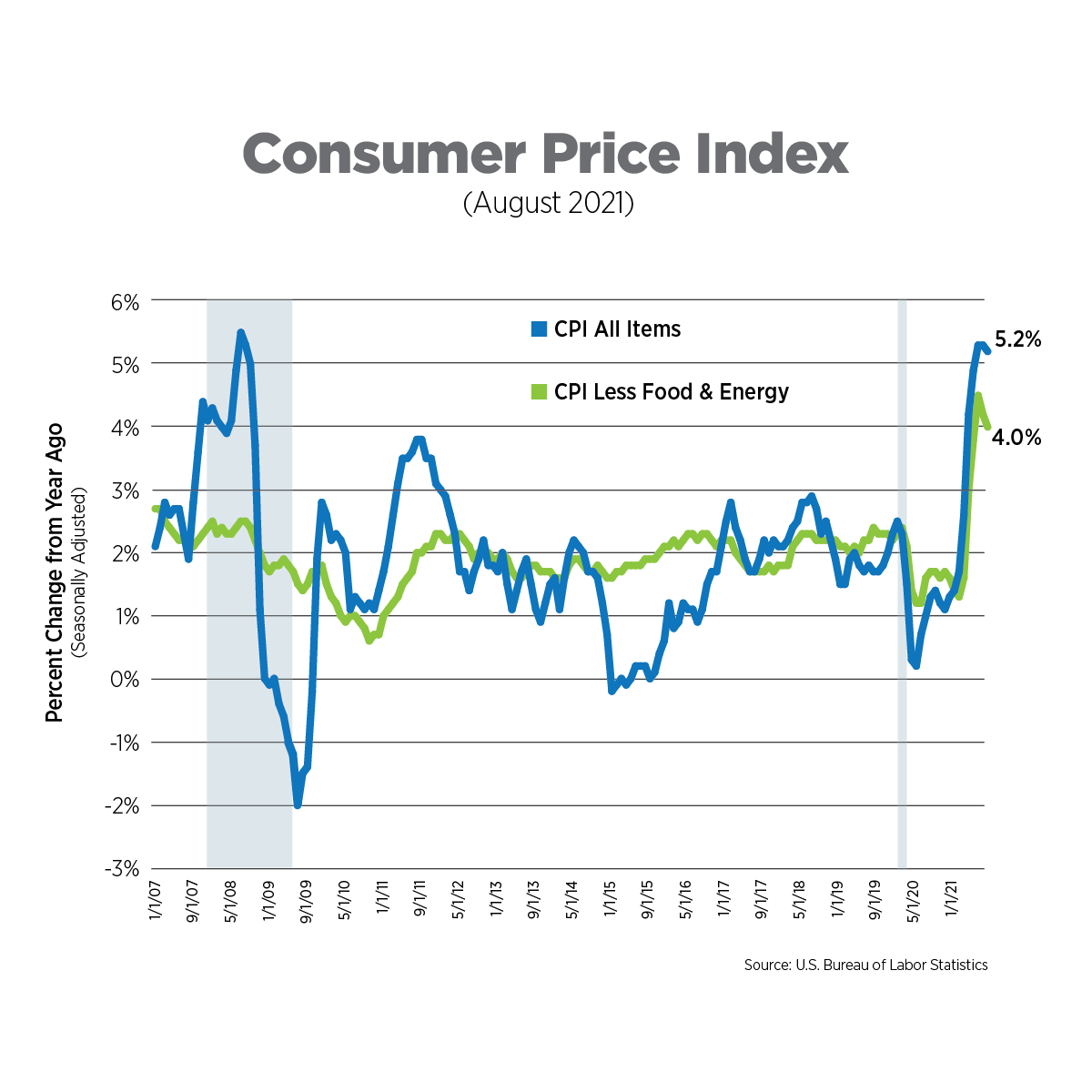

CPI, Latest Release, August 2021, 5.2%

The Consumer Price Index (CPI) rose 5.2% on a year-over-year basis, while prices excluding food and energy (core CPI) rose 4.0%, lower than the prior two months. On a monthly basis, CPI and core CPI recorded their slowest pace of growth in 7 and 6 months, respectively, and were below consensus expectations.

Breaking it down by categories excluding food and energy revealed the highest price increases this month in new vehicles (1.2%), hospital services (0.9%), and motor vehicle maintenance and repair (0.8%) while airline fares fell 9.1%, motor vehicle insurance was down 2.8% and used cars and trucks experienced a 1.5% decrease.

The data suggest the Delta variant may be hindering some consumers from moving forward with leisure activities. In addition to declining airfares, prices were also down for lodging away from home as well as car and truck rentals.

