The delta variant of the coronavirus threw the U.S. economy for a loop during the third quarter, but by early December, signs that the recovery was back on track were broad-based. Job growth for the year averaged 555,000 jobs per month through November; port traffic began to ease; oil prices were beginning to come down; retail sales experienced an unexpected spike, despite inflated prices; and many workers returned to their offices, increasing foot traffic in restaurant and retail establishments. Although Q3 GDP was disappointing at 2.1%, it beat many economists’ expectations, some of whom even speculated a negative reading.

Other than causing volatility in the financial markets, it is far too early to tell what impacts the new omicron variant will have on the economy. Each wave of COVID-19 has had increasingly muted effects as businesses and consumers learn to live with the disruptions and adjust their behaviors accordingly. GDP growth forecasts are strong for 2022, but it is important to note that at the time of this writing, most forecasts had not yet factored in the omicron variant.

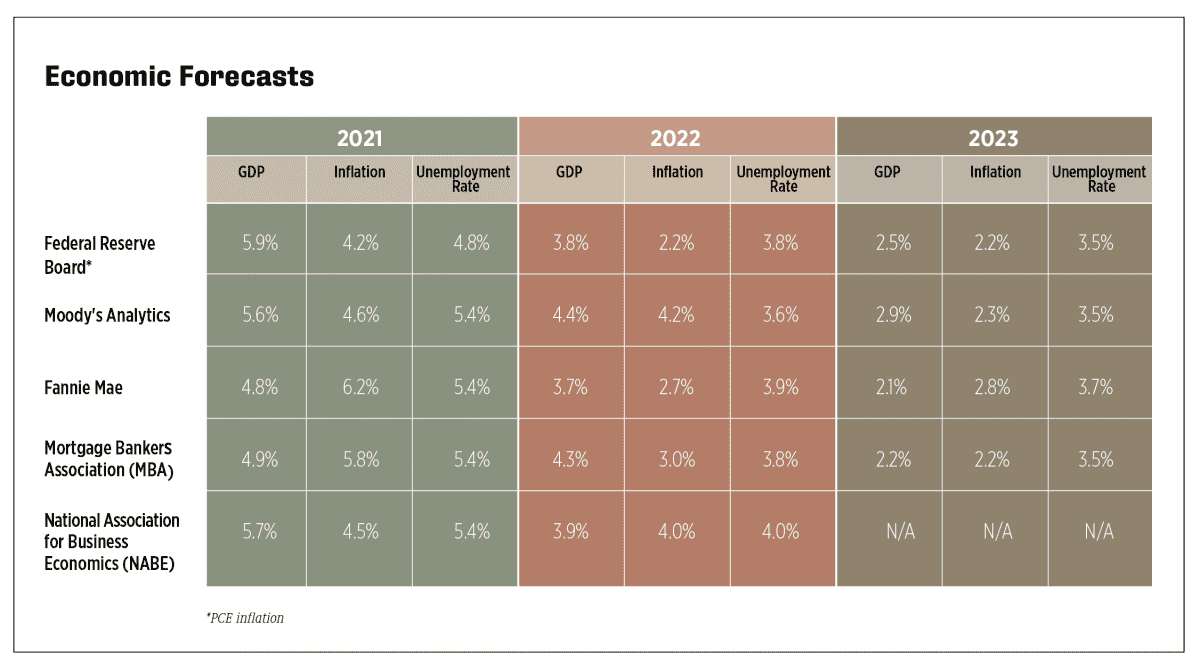

Outside of the pandemic, which will remain a driving factor of the economy well into 2022, inflation remains a top concern. Fears over high inflation are fueling elevated inflation expectations and depressing consumer sentiment. Forecasts for inflation in 2022 range from a low of 2.2% (for Personal Consumption Expenditure inflation) to a high of 4.0% with inflation tempering further in 2023. GDP growth will remain strong in 2022 compared to the past decade, before returning to pre-pandemic levels. Most forecasts call for unemployment to fall below 4.0% in 2022 and to return to pre-pandemic levels in 2023.

