Joint Testimony to Subcommittee on Housing & Insurance in Advance of the Hearing “The Factors Influencing the High Cost of Insurance for Consumers”

NAA and NMHC submitted joint testimony on the topic of difficulties in securing insurance its increasing volatility leading to soaring costs, reduced coverage, and unmitigated risks, all of which pose a significant financial and operational challenge to apartment firms of all sizes and types and ultimately worsens housing affordability.

November 2, 2023

The Honorable Warren Davidson

Chairman

Subcommittee on Housing & Insurance

2129 Rayburn House Office Building

Washington, DC 20510

The Honorable Emmanuel Cleaver, II

Ranking Member

Subcommittee on Housing & Insurance

2217 Rayburn House Office Building

Washington, DC 20510

Dear Chairman Davidson and Ranking Member Cleaver:

On behalf of the nearly 100,000 combined members of the National Multifamily Housing Council (NMHC) [1] and the National Apartment Association (NAA) [2], we are writing in advance of the hearing titled “The Factors Influencing the High Cost of Insurance for Consumers” to share the views of the multifamily housing industry. In recent times, volatility in the insurance market has led to soaring costs, reduced coverage, and unmitigated risks, all of which pose a significant financial and operational challenge to apartment firms of all sizes and types and ultimately worsens housing affordability.

We appreciate and commend the Subcommittee on Housing and Insurance and the broader Financial Services Committee for its interest in exploring the causes of rising insurance premiums across the nation’s housing market, and in particular the significant negative impacts such increases have had on all stakeholders, including, but not limited to, multifamily housing developers, lenders, investors, owners, and our nation’s renters. We respectfully submit this statement for the record for the purposes of providing (i) further information and clarity regarding the momentous impacts the volatile insurance market is having on the broader housing market, including the fact that volatility with respect to insurance rates and costs is significantly exacerbating the nation’s housing affordability crisis; and (ii) policy suggestions for the Subcommittee’s consideration that we believe would be good first steps to help address this crisis in a meaningful way that benefits all stakeholders in our nation’s housing ecosystem.

Ultimately, our primary objective is to be sure that all housing providers can meet long-term housing needs for the 38.9 million Americans who live in apartment homes and continue to foster the growing contributions that rental housing makes for our economy, which currently stands at $3.4 trillion annually. [3] [4] The volatility in the insurance market over recent years hinders the ability of housing providers to increase the nation’s housing supply. We respectfully urge the Subcommittee to consider the policy recommendations and background information contained herein as we strongly believe such policies have the potential to alleviate the pressures from skyrocketing insurance costs on housing affordability nationwide.

Insurance Rates Have Increased at Unprecedented Rates in Recent Years:

For the better part of a decade, owners, operators and developers of rental housing have been hit hard by dramatically rising insurance costs. Coverage limitations, deductible increases and the growing absence of an affordable or viable private insurance market altogether have increased the financial risk borne by housing providers and strained property operations. These challenges have coincided with an increasingly difficult multifamily risk landscape overall. The ability of multifamily firms to attract investments required to meet the nation's housing needs and help address its housing affordability crisis is put at risk by out-of-control insurance costs.

This lack of affordability of insurance options for rental housing property owners has in many cases limited the ability of property owners to make needed investments in their properties. These increased insurance costs are also causing developers to delay or cancel projects which will, undoubtably have a long-term effect on housing supply and affordability for years to come. Recent survey data help illustrate the acute nature of the challenges for rental housing operators and can similarly be felt across the broader housing and real estate markets.