Source: US Bureau of Labor Statistics

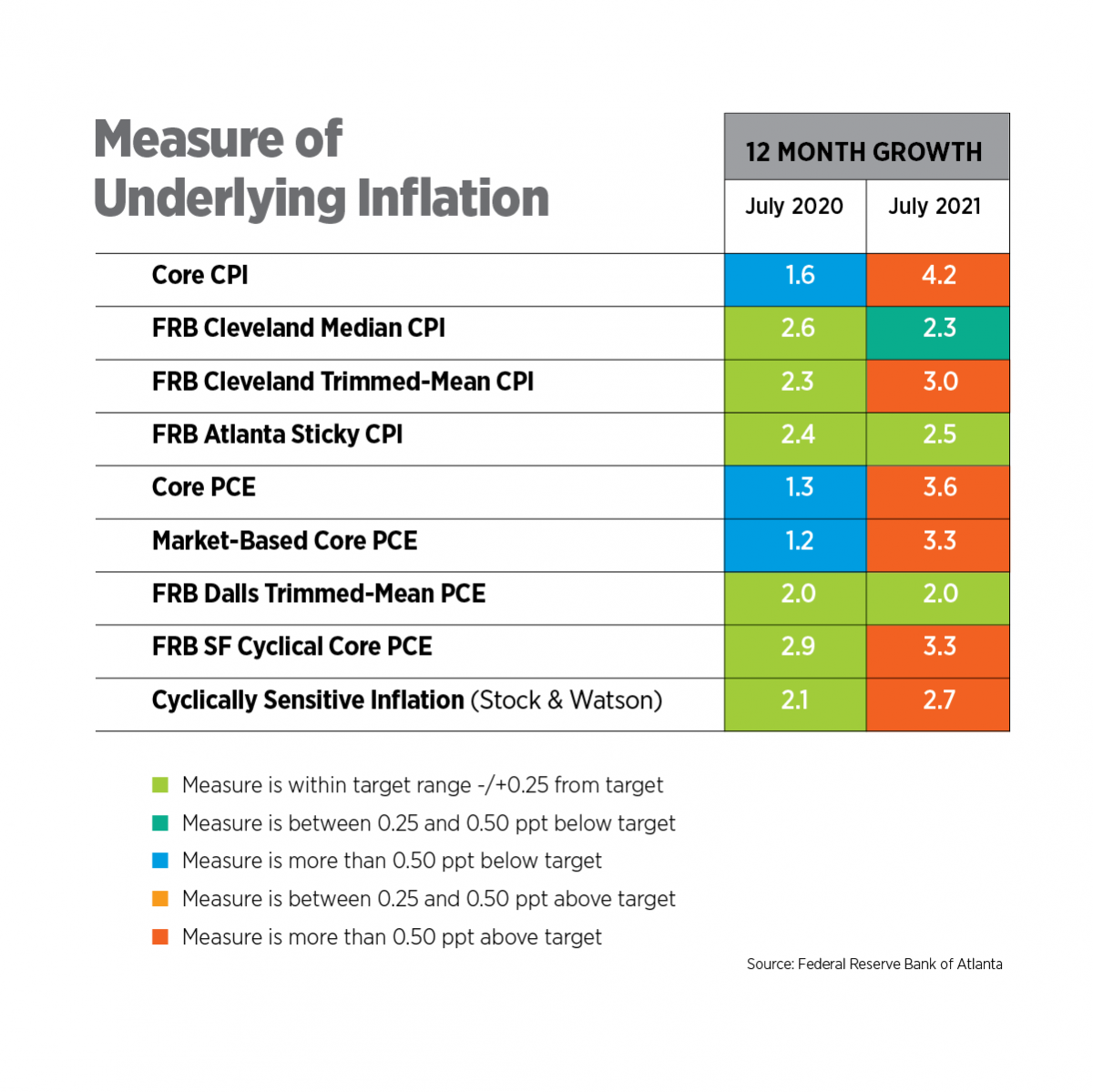

Alternative Measures of Inflation, July 2021

We have examined several alternative measures of inflation in prior Inflation Trackers, but the Atlanta Fed consolidates all of them into an Underlying Inflation Dashboard, updated monthly. As of July, the most recent update, two-thirds of inflation measures tracked in the dashboard were running one-half a percentage point or more above their targets – a troubling indicator of potentially longer-term price pressures.