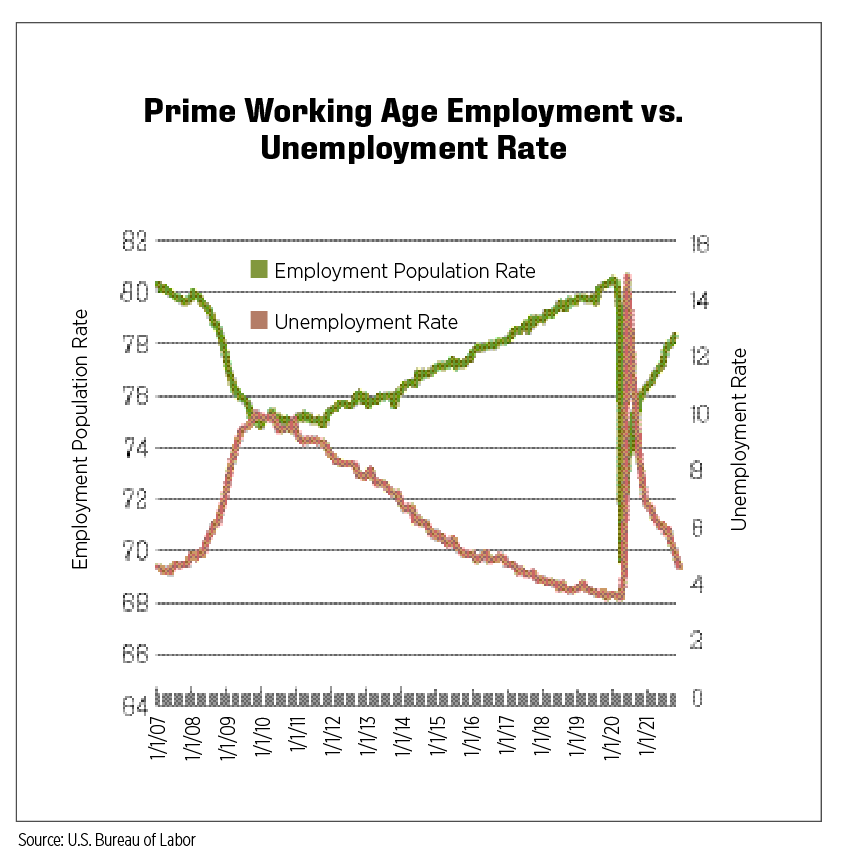

The Fed has begun to rely less on the unemployment rate as a measure of maximum employment for its policy decisions and more on the employment-to-population ratio, particularly for prime working-age adults (ages 25-54). A measure above 80% is indicative of an extremely tight labor market and full employment. In November, the ratio was 78.8%, which still gives the Fed a bit of breathing room on the employment side. That said, Fed officials recently suggested they may double down on the tapering of bond purchases, meaning interest rate hikes may come sooner than expected to counter persistent inflation, which is expected to peak in the coming months. Many analysts are forecasting two to three rate hikes next year and a year-end 2022 Federal Funds rate ranging from 0.2 to 0.375.

The for-sale housing market performed well in 2021, despite somewhat cooling from the frenzied pace of 2020, which was driven by a desire for more space and low mortgage rates. Pricing, however, showed no signs of moderating and contributed to a pullback in activity among some would-be buyers. Both demand and supply-side factors are driving the run-up in prices as builders were constrained by supply chain challenges and increased costs of materials and labor.

Even so, builders are optimistic about the multifamily market, according to National Association of Homebuilders’ (NAHB) most recent Multifamily Market Survey, which measures homebuilder sentiment for low-rent/subsidized apartments, market rate apartments and condos. The component index which measures general construction conditions rose five points in Q3 2021 to 53, indicating that more builders are reporting conditions improving versus conditions deteriorating. The index which measures perception of occupancies rose to 75, its highest level since the series began in 2003.