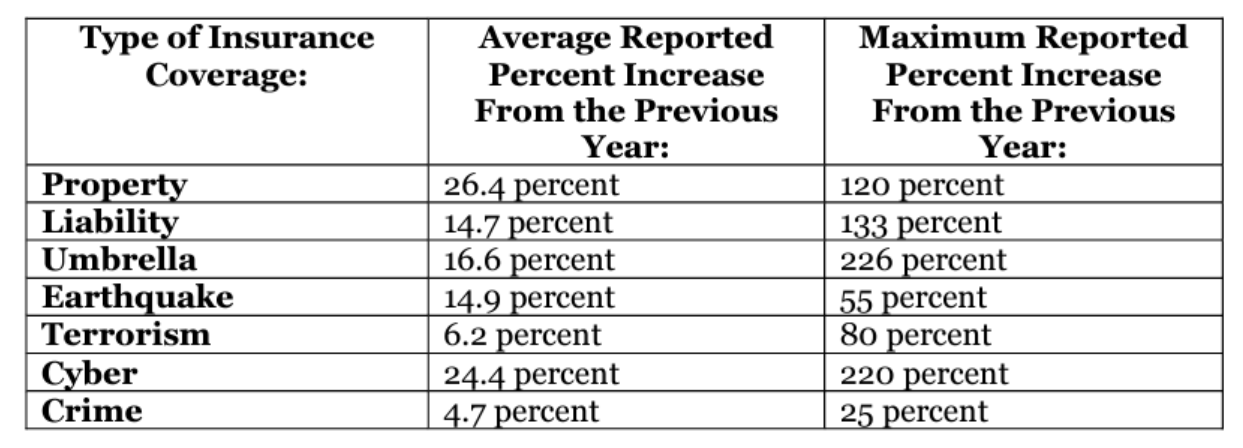

As of the second quarter of 2023, property insurance rates in the United States have increased for 23 consecutive quarters. [5] Further, over the past three years, insurance premiums have been subject to unprecedented increases, with providers reporting annual premium increases ranging from 30 percent to 100 percent for affordable rental housing communities. [6] The below table demonstrates the unprecedented increases in rates for various types of insurance coverage:[7]

The findings of NMHC’s 2023 State of Multifamily Risk Survey and Report, detailed that volatility in the insurance market and accompanying cost increases have only worsened over the last few years, leading policyholders to raise deductibles, and insurers to limit coverage amounts and include new policy limitations In the past three years:

- 61 percent of the respondents had to increase their deductibles to maintain affordability.

- 57 percent of the respondents indicated that their insurance carriers included new policy limitations to reduce their exposure.

- 34 percent reported that their insurance carriers limited or reduced coverage amounts.

Yet, as problematic as these challenges have been across the broader housing ecosystem, the challenge is even more daunting in the affordable and middle-income housing space. A new survey and report, which was released earlier this month and commissioned by the National Leased Housing Association (NLHA) and supported by NMHC, NAA and other affordable housing organizations focused on the impact of the current insurance market challenges on affordable housing providers. The survey found that rental housing businesses are facing much higher premiums—nearly one in every three policies had rate increases of 25% or more.

Key findings include:

- For 2022-23 renewals, 29 percent of housing providers experienced premium increases of 25 percent or more, compared to 17 percent the previous year;

- Limited markets and capacity are responsible for most premium increases, followed by claims history/loss and renter population;

- 67 percent of respondents reported increasing insurance deductibles to manage the increases followed by decreasing operating expenses and increasing rent.

Meanwhile, recently released data from NAA show that rental housing is an industry that relies on slim margins; nationally, 93 cents out of every dollar paid in rent is used to operate and maintain the property, and some markets see even smaller returns.[8]

The combination of these conditions has clearly led to negative impacts on both housing providers and renters, with most housing providers indicating that they would take action to mitigate cost increases due to higher insurance premiums by increasing insurance deductibles, decreasing operating expenses, and being forced to increase rent. These steps are being taken as a last resort when the multifamily housing industry is facing soaring operational costs across the board and at a time of great housing affordability challenges across the nation.

Insurance Costs and Impact on Housing Affordability and Supply

Today, in more and more communities, hard-working Americans are unable to rent or buy homes due to increased housing costs driven by a lack of supply. This lack of supply, in turn, is created by barriers to development that make it increasingly challenging, if not impossible, to build housing at almost any price point. This is particularly true for price points affordable to low- and middle-class families. The total share of cost-burdened households (those paying more than 30 percent of their income on housing) increased steadily from 28.0 percent in 1985 to 36.9 percent in 2021, while other households have been priced out of communities altogether in their search for affordable housing.[9]

And while policymakers at all levels of government must do more to remove barriers to housing production, they must also understand how operational costs—outside of the control of property owners—is exacerbating the situation and directly impacting the cost of housing. With little-to-no budgetary flexibility, housing providers are often forced to rethink or defer necessary maintenance, cut amenities or other resident services or take other unwanted measures to be able to maintain required insurance coverages, which are dictated by agency or lender requirements.