Source: Federal Reserve Bank of Atlanta

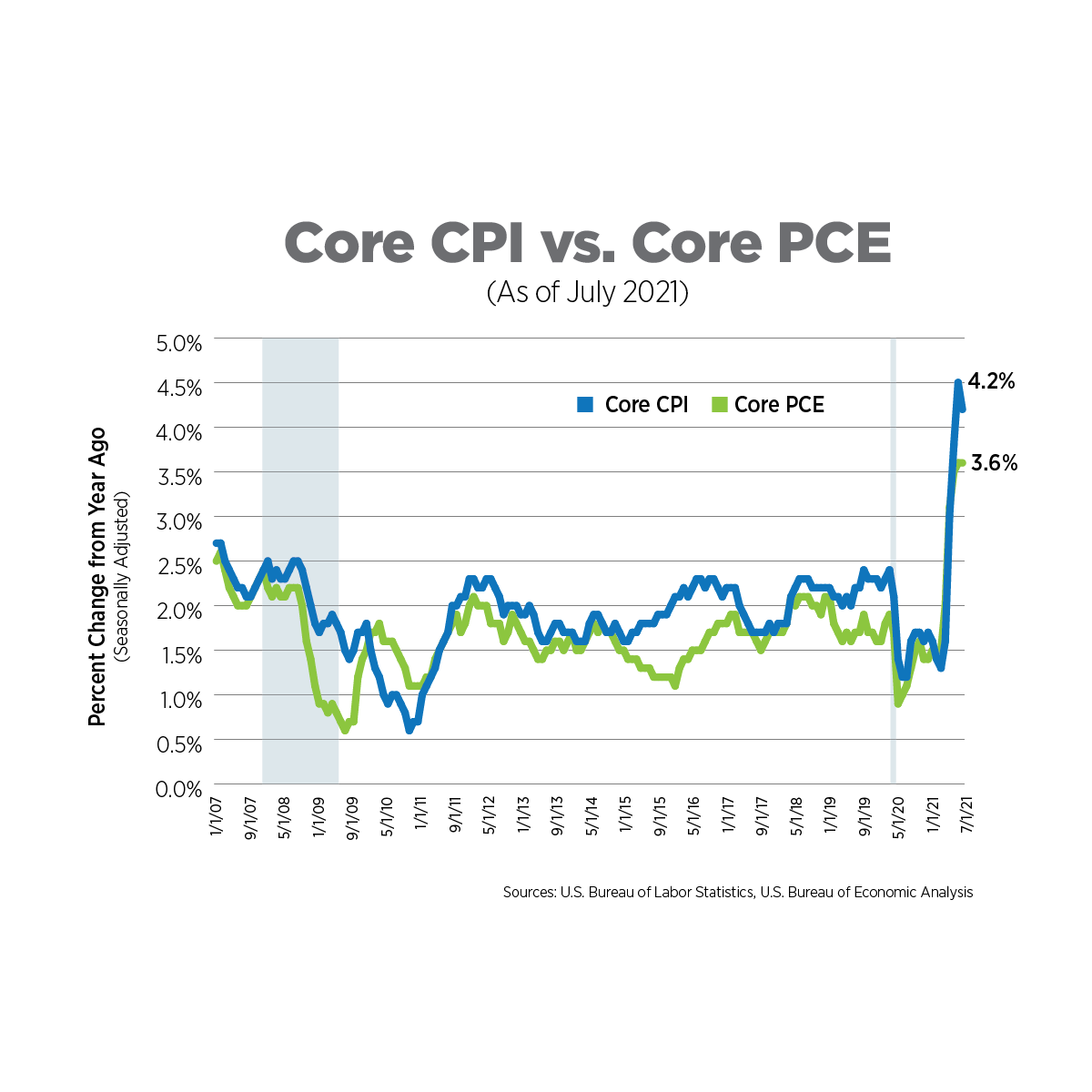

Alternative Measures of Inflation, July 2021

The Personal Consumption Expenditures (PCE) Index is the measure of inflation the Federal Reserve Bank uses in its policy decisions. It is produced by the Bureau of Economic Analysis and uses different formulas, different weights and has a different scope compared to the Bureau of Labor Statistics’ (BLS) CPI.

In July, the core PCE increased 3.6% year-over-year, the same level as the prior month (revised upwards) which was a 30-year high. On a monthly basis, the 0.3% increase in the core PCE was the smallest gain since February. At its current rate of 3.6%, it would take 5 more months for the PCE to achieve a five-year average of 2%, the Fed’s long-term target.

