Addressing compliance in a rapidly changing environment requires modern solutions that incorporate deep industry expertise and leverage the latest innovations.

If the pandemic has taught us anything, it is that safety cannot be taken for granted. This is of utmost importance, especially right now, because apartment owners and operators are being bombarded by a multitude of challenges to the bottom line and profitability.

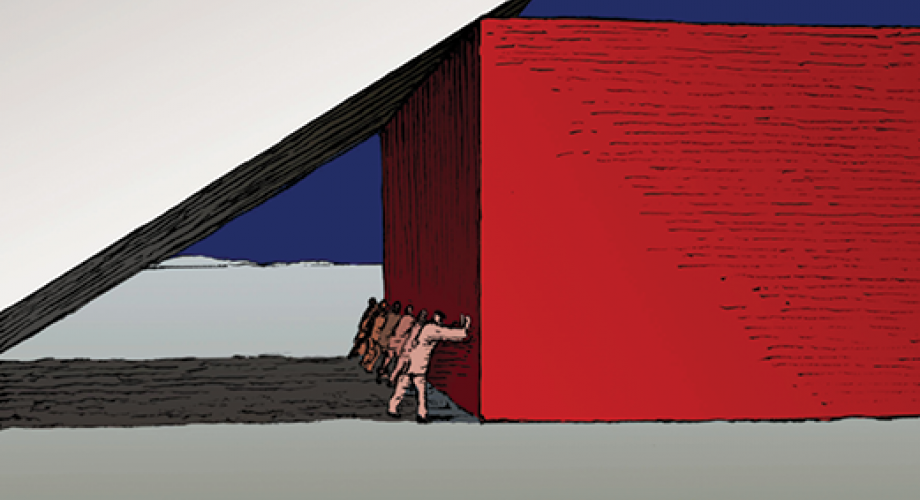

These issues are magnified by the fact that the rental housing sector is still reeling from ongoing issues stemming from rent delinquencies and eviction moratoria. At a recent industry conference, David Schwartz, Chairman and CEO of Waterton, summed up this new era of risk for the industry as one “that requires us to rethink how to confront and mitigate the new landscape. The ripple effect of the lost jobs, rising costs and growing rent delinquencies are just some of the many fires we are putting out.”

Safety compliance isn’t just a good idea in today’s new era of risk; it is essential to the success of the business.

Growing Challenges

Lawsuits are a growing concern for property managers in our litigious world. As an example, according to the New York Civil Justice Institute, consumer class-action lawsuits in New York tripled in the last four years and could climb to an all-time high in 2021. More property owners are facing habitability lawsuits in recent years, and a backlog is building for future years. Juries are handing down multi-million-dollar awards in lawsuits to plaintiffs claiming apartment community owners failed to maintain “habitable” properties. In Los Angeles, a Superior Court awarded residents a $2 million settlement because of a breach of implied warranty of habitability.

The lack of tort reform is one reason for the uptick in lawsuits within the multifamily housing market. It is difficult for an apartment to maintain consistent records when legal interpretation varies by region. In addition, many courts are seemingly going out of their way to support residents in disputes, much to the detriment of owners and operators. Court payouts to claimants make this an appealing business venture for residents, who may or may not have a genuine legal case.

Another reason for the increased legal landmines is that residents are spending more time in their homes and at their communities. The growing work-from-home trend adds more requirements for apartments because residents demand high-speed internet and, in some cases, a socially distanced co-working space on-premises but outside of their own apartments. Pew Research found that 71% of Americans worked from home last year, a huge jump from 20% before the pandemic. That genie can’t be put back in the bottle. Today’s workforce requires at least a portion of the time to be remote, offering employees enhanced flexibility in work-life balance.

This puts added pressure on property managers to deal with more wear and tear on plumbing, electrical and other equipment. In addition, more guests are visiting and making deliveries from food and groceries to packages from online purchasing. More bodies on premises create increased potential for safety-related incidents and claims. This has a direct impact on insurance premiums.

Premiums for the multifamily housing sector for both property and liability insurance have not only increased more than any other asset class, but they have also risen at rates not seen in more than a decade. Multifamily real estate clients of Marsh, the world’s leading insurance broker and risk advisor, saw average property insurance premiums rise 19% in 2020, while the average increase in premiums was 10% for primary liability and sometimes as much as 100% increases for umbrella liability.

Insurance carriers also shift the liability risk to apartment owners by asking them to carry more of the financial exposure by dramatically increasing deductibles and self-insurance limits. Deductibles and retentions rose 33% on average in 2020 for Marsh’s multifamily clients renewing property policies, which followed a similar trend from 2019.

Deductibles and retentions similarly increased 37% for liability renewals. According to Alliant Insurance Services, a leading insurance broker, the insurance industry has been in a “hardening market,” where rates have been trending upward for a few years now. Most industry experts expect these trends to continue throughout 2021 and into 2022.

Developing a Safety Plan to Mitigate Risk

One way to reduce insurance costs is to put a safety plan in place that conforms to not only the legal requirements,

such as OSHA requirements and all local government codes, but also to potential threats on the horizon. However, this is easier said than done. For instance, even though the OSHA general duty clause has been a long-standing part of the Occupational Safety and Health Act, the fact that its proper use is needed for all employees is frequently misunderstood. Employee training and communication are key to ensuring a safe work environment for employees and residents. Safety plans also need to keep up with all the constantly changing local municipality regulations regarding real estate. This can be particularly challenging when the applicable federal, state, city and county municipal codes get updated on an ongoing basis. COVID regulations were a great example of how fluid these government mandates can be in different regions.