Today’s current challenges will have a lasting impact on our ability to address housing affordability and meet rental housing demand in the long-term. Year-after-year of increasing insurance costs, coupled with other economic uncertainty, is impacting property valuations, disrupting transactions, and putting substantial pressure on the operating budgets of rental housing properties, often resulting in growing areas of uninsured risk. While not new, the challenges in the insurance marketplace have only made the situation more dire at a time when NMHC and NAA members are reporting that current economic and regulatory challenges are causing them to cut back significantly on development activities, in some cases, by as much as 50 percent. This slowdown has longterm implications. NMHC’s September 2023 Quarterly Survey of Apartment Market Conditions also indicates the following troubling statistics:

- The majority of respondents (57%) reported lower sales volume from three months prior.

- Nearly two-thirds (64%) of respondents reported equity financing to be less available than three months ago, marking the seventh straight quarter of less availability; and

- 83 percent said it was a worse time for mortgage borrowing compared to three months earlier, the ninth consecutive quarter in which debt financing became less available.

Snapshots of the Soaring Cost of Insurance & Impact on Housing Operations and Affordability

- Middle-Income/Workforce Housing property owner and developer

A national developer, owner and manager focused on middle-income housing production has faced a cumulative increase of all insurance costs between 2021 and 2023 of 32 percent and a cumulative increase of property insurance costs between 2021 and 2023 of 40.6 percent. When looking at their portfolio only in the state of Florida, the cost increases are even more dramatic with a cumulative increase of all insurance costs between 2021 and 2023 of 53.5 percent and a cumulative increase of property insurance costs between 2021 and 2023 of 63.5 percent. Looking at the cost increases per apartment costs is even more telling. The cost of insurance per apartment rose from $477 in 2021 to $629 in 2023. In Florida, the cost of insurance per apartment rose even more dramatically from $641 in 2021 to $983 in 2023.

- Mixed-portfolio property owner

Over the past 12 years, a vertically integrated multifamily investment, development, and management firm with over 80,000 apartment homes across the nation has faced a 1700% increase in liability insurance premiums.

- Mixed-portfolio property owner

Another vertically integrated national real estate investment manager, diversified across market rate apartments, quality affordable housing, and service-rich seniors housing manages its insurance costs through a combination of its own captive insurance plus going to the insurance market. Even with this approach it saw its insurance costs go up 43.2 percent just over the past year after experiencing a 14.6 percent increase the prior year.

- Affordable/Senior Housing Operator

A large, Christian based non-profit affordable housing provider saw its renewal move them to a $100,000 deductible for the first time in their history. They have seen the property insurance liability for their affordable housing properties increase by over 400 percent over the last 6 years. They report that in recent years there has been little room left for negotiation — carriers have increased premiums and raised deductibles but adopted a ‘take it or leave it’ approach.

- Affordable Housing Operator

Despite a low loss-run history, a large, mission-driven acquirer and developer of affordable housing across the nation, has in some markets seen their insurance premiums double at their most recent insurance renewal in March of 2023. These significant increases have made it more challenging to preserve and develop affordable housing across the nation.

Property Insurance Rates Largely Driven by Volatility in the Broader Market

The fact of the matter is that the insurance markets are undergoing an unprecedented level of volatility. Prior to 2017, the property insurance market was relatively stable in that large, catastrophic events were relatively infrequent; thus allowing insurers to fund and reserve capital as well as plan for the payment of claims for such catastrophes. [10] Further, the market was relatively competitive and new capital continued to enter the broader market, which allowed for brokers to structure insurance programs in innovative ways that offered broad coverage terms with high insurance limits and low deductibles. [11] However, starting around 2017, the property insurance market increasingly began to destabilize as more frequent natural catastrophes occurred, in conjunction with the inflationary impact of higher materials and labor costs as was the occurrence of more recent supply chain issues linked to the COVID-19 pandemic.[12]

