to point to a strong, resilient and growing economy. GDP, jobs, wages, inflation, consumer spending and productivity growth are all reasons for optimism. The election, ongoing conflict in Eastern Europe and the Middle East and a potential spike in oil prices all throw uncertainty into the mix and are valid grounds for pessimism.

With a long-run growth potential of 2.0%, real GDP (adjusted for inflation) bested that in Q2 2024, growing a solid 3.0%. Additionally, the Atlanta Fed’s GDPNow forecast is estimating 3.4% growth in Q3. Consumers’ pessimism and uncertainty are having little impact on their wallets as spending data reveals. Consumer spending rose 2.8% from the prior quarter and contributed 1.9 percentage points to GDP, with expenditures for services comprising two-thirds of the total. Advance retail sales, which do not adjust for inflation, have also been compelling, averaging 1.9 year-over-year increases in Q3, higher than expected, especially given price reductions in some goods.

After some troubling upturns earlier this year, inflation has been moving in the right direction for the past six months, with the index for all CPI items rising 2.4% year-over-year in September, the lowest rate since February 2021. Services inflation is responsible for core inflation (excluding food and energy) remaining elevated at 3.3%. Prices for services rose 4.7% compared to price declines of -2.9% for durable goods and -0.7% for nondurables.

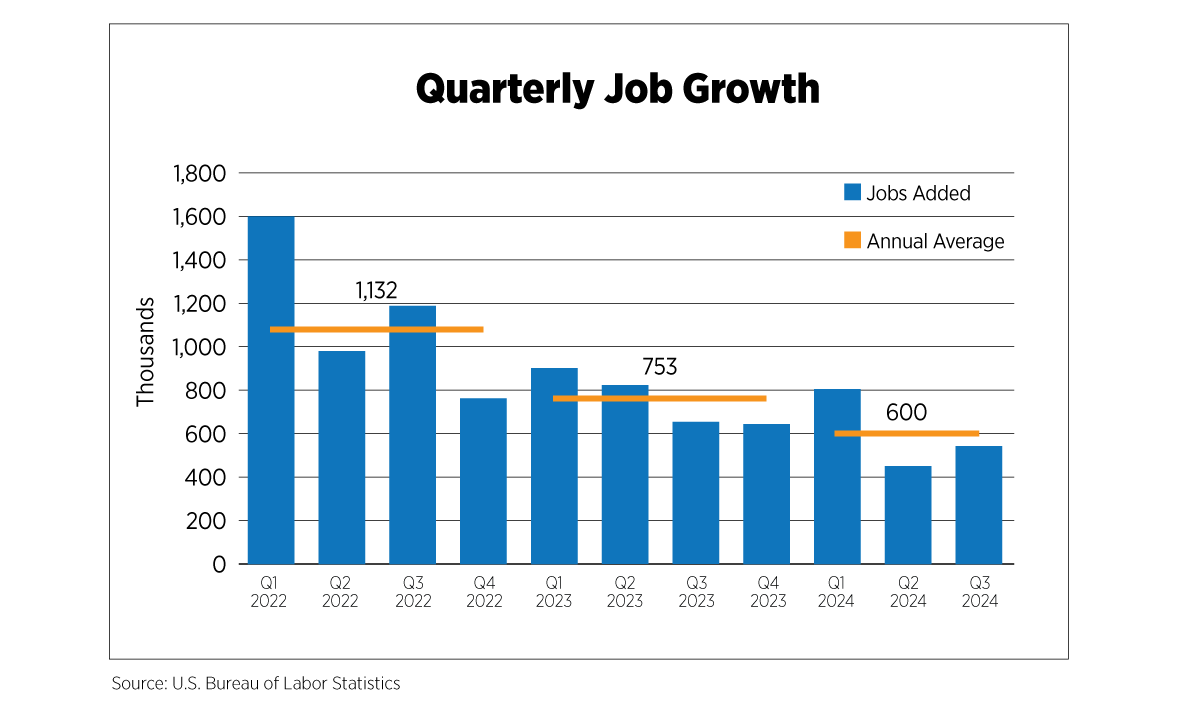

Employment came back strong in September, easing concerns somewhat about lackluster growth through the summer months and elevating job additions for the quarter to 557,000. While it’s clear that the labor market has cooled considerably for the past two years, recent job growth has been squarely in line with pre-pandemic levels. Other labor market indicators also stayed consistent with steady economic expansion, including the level of unemployment claims, which have been mostly below 250,000 per week. Job openings have also retreated and there are now roughly 1.1 jobs per unemployed persons, compared to more than two jobs per person in March 2022 when job openings peaked. Quit levels are one more indicator the labor market is favoring employers, with 3.1 million workers (just 1.9%) quitting their jobs in August, the lowest in four years.