Sources: U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis

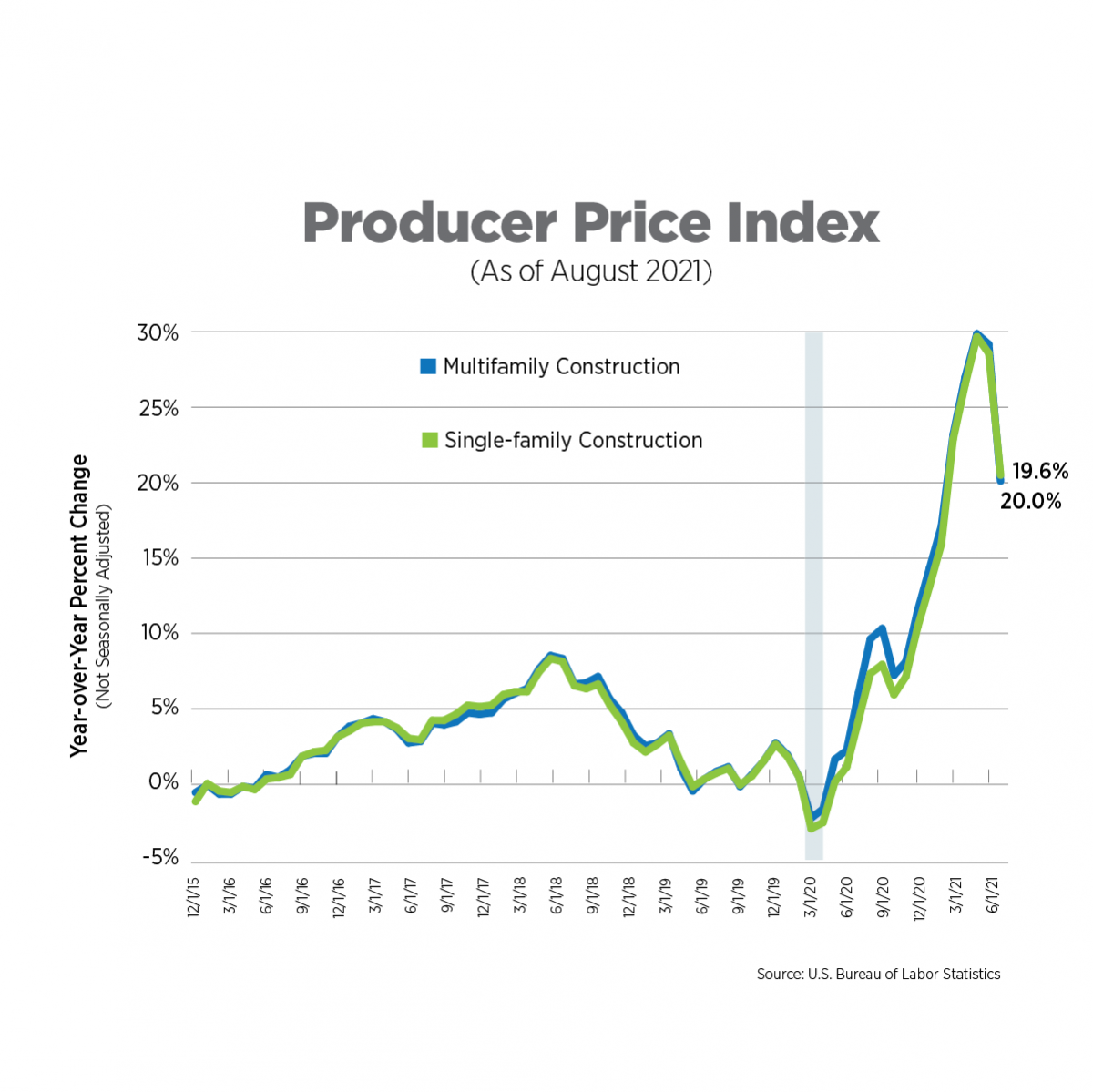

The Producer Price Index (PPI), August 2021

The BLS aggregates all construction inputs excluding capital investment, labor and imports for single-family and multifamily construction. Price increases finally decelerated in August, but are still highly elevated at 20% and 19.6%, respectively, on a year-over year basis. While lumber prices have finally moderated, the costs of steel mill products, building paper products and asphalt, among others, are still experiencing massive increases.