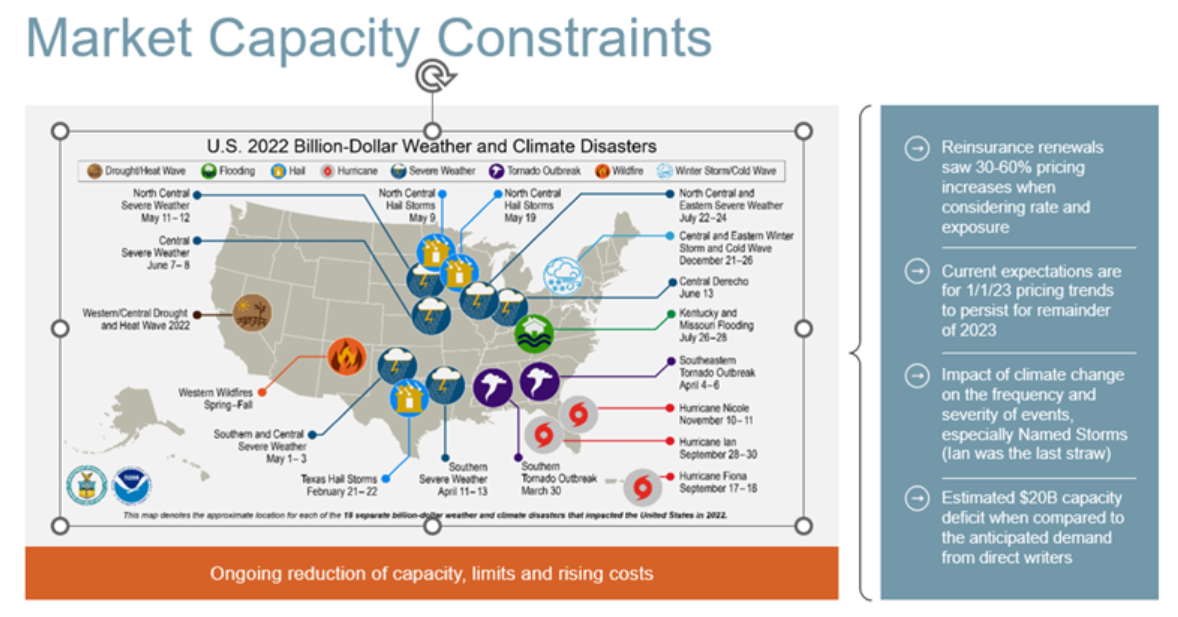

More recently, insured losses arising from natural disasters were calculated at $121 billion and almost $115 billion in 2021 and 2022 respectively. [13] Insured losses in 2022 were well above the ten-year average, with $132 billion in total insured losses and $125 billion in natural catastrophe insured losses. [14] Marsh’s May 2023 Market update indicates that the first quarter of 2023 rate increases trended near 15 percent plus additional building cost increases (i.e. over-10 percent average), culminating in an over-25 percent premium increase. [15]

The instability of the property insurance market due to several factors outlined in this statement, including the recently unprecedented frequency of natural disasters, has had a disproportionate impact on housing providers, developers and other stakeholders in the housing industry nationwide in that many insurers have simply ceased to underwrite multifamily or other similar property casualty policies broadly nationwide or in certain markets prone to natural disasters such as the Gulf Coast. For example, Florida has seen unprecedented impacts to its property insurance market due to the frequency of natural disasters. Following the occurrence of Hurricane Ian in Florida in September 2022, United Property & Casualty Insurance Company, a significant regional insurance carrier, became insolvent. [16] This insolvency was in addition to at least 15 other Florida insurance carriers that have become insolvent since 2020.

The situation in Florida has gotten so bad for insurance carriers that in July 2022, Demotech, the chief ratings firm in Florida, publicly announced that it was on the verge of downgrading more than a dozen insurance carriers in Florida. This would have impacted the Fannie Mae and Freddie Mac insurance rating requirements, which provide that mortgage lenders must obtain additional insurance coverage on applicable properties if an applicable insurer’s ratings fall below an “A” rating and if the homeowner is unable to immediately purchase “A” rated replacement policy. [17] [18] Accordingly, the Florida Office of Insurance Regulation announced earlier this year that the state would provide 100 percent backstop coverage of any claim left unpaid by a bankrupt insurer through the Florida Insurance Guaranty Association and the state-run Citizens Property Insurance Corp. The temporary program would be in effect until the end of hurricane season on November 30th. [19] Specifically, this arrangement takes advantage of an exception to Fannie Mae and Freddie Mac’s rules, by using Citizens, through an endorsement, to cover outstanding claims that would not be paid by the Florida Insurance Guaranty Association in case the insurer becomes insolvent and is put into receivership. [20] In December 2022, Fannie Mae and Freddie Mac announced that they would accept Florida’s insurance stabilization temporary solution given the fluctuations in the Florida insurance sector. However, both entities specifically noted that their respective approval was specific only to Florida’s arrangement, and other states would have to obtain approval for other state programs, as applicable. [21]

Despite the gravity of the situation in Florida, the factors at play are not unique to just Florida. During a similar time period, at least 20 insurers in Louisiana have become insolvent or have left the state entirely. [22] Public reporting indicates that states that are prone to natural disasters such as tornado convective storms, wildfires and flashfloods are feeling similar pressures to their respective property insurer markets. [23] For example, major insurers such as State Farm, All State and AIG all no longer underwrite new homeowners’ insurance policies in California due the state’s proximity to several natural disasters. [24] And while these impacts have been publicized for their significant impact on the single family housing market, the multifamily rental housing space has seen similar, if not worse, trend lines.

