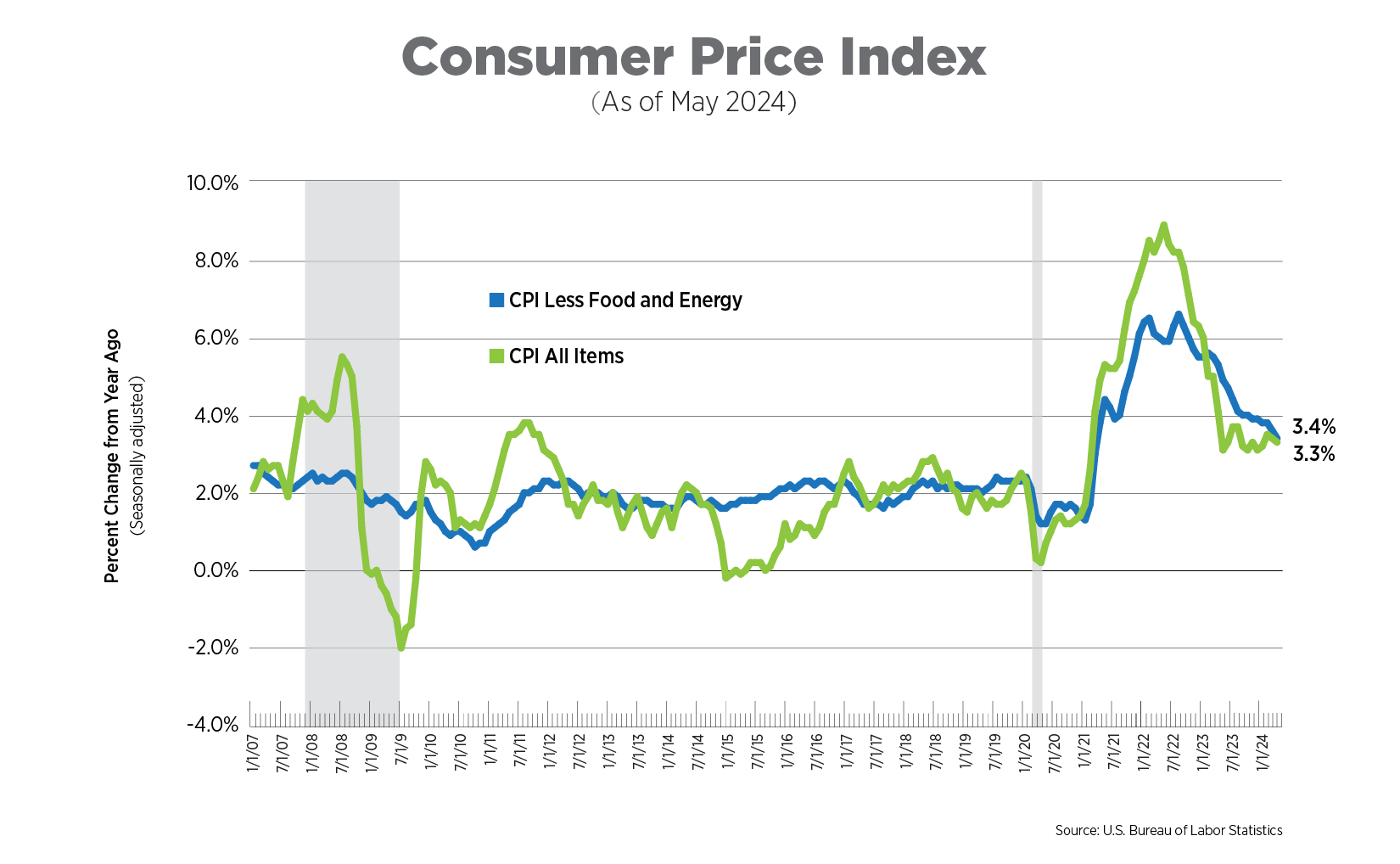

CPI, Latest Release, May 2024

Inflation measures for May came in below expectations with headline CPI up 3.3% and core increasing by 3.4%. While the headline number has been more volatile, Core CPI has decelerated steadily for more than a year. Monthly measures show a 0.2% rise for core items, and no change for all items, on average, helped in part by a 3.6% drop in gas prices. The last time the CPI indicated no changes in prices was July 2022. Price increases for core CPI were driven by tobacco and smoking products (+1.6%) and medical care commodities (+1.3%) while airline fares declined by 3.6%.

CPI for Housing, May 2024

The CPI includes two measures for shelter costs: owners’ equivalent rent (OER) and rent of primary residence, both of which are self-reported. Together, they comprise about one-third of CPI. Both measures continued their slow deceleration in May. Rent rose 5.3% year-over-year while OER climbed 5.7%, their lowest rates of increase in about two years. Monthly growth of 0.4% is still elevated from pre-pandemic levels.

The lag in CPI shelter costs to private sector data has extended far longer than originally estimated and is the main reason CPI is still well above the Fed’s 2% target. In May, ApartmentList reported a year-over-year drop of 0.8% in rents nationally, while RealPage and Yardi reported 0.2% and 0.6% growth, respectively.

Super Core Inflation, May 2024

Due mainly to lags in CPI shelter data, the Fed has begun to focus more on “super core” inflation, that is, prices excluding food, energy and shelter. At 1.9% year-over-year, super core inflation was at its lowest level since March 2021. In addition to the drop in airline fares, prices for new vehicles were down 0.5% over the month while apparel prices fell 0.3%.

Inflation Expectations, May 2024

The Fed tracks 21 different measures of inflation expectations. The data presented in the chart below are inflation expectations one year from now from the Federal Reserve Bank of New York’s Survey of Consumer Expectations and the University of Michigan’s Consumer Sentiment Index. Both measures remained essentially flat, up 3.2% and 3.3%, respectively. Consumers who take part in the Fed’s survey expect prices for food, gas and rent to remain stable over the next 12 months, but to increase for medical care.

Wage Growth, May 2024

Wage growth, as measured by average hourly earnings, increased 4.1% year-over-year. While off from average highs of 5.4% in 2022, wages are still elevated and are one of the data points which will give the Fed pause when considering looser monetary policy. The greatest increase in wages occurred in the financial activities sector, which includes banks, securities firms, insurance and real estate companies, up 5.7%, followed by manufacturing at 5.1% and construction at 5.0%.

What to Watch in the Next Month

- Interest rate cuts by other central banks around the globe sparked hope that the Fed might cut rates sooner. But strong wage and employment growth mean they will be in no hurry and can wait out summer data releases before considering the first cut in September.

Next Tracker: July 11, 2024