Property managers are reporting higher instances of fraud during the pandemic, resulting in much needed defenses.

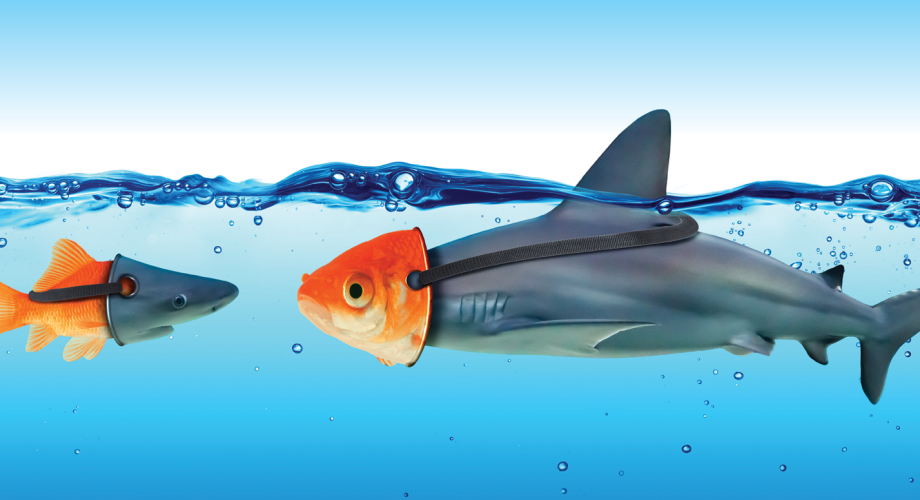

The uptick in apartment rental application fraud, where prospective residents use fake financial

documents to inflate their income, is cause for significant concern.

According to a recent Snappt survey of property managers, 85% now report being targeted by application fraudsters, compared to 66% pre-pandemic.

Rachel Palmer, Chief Administrative Officer at Tampa, Fla., based American Landmark Apartments, which counts 35,000 units in its portfolio, has witnessed the problem firsthand.

She says about 40% of the applications her team vets each month are fraudulent. Most come in the form of altered bank statements and bogus paystubs—documents that are easily obtained online today but are hard to spot with an untrained eye.

With an average rent of $1,500 a month across the units she manages, that translates into $21 million in revenue that’s at risk every 30 days if she doesn’t stop those applicants from becoming her residents. “It’s not pocket change,” Palmer says.

The problem isn’t just that some prospective residents are engaging in fraudulent behavior, it’s also a matter of how many do not see their actions as unacceptable.

When asked their view of altering financial documents to apply for an apartment, nearly a quarter of renters said doing so was either “somewhat” or “extremely” acceptable, according to the same survey.

“There’s a lot more cunning in the world we live in today,” Palmer says. “We want to see the good in people, but there’s bad out there, too.”

Bigger than just multifamily

Fraud in general was already burgeoning pre-pandemic. But since that time, it has exploded, costing businesses $5.4 trillion globally, according to a report from Crowe UK and the University of Portsmouth. That’s more than twice the gross domestic product of the U.K. Crowe has called fraud “the last great unreduced business cost.”

In the U.S., reports of fraud, identity theft and other deceptions spiked by 67% between 2019 and 2021, according to the Federal Trade Commission. The grifts range from cyber and payment fraud to lying on bank loan applications, and more recently, supply chain and ESG reporting fraud, according to PwC.

While many of these schemes are orchestrated by professional criminals, evidence suggests an increasing number of these perpetrators are casual practitioners of deception.

For example, LexisNexis Risk Solutions found over 30,000 fraud rings engaged in forgery, filing false claims, identity theft, identity manipulation and fake checks. Many groups comprised family members or circles of friends who collaborated to improve their collective fraud success rates.

A cottage industry has sprung up online to help consumers buy fabricated documents, including fake paystubs and bank statements, to fraudulently qualify for loans, mortgages,

car purchases and apartment leases, among other transactions.

Your own personal fraud ‘coach’

It’s from these sources that today’s apartment rental application fraudsters are buying their bogus documents.

These businesses claim to simply provide the documents as “novelties” and explicitly state they’re not distributing their wares to aid and abet illegal activity.