Many real estate owners and managers try to get by on cookie-cutter preventative policies and procedures passed down from other properties that include some risk mitigation and safety protocols. However, lenders, investors and insurance companies are upping the ante, wanting more risk reduction measures. Apartment owners and operators often scramble to incorporate these frequent and mission-

critical changes to operations. Without a strong infrastructure in place, these safety programs are hard to maintain, hard to communicate and hard to enforce.

There is no one-size-fits-all safety plan for all properties because every apartment community is different, with specific issues that will need to be addressed. However, some of the most common safety risks include poor/broken lighting, electrical/wiring, pest infestation, mold and general cleanliness hazards. In addition, many seasonal threats are preventable, such as slips and falls during the wet season with proper drainage, pool maintenance in the summer from monthly treatment and falling tree branches during the spring storm season with proper landscaping. The key is to schedule regular property maintenance throughout the year and to track its enforcement. One of the best ways to ensure employees complete these detailed tasks is tying performance bonuses and advancement incentives to measurable preventative maintenance and safety.

“It’s not one safety protocol that’s going to save the day but the totality of the safety program,” said attorney Carrie Cherveny, Chief Compliance Officer & SVP Strategic Solutions of HUB International. “A safety program is useless unless you have the means to track adherence. There is nothing a plaintiff’s lawyer loves more than knowing you have a safety policy and failing to enforce it. It doesn’t get more negligent than that.”

The executive leadership team is usually tasked with developing these safety programs. However, aside from insisting on their existence, these managers generally don’t have the time to personally audit how well their teams in the field are actually adhering to their programs. Even when an organization employs a dedicated person to ensure compliance with risk management policies, auditing and enforcing compliance proves to be a challenge.

Property Management 2.0

Until recently, tools to objectively measure compliance have been limited, with many relying on a set of Excel spreadsheets. According to a Multifamily Insiders report, only 53% of apartments used a mobile-based maintenance tracking system. Without a system to provide transparency on how well onsite teams comply with safety protocols, it is difficult to identify properties at risk of loss. Data is needed on maintenance, life cycle and supplier relationships, inspection results and conditions for each property. This data can be converted into reports and dashboards that may reside in ledgers, databases and spreadsheets, informing everything from day-to-day operations to overarching loss control and compliance programs.

Collection of data alone is insufficient. It is critical to examine this data to recognize trends, deploy appropriate controls and track compliance with those controls. The dashboards and reporting should quickly identify where attention is needed most for specific properties, so managers can focus on what really matters. A failure to execute this will make risk transfer difficult, if not impossible. Operations management and compliance software can consolidate processes and systems into one place for ease of use and transparency.

Property managers at apartment communities are habitually overburdened, so any tool that can automate the process, save time and ensure that properties remain compliant will be crucial. There are tools to simplify and modernize the job of staying on top of these safety management responsibilities. From spreadsheet replacement solutions to full-function, self-serve software suites that allow additions to a program onsite, applications address everything from leases to losses. They may bundle risk management, business analytics, employee communication and visitor management across multiple units and properties.

Stakes Are Too High Not to Comply

The business ramifications of educating and enforcing a safety program with employees can have a ripple effect on an apartment’s operations. It is important to note that creating a new safety program and enforcing it may not be a huge increase in cost but a reallocation of existing budgets that create greater efficiencies across an organization. The biggest cost savings often is ensuring the system or program is repeatable and scalable. In fact, the benefits that result from digital risk-mitigation tools can far outweigh the costs (see sidebar).

Owners and operators need to shift from a reactive mindset to looking for proactive strategies to get ahead of potential threats. The importance of these proactive digital software solutions cannot be understated: One only has to go through the “what if” worst-case scenarios to understand the risks to a reactive-thinking business. Mistakes can prove costly to an apartment firm with a lawsuit and have bigger ramifications with even criminal penalties or tragic endings. These are grave consequences from fixable maintenance that can be implemented, tracked and reported.

During the past year, the rapid pace of innovation as companies seek to accommodate a new era with remote management and contactless operations has resulted in a slew of new solutions that can deliver a safer environment for residents and a more profitable business for apartment owners.

Daniel Cunningham is CEO of Leonardo247and Host of the Apartment Academy Podcast.

The Benefits of Digital Risk-Mitigation Tools

- Building resident loyalty. Residents will stay at apartments where they feel safe, respected and valued.

- Improving employee retention. Employees who are well trained and have easy-to-use tools that make their jobs easier are more likely not to seek other employment opportunities.

- Reducing insurance costs. A digital record of ongoing maintenance and mitigation measures can reduce premiums with underwriters upon the next renewal cycle.

- Lowering operating costs. Streamlining headcount with automated tools can not only reduce overhead but also help reduce or eliminate unexpected costs, such as accidents and lawsuits.

- Minimizing lawsuits. Reducing legal risks can cut costs dramatically in this litigious market.

- Eliminating government citations. Code compliance can save time and money by avoiding any municipal entanglements.

- Increasing revenues and property values. Preventative maintenance can bolster profitability and be an investment in the property’s value that will produce dividends over time.