NAA, NMHC Submit Joint Letter Regarding Basel III Endgame Notice of Proposed Rulemaking

NAA and NMHC submitted a joint letter to the FDIC, the Federal Reserve, and the Comptroller of the Currency regarding a Notice of Proposed Rulemaking (NPR) for regulatory capital rule amendments. The letter urges the application of a lower risk weight of 50% to properties using the Low-Income Housing Tax Credit (LIHTC).

January 16, 2024

The Honorable Martin Gruenberg

Chair

Federal Deposit Insurance Corporation

550 17th Street NW

Washington, D.C. 20429

The Honorable Michael Barr

Vice Chair

Board of Governors of the Federal Reserve System

20th Street and Constitution Ave. NW

Washington, D.C. 20551

The Honorable Michael Hsu

Acting Comptroller

Office of the Comptroller of the Currency

400 7th Street SW

Washington, D.C. 20219

Regulatory Capital Rule: Large Banking Organizations and Banking Organizations with Significant Trading Activity: FDIC RIN 3064–AF29; FRB Docket No. R–1813, RIN 7100–AG64; OCC Docket ID OCC–2023–0008

Dear Chair Gruenberg, Vice Chair Barr, and Acting Comptroller Hsu:

The 19 undersigned organizations appreciate the opportunity to comment on the Notice of Proposed Rulemaking (NPR) for regulatory capital rule amendments applicable to large banking organizations and to banking organizations with significant trading activity, or Basel III Endgame, published on July 27, 2023.

We represent organizations that develop and finance affordable housing financed using the Low-Income Housing Tax Credit (LIHTC), our nation’s primary tool for financing the development and preservation of affordable housing.

In recognition of the strong historic performance of LIHTC properties, and the importance of supporting robust investment in affordable housing, we urge you to apply a lower risk weight of 50% to LIHTC properties. This threshold is consistent with what is available to statutory multifamily mortgages, more accurately reflects the risks of LIHTC investment, and would support investment in affordable housing at a time of staggering need.

The Federal Reserve Board has already recognized LIHTC’s outstanding performance in setting the Dodd-Frank Act Stress Test risk shocks under a severely adverse scenario. The relative fair value shock assigned to Section 42 (LIHTC) investments is only -4.9%, far lower than the -69.9% for real estate private equity and -28% for real estate debt; and the relative carry fair value shock for unfunded LIHTC equity commitments is only -1.6%.1

Background. LIHTC is the federal government’s primary policy to mobilize private investment in the production and preservation of affordable rental housing. Since 1987, LIHTC has financed 3.8 million affordable apartments2 – almost all of the new and substantially rehabilitated affordable housing production in the United States over that period.

Commercial banks subject to the proposed capital rule are the dominant source of LIHTC investment. Banks provide about 85% of all LIHTC equity investments.3 An analysis of OCC data shows that 98% of national banks’ LIHTC investments come from banks with assets >$50 billion.4 Accordingly, bank capital rules have a material effect on the availability and pricing of LIHTC investments, which in turn will affect the volume and characteristics of affordable housing production and preservation.

LIHTCs are subject to statutory volume caps administered by state housing finance agencies (HFAs). Both the HFAs and private investors underwrite LIHTC projects and monitor their operations on an ongoing basis. The tax credits are claimed over a 10-year period and are subject to a partial recapture of the tax credits if the property ceases to serve low-income residents at restricted rents within a 15-year period. The recapture exposure equals one-third of the credits already claimed and phases out over years 11-15. HFAs and project sponsors also have extended use agreements that preserve affordability for at least 30 years.

In a typical LIHTC transaction, the investors are limited partners in a partnership where the property developer/operator is the general partner. Virtually all the tax benefits pass through to the limited partner investors.