Other nuances of the property insurance market that that have led to higher insurance rates include (i) the expansion of the litigation funding industry and (ii) the unique dynamics of insurers’ investment portfolio performance. The litigation funding industry refers to an approximately $39 billion industry in which entities such as hedge funds, venture capital funds, and other undisclosed or shadow investors provide funding for commercial litigation that is paid back after insurance settlements related to the litigation are paid out. [25] Recent academic literature indicates that a prevalent pattern of the litigation funding industry is such undisclosed entities charging plaintiffs usurious rates in a manner that is similar in scope and risk to payday lending. [26] The response by the insurance industry to the rise in the litigation funding industry has been to increase insurance rates and tighten coverage requirements, which in turn has resulted in higher rates for coverage holders in the ordinary course of business. For example, in 2020, AM Best, an insurance industry rating agency, downgraded “U.S. commercial general liability insurance segment, owing to unfavorable claims trends driven by social inflation and other factors such as third-party litigation financing.” [27]

With respect to the nature of insurers’ investment portfolio performance, it is important to note that insurers typically hold significant investments in corporate bonds and structured securities like collateral loan obligations, residential mortgage-backed securities as well as consumer-backed securities, among others. Due to rising interest rates in connection with the inflationary nature of the current economy, the value of these investments has decreased over the last year to two years. [28] In fact, this is the exact phenomenon that led to bank failures earlier this year, including Silicon Valley Bank and Signature Bank.

Further, rising interest rates have raised the cost of borrowing and doing business for insurance companies nationwide, which has only served to force such insurance companies to find other means of raising capital and offsetting such costs. The primary means by which insurance companies have offset such dynamics has been to raise insurance rates for coverage holders and new applicants, even when applicable risks and the total insurable value (TIV) of an applicable property have not materially increased.

Ultimately, we believe that the main causes of rising property insurance rates nationwide can be summed up through the following high-level factors, subject to the various nuances described more fully in this statement:

1) Impact of Rising Inflation on Replacement Costs Methodology

Insurers use varying methodologies for determining a property’s insurable replacement costs (e.g., internal valuations, engaging third party services, relying on the expertise of construction/development teams, using industry standards such as Marshal and Swift, CoreLogic or the National Building Cost Manual, or reviewing guaranteed maximum price schedule of values and other metrics to determine corresponding costs), among other means. Rising inflation in recent years has led to higher construction/rebuilding costs, which ultimately impact replacement costs for properties insured under operational insurance programs. The net effect of this phenomenon is that insurers are raising insurance premiums and rates to account for significantly higher replacement costs.

In sum, since March of 2020 when the COVID-19 pandemic began, construction costs have increased dramatically due to the economy’s current inflationary environment, which has resulted in significant increases in the replacement value of current rental housing assets. When the TIV of multifamily housing assets increases, housing providers are forced to buy higher limits of insurance coverage, which causes premiums to increase.

2) Insurance Market Capacity Constraints and Policy Limitations

As noted earlier, there are several factors currently at play that are causing the property insurance market to become more volatile. Additional capital is exiting the market due to additional losses and corresponding increases in capital from reinsurers. Further, the reinsurance market is separately undergoing volatility as well. For example, as of January 2023, treaty reinsurance renewals have been seeing significant rate increases, together with reductions in capacity and increase in retentions for catastrophe capacity. Given new and more frequent catastrophic events and disasters in recent years, carrier risk models have been adversely affected, which has limited underwriting profitability. Accordingly, insurers are being forced to take such factors into account, which results in significant rate increases and limited capacity for coverage.

Rising Insurance Rates Are Having Harmful Impacts on All Stakeholders in the Real Estate and Affordable Housing Markets

There is wide consensus that key solution to addressing the nation’s affordable housing crisis is to boost affordable housing supply, and in doing so, incentivize private sector affordable housing market developers, lenders, and other stakeholders to participate in the affordable housing market. Unfortunately, the recent trend of unprecedented rising insurance premiums has been a significant contributor to (i) disincentivizing housing providers from participating in the affordable housing market and (ii) rising rent inflation for tenants, particularly in higher cost of living jurisdictions.