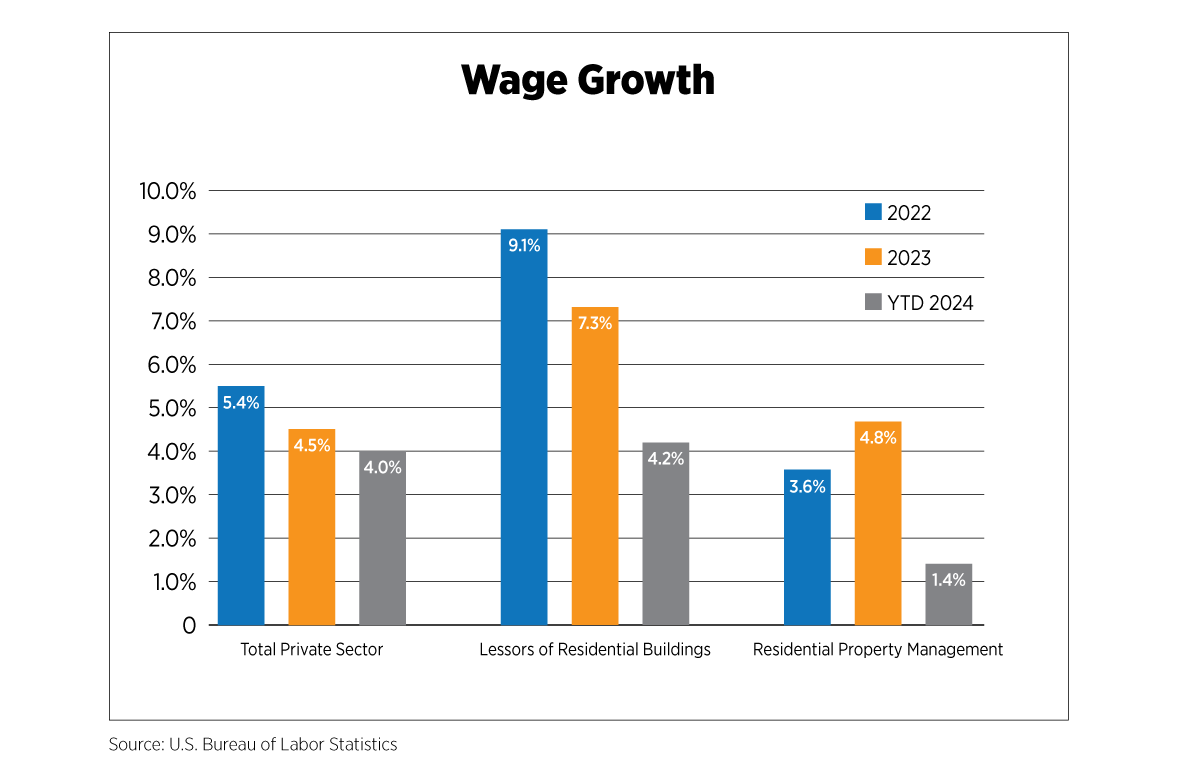

Wages have begun to creep up over the past two months following signs of moderation during the first half of the year. Despite their stickiness, they are decelerating on an annual basis after a cycle high of 5.4% in 2022 and an average of 4.5% in 2023. Year-to-date, total private sector wage growth is averaging 4.0%. The two industry sectors which include the highest percentages of multifamily housing firms are showing a similar pullback in wages, especially those firms classified as residential property managers, where wage growth in 2024 is averaging just 1.4% through August.

Outlook

The Fed has forecasted two more 25-basis-point rate cuts before the end of the year, but it will continue to evaluate economic data in the coming months. It has also signaled that it is no longer focused as much on inflation as employment. Recent natural disasters and work stoppages may negatively impact the October employment report, but it should prove to be a temporary phenomenon.

At the time of this writing, with the election looming, interest rates still high and rent growth generally anemic, the apartment industry is not quite ready to celebrate. Based on anecdotal evidence, expense growth may be starting to moderate, which will provide a much-needed boost to net operating income. Demand has been persistently strong, alleviating the backlog of supply in some markets and contributing to rent increases in those markets with lower rates of new construction. The gridlock in capital markets is just beginning to clear up but more price discovery and further easing of interest rates are essential to returning to normal levels of activity. And even though interest rates will remain elevated, once election uncertainty passes, business investment should begin to pick up.