Tax benefits – LIHTC plus depreciation and other taxable losses – are virtually the sole source of the investors’ return. Investors do not expect, and generally do not receive, operating cash or disposition proceeds in excess of their exit taxes. Accordingly, LIHTC investments more closely resemble a fixed-income investment (where the income takes the form of a highly predictable stream of tax benefits) than a traditional real estate equity investment where variable cash flow and speculative capital appreciation constitute the investors’ return. Accordingly, LIHTC investor returns – currently 6.28% and generally about 200-400 bps above 10-yearTreasuries5 – more closely resemble mortgage rates than private equity returns.

Risk Weights. Because LIHTCs qualify as a community development investment under section 24 (Eleventh) of the National Bank Act, the current and proposed policies assign them a 100% risk weight. As the agencies explain:

Equity exposures to community development investments and small business investment companies generally receive favorable tax treatment and/or investment subsidies that make their risk and return characteristics different than equity investments in general. Recognizing this more favorable risk-return structure and the importance of these investments to promoting important public welfare goals, the proposal would effectively retain the treatment of equity exposures that qualify as community development investments and equity exposures to small business investment companies under the current capital rule and assign such exposures a 100 percent risk weight.6

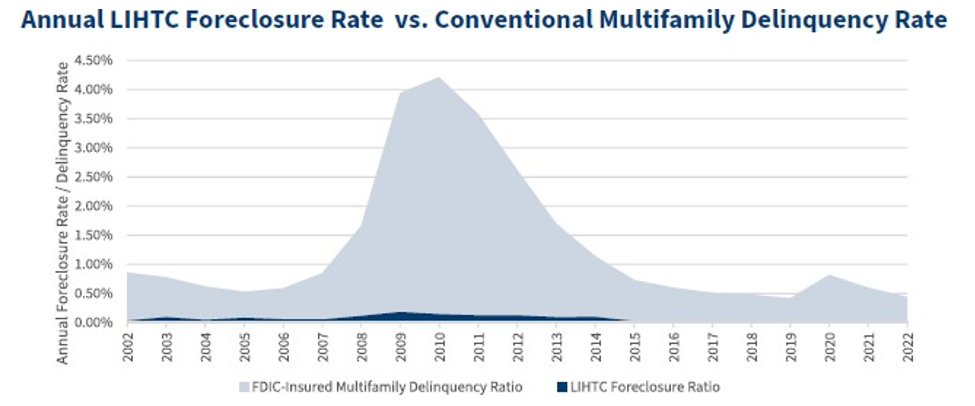

We appreciate this consideration but believe LIHTC’s performance justifies a risk weight comparable to statutory multifamily mortgages. While it may seem counterintuitive, LIHTC investments have consistently outperformed multifamily mortgages. The following chart compares the annual LIHTC foreclosure rate with the rate at which multifamily mortgages were either at least 90 days delinquent or in foreclosure since 2002.

Source: CohnReznick, Affordable Housing Credit Study: A Comprehensive LIHTC Property Performance Report, November 2023, p.80

Multifamily serious delinquencies reached above 4% during the Great Recession, but the LIHTC foreclosure rate has typically stayed below 0.1% since 2002. Similarly, IRS data show the LIHTC recapture rate averaged only 0.08% for tax years 2008-2019, peaking at 0.17% in 2009.7 These IRS data are especially useful because recapture is the way LIHTC investors incur losses and it reflects both the incidence as well as the severity of loss.

The national accounting firm CohnReznick, which has tracked LIHTC performance for more than 20 years, explains: “Given the pent-up demand for affordable housing, the effective leverage and oversight under the public-private partnership model, and the various mechanisms afforded by housing credit properties to offset underperformance, conventional apartment properties are much more likely to suffer foreclosure.”8