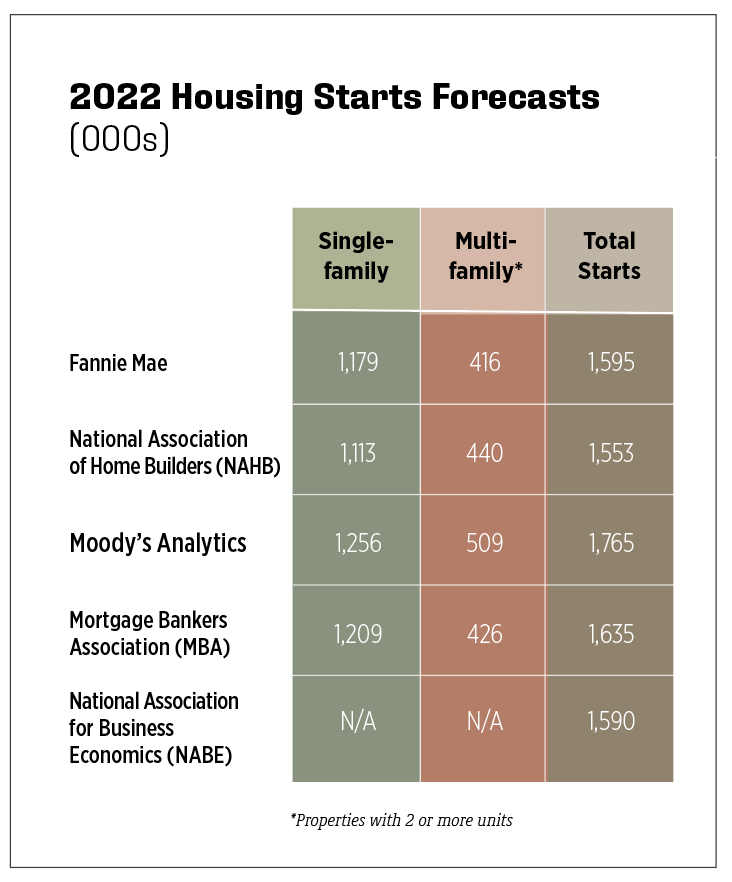

Overall housing construction indicators are on track to hit their highest levels since just before the financial crisis, and for multifamily, since the 1980s. Housing starts are forecast to remain strong in 2022, but it will take more than a few years of robust construction levels to offset the chronic undersupply of apartments during the past three decades. The combination of an already-existing gap and new supply chain challenges will only exacerbate affordability issues in 2022 and beyond. Although wages are on the upswing, they are not increasing fast enough to offset housing costs. And while many consumers were made whole and kept afloat during the pandemic thanks to fiscal stimulus, their savings are being depleted, particularly for those currently detached from the labor force because of illness, caring for sick family members or performing childcare functions.

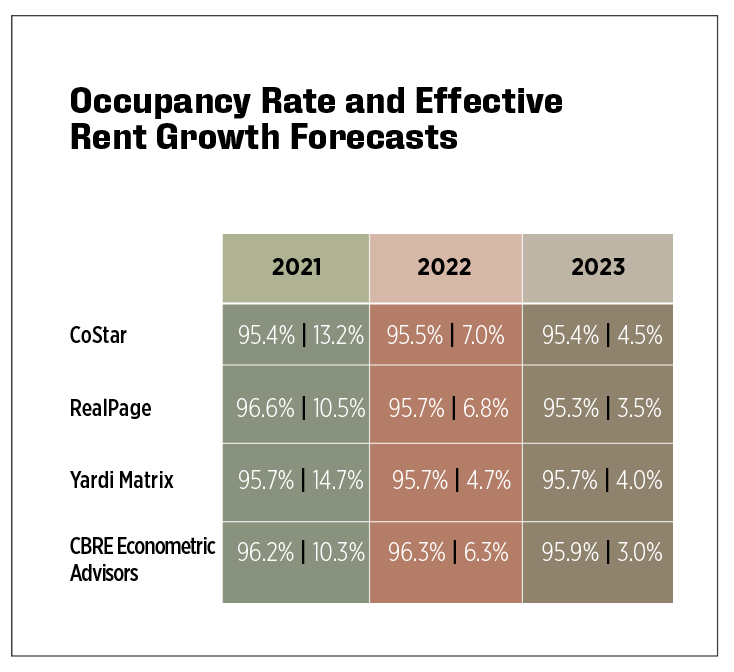

To call 2021 a record-breaking year for the apartment industry may be an understatement. By all measures – occupancy, rent growth, absorption, pricing – professionally-managed and maintained apartments performed well beyond expectations. In fact, RealPage reported the highest occupancy rates on record, 97.5%, in November 2021. Rent growth for new leases also hit record levels of 13.9% while renewal rates averaged 8.0% in the latter part of the year.

Apartments have been a favored asset class for years, but 2021 volume figures showed just how cemented investors’ confidence is in the market. After stripping away 2020 base issues when sales plunged during the second and third quarters, the percent increase in transaction volumes this year compared to 2019 averaged 47% from April through October, according to Real Capital Analytics (RCA). Pricing is also on the rise, with the RCA Commercial Property Price Index for apartments averaging an 11.9% year-over-year increase through October and a 22% increase from the same period in 2019.