Take, for example, a YouTube video from a fraud “coach” who advises her followers that she’s not presenting her information to help them commit a crime.

“We are not here to help you defraud the banks, government or creditors in any way,” she says. “We are just educating.”

She then goes on to “teach” watchers how to avoid getting caught – by advising them to convince someone else to commit fraud on their behalf.

How property managers are fighting back

Dallas-based Eleven Market Research talked with some of the largest apartment operators in the U.S., and 40% of the 230 respondents manage more than 10,000 units. All of them focus on the application vetting process in their jobs, with most (84%) leading teams of professionals who qualify rental applications themselves.

Given the degree of fraud they’re seeing today, it’s no wonder 89% of Eleven Market Research survey respondents said making sure applicants can afford the rent and avoiding future payment issues and evictions were somewhat or extremely important goals of their application- vetting process.

But the challenges of hitting those goals are daunting, because of the ease with which bank statements and paystubs can be altered.

Altered documentation was the biggest problem identified in the survey, with 84% of respondents saying it was a somewhat or extremely significant challenge. The next largest percentage (79%) ranked running afoul of the Fair Housing Act for flagging applicants with altered documentation in the same category.

In tandem, these two largest challenges underline the Catch 22 managers find themselves in when fighting application fraud: Choosing between a potential Fair Housing violation or the risk of letting a fraudster in the door.

Fighting fraud on multiple fronts

Given these hurdles, property managers do what they can to stop fraud before it gets inside the building including:

- Asking for financial statements such as paystubs and bank statements (78%)

- Using resident screening software (66%)

- Running credit checks (61%)

- Implementing ID verification (59%)

- Using a solution to detect fraudulent documents (59%)

- Checking references (56%)

- Running a criminal background check (56%)

- Checking prior convictions (56%)

- Linking bank accounts to avoid payment issues (33%)

But even after taking these steps, managers said fraud was still slipping through the cracks.

More than three quarters of respondents (78%) said the fact that their process wasn’t spotting bad applicants was a somewhat or extremely significant challenge, while 75% put screening reports that contain faulty information in the same tranche.

Meanwhile, 72% said potential Fair Credit violations as well as erroneously denying good applicants were similarly difficult hurdles. Finally, the staff time it takes to vet applicants was among the most significant challenges for 69% of respondents. (Previous surveys indicate property staff spend between four and 10 hours on the vetting process for each applicant.)

Three core components of application vetting

The length and complexity of the process speaks to the severity of the challenge property managers face.

But what’s interesting is that three of these steps took the majority of time for property staff to complete, constituting the core of application vetting. Those three areas were:

- verifying bank statements (72%)

- verifying paystubs (67%)

- checking references (67%)

These were also among the most important steps of the entire process.

For 90% of respondents, verifying the accuracy of a paystub was somewhat or extremely important, while nearly the same cohort, 89%, put authenticating an applicant’s bank statement in the same tier.

Only verifying an applicant’s ID, i.e., confirming the person is who they say they are, was seen as more critical to the process, with 92% of respondents ranking it with the highest degree of urgency.

The takeaway is that while application fraud can seem almost overwhelming, by focusing on the three core components of application screening – verifying bank statements, paystubs and ID – property managers can more effectively allocate staff time.

“We have to put processes in place so that this doesn’t overwhelm our company and our people,” Palmer says. “It’s just a small step, but it is a step in the right direction for us to stop deceit in its tracks.”

Revisiting the basics of good property management helps, too.

- Set the bar higher for applicants by requiring two months of paystubs or bank statements with an application.

- Look for variable dates between when a paystub was issued and when the deposit hit the applicant’s account.

- Pick up the phone and call employers to confirm an applicant works where they claim.

- Incentivize your team to prioritize legitimate applications by tying future bonuses to a property’s on-time rent payment score, not just new leases.

The increased risks of apartment application fraud and the lingering effects of the pandemic mean management companies must work harder than ever to make sure they’re not actually accumulating record levels of bad debt, instead of higher rent rolls. Focusing on these three areas can help.

Daniel Berlind is CEO of Snappt and President of Berlind Properties.