One unique and critical aspect of affordable housing communities, including, but not limited to, those communities that are often developed via housing providers that have utilized the federal Low-Income Housing Tax Credit (LIHTC), is that such communities are income-restricted (i.e., typically eligible only for households earning more than 60 percent of area median income (AMI)) and rent-restricted (i.e., typically where programmatic rents are established so that the aggregate housing costs do not exceed 30 percent of a household’s income).

Due to such income and rent restrictions, housing providers of affordable housing communities typically cannot simply pass through insurance rate increases to their residents via rent increases. Accordingly, housing providers will be subject to reduced cashflow at properties or the depletion of property reserves, which force such housing providers to undergo several options that are negative not only for the housing providers, but also for their applicable tenants. Examples of such options include, but are not limited to, defaulting on debt, reducing services for residents, deferring maintenance plans and services, and ultimately, electing to opt-out from participation in the affordable housing market as compliance with income and rent restrictions under the LIHTC program and others becomes increasingly untenable.

Within the current economic climate of persistent inflation, housing developers and providers are already dealing with supply chain disruptions and increased construction, development, operation, maintenance, and other costs that are making the construction and operation of affordable housing units increasingly untenable. Rising insurance rates have contributed to this untenable situation not only because of the added costs, but also due to the unique nature of insurance coverage and requirements that are imposed on housing providers. For example, when a lender underwrites a property, increased operating costs, which include insurance premiums, ultimately decrease debt proceeds, which ultimately limits a housing provider’s ability to engage in further transactions. While housing providers and developers can take steps to reduce certain operating expenses (e.g., lowering utility expenses through investments in energy efficient designs, among other things), there are few to no options to mitigate the costs of rising insurance premiums.

Private-sector and public-sector lenders, ranging from private sector banks and investors to State Housing Finance Agencies, the Department of Housing and Urban Development (HUD), and the Department of Agriculture, among others, typically require housing developers, as their borrowers, to obtain and maintain property casualty and general liability insurance policies as a condition to receiving financing for the duration of the loan. Housing providers and developers do not typically have alternative options for obtaining and maintaining such insurance policies; thus, they are stuck having to pay for these policies even if the rising costs are well-above standard metrics such as inflation, the consumer price index, or others.

In addition, housing developers and builders have seen significant increases in the rates for builders’ risk insurance policies. [29] Due to many of the factors described herein, insurers have generally tightened the underwriting criteria for builders’ risk policies, which has led to significantly higher deductibles, warranty requirements, and premium amounts. [30] This trend has particularly been seen in markets that are prone to natural disasters, such as the Gulf Coast area. That said, “typical” underwriting criteria for builders’ risk policies often make obtaining such policies increasingly challenging for applicable parties. This is because underwriting requirements typically include stringent requirements for costly security measures and other things, including, but not limited to, security fencing, video monitoring, and/or 24-hour security, all of which only adds to the costs associated with a typical project.

With respect to insurers providing general liability policies, recent trends indicate that many providers of such policies are declining to underwrite and issue insurance policies in affordable housing/subsidized housing communities and/or in jurisdictions and communities where there is a segment of subsidized housing located therein. While many of the factors described in this statement contribute to such pattern, one additional factor of note is the use of the “crime score” methodology by several insurance carriers, particularly in the multifamily housing space, who use such score as a metric to assess and price general liability risk. The “crime score” methodology is utilized by such insurance carriers to decline to underwrite and issue a policy with respect to a property located in an area that has a “crime score” above a specified “crime score” threshold.

The immediate impact of use of such “crime score” methodology by insurance carriers is that there is a disproportionate and negative impact on multifamily and affordable housing growth because many affordable housing units are often located or proposed to be developed into communities that have higher “crime scores”. There are also several issues in the actual methodology related to “crime scores”, as raised in a study conducted by the Center for Real Estate Excellence at Virginia Tech, whereby many stakeholders are concerned that the use of such methodology not only disincentivizes insurers, developers, and other stakeholders from participating in the affordable housing market, but also serves as de-facto discriminatory redlining of affordable housing communities. [31]

Ultimately, unprecedented increases in property insurance rates have disincentivized housing providers from participating in the affordable housing market, and in certain cases, have pushed existing housing providers from continuing to operate affordable housing units/buildings. This impacts not only housing providers, but also the existing residents they serve and the everyday Americans who are desperate for affordable housing opportunities. As insurance rates rise or availability for affordable coverage declines, housing providers are left with no choice but to avoid or remove themselves from the affordable housing market, or in certain cases, raise rents or lower services, all of which is significantly detrimental to tenants nationwide who are in a sustained need for affordable housing opportunities.