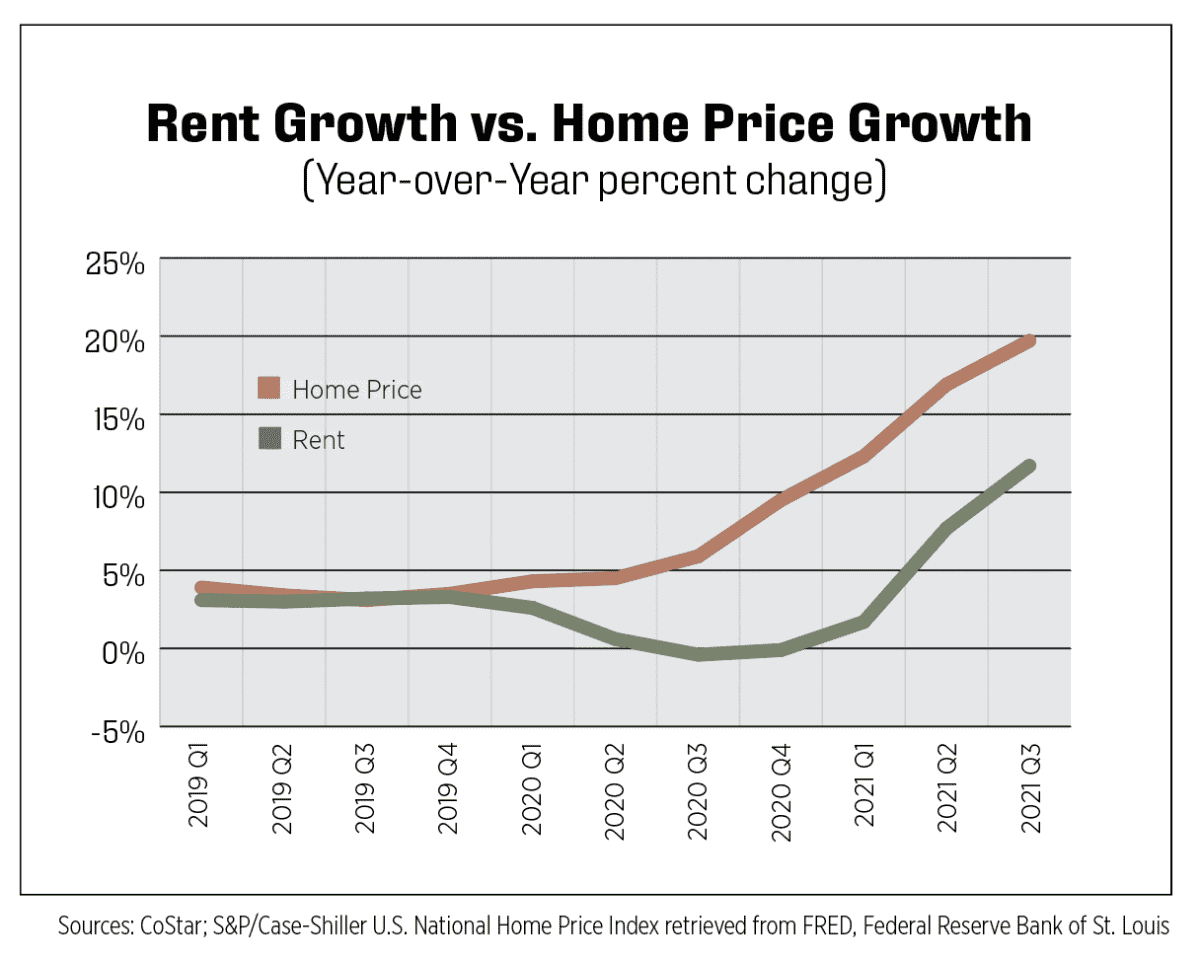

Forecasts for the industry are bullish, particularly for rent growth, ranging from 4.7%–7.0% growth on top of 2021’s 10.3%–14.7% growth. Supply and labor issues and resultant construction delays will hamper new deliveries and keep rents on the rise, but affordability headwinds will keep those increases restrained in some markets. But the rental housing industry has good reasons to be optimistic: For-sale housing prices are increasing at a faster pace than rents, more Gen Z’s are entering the rental market, incomes are rising and the job market is poised to continue its recovery.

The challenges for the industry remain largely unchanged from 2021. Apartment owners and operators will continue to be plagued by the labor market in 2022 with difficulties recruiting, hiring and retaining employees alongside increased costs for labor. Price pressures and supply chain issues may ease somewhat during the second half of the year but will remain a headwind. And policy risks will continue with widespread appeals for rent controls, rent caps and other housing-adverse policies across the country.