Source: U.S. Bureau of Labor Statistics

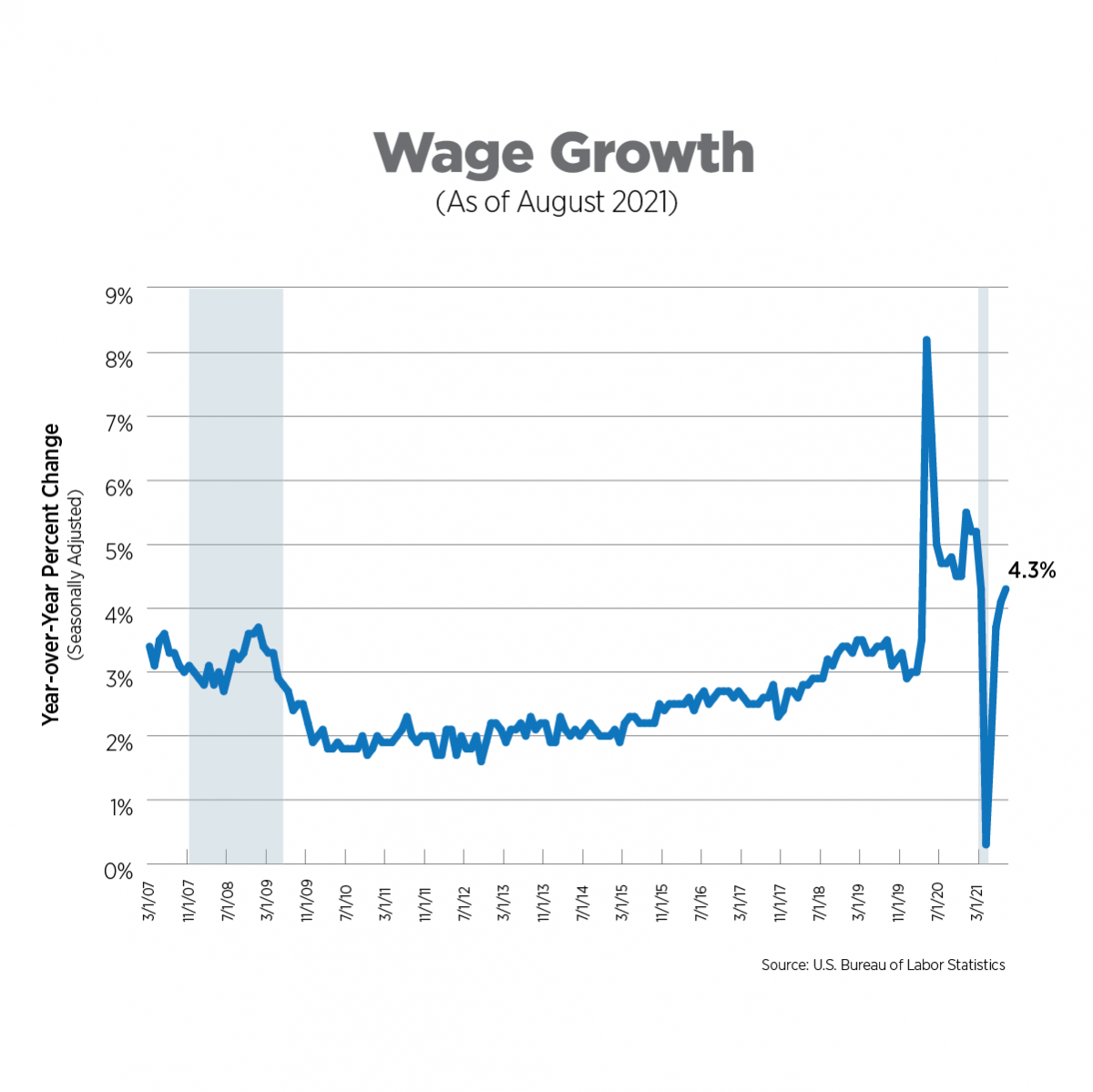

Wage Growth, August 2021

Wage growth, as measured by the change in average hourly earnings, has been nothing if not volatile since the pandemic began, reflective of large fluctuations in employment levels, particularly among lower-wage workers. In August, wages increased 4.3% on a year-over-year basis, driven by the leisure & hospitality sector, education & health services, and retail trade.

With the number of job openings at record levels and businesses experiencing persistent hiring challenges, wage increases can be expected to continue until the labor market begins to normalize. The end of unemployment benefits and the return to full-time classroom instruction should result in more and more workers returning to the labor force.

Source: U.S. Bureau of Labor Statistics

What to Watch in the Next Month

- There are initial signs this week that the Delta variant may have hit its peak in the U.S. If this is true and there are no additional restrictions put in place for businesses, we may very well see more subdued price increases in the coming months. Several Asian countries, which had closed factories and ports, are considering easing up on COVID-19 restrictions which will help alleviate some of the supply chain bottlenecks that are causing price hikes around the globe.

- The Federal Open Market Committee meets September 21-22. Between signs that inflation may be moderating and the disappointing August jobs report, it is highly likely there will not be any policy changes announced at the meeting. However, the Fed has indicated it may begin slowing the level of its monthly bond purchases before the end of this year.

Next Tracker: October 13, 2021