The continuing increases in U.S. job growth, signs of sustained wage growth, and generational lifestyle shifts all continue to support the remarkable multi-year trends in multifamily housing. Although rental rate growth has waned marginally in 2016, demand is strong and supply continues to increase. Product design, amenities, services, price points and markets are changing and being shaped around both Millennial and boomer generation demographics and lifestyles.

The success of the sector has required executives and key management of multifamily investment, development and management companies to continue holding employees as a top priority as a component of strong and effective talent management. Employee expectations are high in all categories, across compensation, benefits, company culture and values, and relationship to community. Compensation is of particular importance as pressure to meet job performance expectations, investor returns and sustain employee retention all are essential to success.

Competitive Market for Top Talent

The marketplace for top talent is as competitive today as it has been for the past several years. As reported by the CEL National Real Estate Compensation and Benefits Survey (the 27th annual and the largest and most comprehensive in the industry), management is keenly focused on compensation trends as well as career paths, roles and resources as the components of growth, profitability and long term organizational stability. In 2016, hiring remains steady in most all functional areas, challenged by the marketplace realities of declining “job ready” graduate skills, high turnover for another opportunity, declining tenure, pressure for expanding non-traditional benefits (as well as reducing employee share of healthcare costs), maintaining a platform with contemporary technology, and managing millennial generation workplace environment expectation.

Cash Compensation Trends

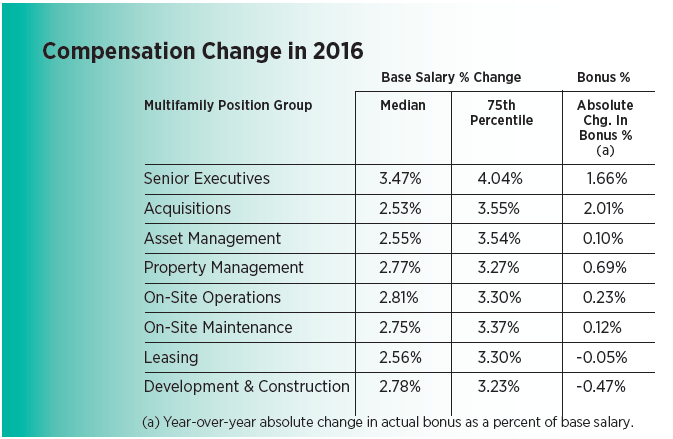

Cash Compensation in 2016 was up across the spectrum of multifamily sector positions, reflected in both Base Salary merit increases year over year in the 2.5 percent to 3.5 percent range (median to 75th percentile) as well as bonus payouts (as a percentage of salary) generally rising, particularly at higher position levels.

Additionally, expectations for 2017 continue to reflect a rising pattern with a majority of CEL survey respondents indicating that merit increases will increase in 2017 up to 1 percent or higher. Although the bonus (as a percent of Salary) may appear to be only marginally higher, it is important to also note that bonus realization (payout as a percent of target) has been steadily rising (since 2009) and is now approaching 85 percent. Bonus programs (and awards) increasingly have focused on defining and rewarding high performers, and bonus plans are increasingly more structured in defining the relationship between bonus awards and levels of performance.

Long-Term Incentive Programs (LTIP)

For senior management rising stars and high performers, LTIP programs are the key to retention and recruitment. Pressure for inclusion of more employees in LTIP programs related to asset investments, JVs, promotes and long-term enterprise value is increasing for private companies, in order to compete with public company LTIP vehicles (restricted shares, LTIP units and stock options). LTIP programs are an essential component of Talent Management, offering opportunity to build wealth, as one of the many components of career development, responsibility, leadership, recognition, training and retention.

Looking Forward

The multifamily sector continues its many year growth trend and at this point sees no general shift to oversupply, declining rental rates or competitive concessions (net of isolated market/sub-market situations). Demographic trends are on the side of an increasingly rental-oriented residential sector. The past few years have coincided with relatively flat economic and income growth, and a transition to higher interest rates, increases in wages and stronger growth projections will likely not significantly change the underlying economic, demographic and lifestyle shifts that have impacted the housing sector.

It is unlikely that the growth trend in compensation for multifamily executives and management will recede in the near term, as market fundamentals remain strong and the market for talent remains highly competitive.

James B. Wright is Managing Partner of CEL Compensation Advisors, LLC.