Policy Solutions That May Alleviate Impacts of the Insurance Crisis

It is increasingly clear that given the lack of private sector capacity and ability to mitigate these risks and the resulting market failure, policymakers must look for ways to incentivize a more robust insurance and reinsurance market for multifamily housing so that affordable, attainable and quality lines of coverage are available to meet property needs and mitigate risk.

In the near-term, there are several administrative or regulatory actions that are being discussed among stakeholders and policymakers that could provide some relief, which include, but are not limited to:

- Require HUD to explore existing authorities to provide additional funding and flexibility to property owners to account for property level insurance increases.

- Require HUD, the Federal Housing Finance Agency (FHFA), USDA (United States Department of Agriculture) Rural Housing and other federal stakeholders to review and update lender insurance requirements.

In the absence of accessible and affordable private sector insurance solutions, today’s lack of capacity in the insurance and reinsurance markets is reaching crisis levels and has begun to raise serious alarm across the entire financial system with trillions of dollars in uncovered or uncoverable risk across real estate. NMHC, NAA and other stakeholders in the real estate industry are early in its coalition work to identify possible, long-term solutions. That said, in the past, policymakers have stepped in and created backstops such as the National Flood Insurance Program (NFIP) and the Terrorism Risk Insurance Act (TRIA), when the market disruption or dysfunction has reached similar levels. Similar steps may be necessary in this current environment.

This hearing today is an important step forward in determining what is needed to ensure that federal programs and funding are designed to help mitigate the risks rental housing providers are facing. It is just as important for Congress to examine and support predisaster mitigation and community resiliency efforts that will improve the insurability of our nation’s rental housing stock and protect the availability and affordability of basic flood insurance coverage.

NMHC and NAA have identified several other areas that should be considered and could help lessen the financial and physical risk faced by rental housing providers and would benefit from Congressional action:

-

National Flood Insurance Program (NFIP)

Because of the challenges in the broader property insurance market, it is absolutely critical that the NFIP is reauthorized and reformed to ensure its long-term viability. The NFIP must be able to continue to ensure that affordable flood insurance is available at all times, in all market conditions for every at-risk rental property. These include more than just high-rise multifamily properties in urban centers and extend Resiliency/Mitigation At the same time, it is essential that Congress do more to prioritize community resiliency and ensure flood prevention and mitigation measures are widely available and affordable to property owners of all types. Resiliency, mitigation and a stable and affordable insurance are all important parts of a comprehensive strategy that is needed to protect our communities and our residents. -

It is critical that federal policymakers advance mitigation and resilience strategies that are realistic and not cost prohibitive, protect the long-term viability of rental housing communities regardless of their financing structure, and help reduce the financial and physical risk faced by housing providers and renters by increasingly destructive natural disasters. For example, the Federal Emergency Management Agency (FEMA) administers several mitigation grant programs to reduce damage, claims, and risk in the event of a natural disaster such as flooding. Yet, while apartment communities are not explicitly excluded from eligibility for existing FEMA funds, the grant programs are overwhelmingly focused on primary, single-family homes.

Even further, FEMA has only recently focused attention on the importance of mitigation efforts for properties that cannot benefit from traditional mitigation techniques like building elevation. Unfortunately, many of the recommendations for alternative methods of mitigation that FEMA has made to property owners are impractical for apartment communities and the majority would not afford any flood insurance premium reduction despite the large cost of implementation. Congress should direct FEMA to undertake further actuarial work and issue alternative mitigation guidance specific to rental property owners that is realistic, cost effective and would result in premium reductions under the NFIP and private sector insurance solutions. Additionally, expressly authorizing apartment firms to be eligible for existing mitigation programs or establishing a multifamily and commercial property specific mitigation grant program to address the unique challenges faced by these property owners would be key.

Conclusion

To stabilize the insurance market challenges we have outlined and prevent growing exposure to taxpayers in the wake of unrelenting natural disasters, it will require partnership between policymakers and private sector stakeholders from real estate and insurance to advance solutions that improve climate resilience and sustainability and allow for properly functioning insurance and reinsurance markets to protect our nation’s rental housing stock and the broader economy. NMHC and NAA stand ready to assist policymakers in this important work. We thank you for the opportunity to present the views of the multifamily industry as you explore these critical issues.