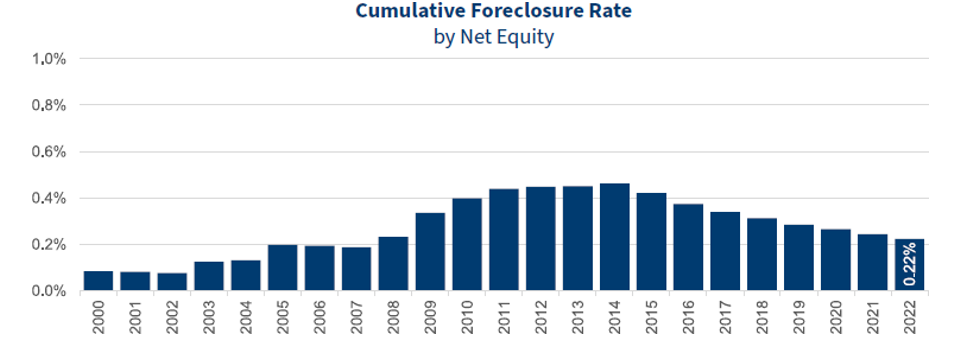

Another metric, LIHTC’s cumulative foreclosure rate by net equity (total foreclosed net equity divided by total equity), tells a similar story. As the following chart shows, the cumulative foreclosure rate peaked at a very low level, below 0.5%, in the aftermath of the Great Recession and has decreased to 0.22% by 2022, as more properties have come online and no foreclosures were reported in 2021 and 2022.

Source: CohnReznick, p.79.

CohnReznick reports that relatively few LIHTC properties suffer from severe underperformance.

Further, underperforming properties can fund their operating deficits through management fee deferral, operating deficit guarantees and reserves, or advances from the general partner or syndicators. In instances of property underperformance, housing tax credit property owners have various options to support or recapitalize their properties financially.

Since the [LIHTC recapture] consequences for owners are very harsh, they are motivated to keep their properties in compliance with housing tax credit program rules and avoid foreclosure at all costs.9

This concludes our comment. For further information, please contact Benson Roberts [email protected] or Sarah Brundage [email protected] at the National Association of Affordable Housing Lenders or Emily Cadik [email protected] at the Affordable Housing Tax Credit Coalition.

Sincerely,

Affordable Housing Tax Credit Coalition

Council for Rural and Affordable Housing

Enterprise Community Partners

Housing Assistance Council

LIHTC Working Group

Local Initiatives Support Corporation (LISC)/National Equity Fund

Low Income Investment Fund (LIIF)

National Affordable Housing Management Association

National Apartment Association

National Association of Affordable Housing Lenders

National Association of Home Builders of the United States

National Association of State and Local Equity Funds

National Council of State Housing Agencies

National Housing and Rehabilitation Association

National Housing Conference

National Leased Housing Association

National Multifamily Housing Council

National Rural Housing Coalition

Stewards of Affordable Housing for the Future (SAHF)

1 Federal Reserve Board, 2023 GMS Component: Severely Adverse Scenario (GICS-Based Data Input

2 National Council of State Housing Agencies, State HFA Factbook: 2022 NCSHA Annual Survey Results, Tables 3A and 5.

3 CohnReznick, Housing Tax Credit Monitor, December 2023

4 NAAHL analysis based on data at Public Welfare Investments Resource Directory. The FDIC and Federal Reserve Board do not publish comparable data for the banks they supervise. However, because the OCC supervises most of the largest commercial banks, the OCC data are especially germane.

5 CohnReznick, Housing Tax Credit Monitor, December 2023

6 NPR, p. 64077

7 IRS, SOI Tax Stats - Corporation Income Tax Returns Line Item Estimates (Publication 5108) The recapture rate equals the LIHTC amount recaptured divided by the LIHTC amount claimed. IRS did not publish LIHTC recapture data for 2020 to protect taxpayer identities.

8 CohnReznick, Affordable Housing Credit Study: A Comprehensive LIHTC Property Performance Report, November 2023, p.79.

9 CohnReznick, Affordable Housing Credit Study: A Comprehensive LIHTC Property Performance Report, November 2023, p.78.