Sincerely,

Sharon Wilson Géno

President

National Multifamily Housing Council

Robert Pinnegar

President & CEO

National Apartment Association

[1] Based in Washington, D.C., NMHC is a national nonprofit association that represents the leadership of the apartment industry. Our members engage in all aspects of the apartment industry, including ownership, development, management and finance, who help create thriving communities by providing apartment homes for 40 million Americans, contributing $3.4 trillion annually to the economy. NMHC advocates on behalf of rental housing, conducts apartment-related research, encourages the exchange of strategic business information and promotes the desirability of apartment living.

[2] The NAA serves as the leading voice and preeminent resource through advocacy, education, and collaboration on behalf of the rental housing industry. As a federation of 141 state and local affiliates, NAA encompasses over 93,000 members representing more than 11 million apartment homes globally. NAA believes that rental housing is a valuable partner in every community that emphasizes integrity, accountability, collaboration, community responsibility, inclusivity and innovation.

[3] 2021 American Community Survey, 1-Year Estimates, U.S. Census Bureau, “Total Population in Occupied Housing Units by Tenure by Units in Structure”.

[4] Hoyt Advisory Services, National Apartment Association and National Multifamily Housing Council, “The Contribution of Multifamily Housing to the U.S. Economy”

[5] CIAB’s Q2 2023 P/C Market Survey and NMHC State of Multifamily Risk Survey & Report, June 2023, (the 2023 NMHC State of Multifamily Risk Survey & Report). This study covered 160 respondents that covered a broad range of actors in the housing ecosystem, including, but not limited to, owning 1.6 million units; managing 1.5 million units, with the average portfolio containing 11,292 owned units and 18,973 managed units respectively.5 The study also covered several types of housing classes, including Market-rate Class A; Market-Rate Class B, Market-Rate Class C; Subsidized/Affordable; Purpose-built Student Housing; and Age-Restricted (Seniors).

[6] Id

[7] Id

[8] 2023 NAA “Breaking Down One Dollar of Rent.”

[9] NMHC tabulations of 1985 American Housing Survey microdata, U.S. Census Bureau; 2021 American Housing Survey, U.S. Census Bureau.

[10] 2023 NMHC State of Multifamily Risk Survey & Report at 7.

[11] Id.

[12] Id.

[13] Swiss Re Institute, Hurricane Ian drives natural catastrophe year-to-date insured losses to USD 115 billion, December 1, 2022.

[14] Id. at 8.

[15] Id.

[16] Storm-Driven Insurer Insolvencies Stir State Actions: Explained, Bloomberg Law, December 29, 2022,

[17] Florida Creates Backstop to Protect Homeowners Insurance through Hurricane Season, Program Business, July 28, 2022,

[18] Florida Ratings Crisis: Fannie and Freddie Agree to Accept Citizens-as-Backstop Plan, Insurance Journal, December 8, 2022,

[19] Florida Creates Backstop to Protect Homeowners Insurance through Hurricane Season, Program Business, July 28, 2022,

[20] Florida Ratings Crisis: Fannie and Freddie Agree to Accept Citizens-as-Backstop Plan, Insurance Journal, December 8, 2022,

[21] Id.

[22] More insurance companies pull out of Louisiana: 'We are in a crisis', Fox Business, January 16, 2023.

[23] Property market braced for heavy loss bill from Q1 convective storms, Inside P&C, April 11, 2023.

[24] Uninsurable America: Climate change hits the insurance industry, Axios, June 6, 2023.

[25]How Litigation Funds Are Affecting Lawsuits Against Insurance Companies – Forbes Advisor

[26] “Consumer Litigation Funding: Just Another Form of Pay Day Lending?”, Paige Marta Skiba & Jean Xiao, Vanderbilt University Law School.

[27] AM Best, Best’s Market Segment Report: AM Best Assigns Negative Outlook to US General Liability Insurance Market, December 15, 2020

[28] “The Impact of Rising Rates on U.S. Insurer Investments,” National Association of Insurance Commissioners, February 2023, https://content.naic.org/sites/default/files/capital-markets-special-reportsimpact-of-rising-rates.pdf.

[29] Carriers Shift More Risk Onto Builders For Multi-Family Frame Projects, CRC Group, 2022, https://www.crcgroup.com/Portals/34/Flyers/Tools-Intel/Builders%20Risk%20SOM_Final.pdf?ver=202207-29-075543-540.

[30] Id.

[31] Roberts, Jeffrey G., “10 Reasons to Carefully Consider How Insurance Carriers Use Crime Scores to Assess Risk in the Affordable Housing Industry