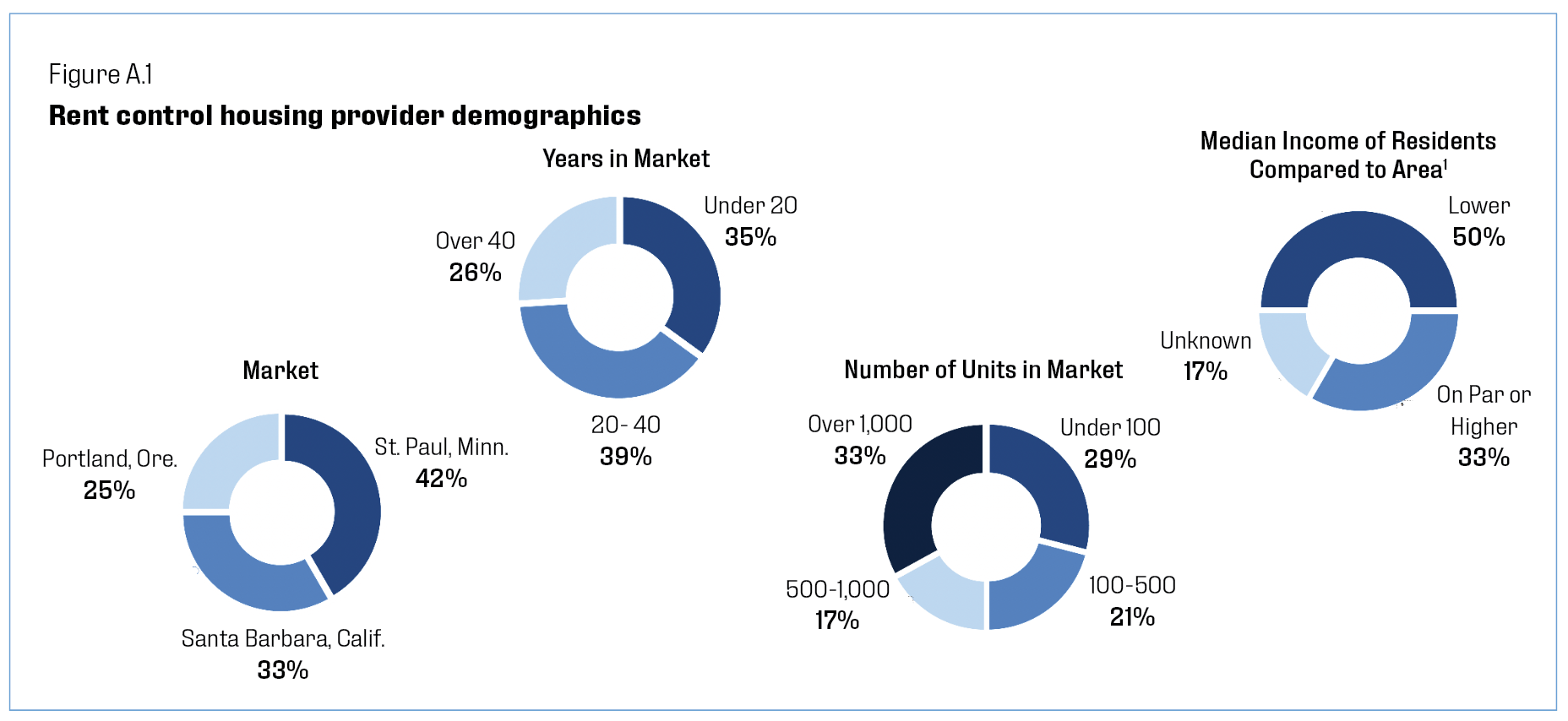

From December 2022 to February 2023, ndp analytics conducted 24 interviews with housing providers and developers from three different markets impacted by rent control policies and proposals: St. Paul, Minn.; Santa Ana/Santa Barbara, Calif.; and Portland/Eugene, Ore. The interviewees ranged from large firms operating thousands of units and having properties across the country to small, mom-and-pop businesses with a handful of units and, often, invested in real estate as part of a retirement plan or second source of income. (See Appendix A for more detail.)

The housing provider research was supplemented with an online public opinion poll of 1,039 respondents across the United States in February 2023. The poll questions focused on housing availability, residential construction and policy perspectives.

Five key findings detailed in this report are:

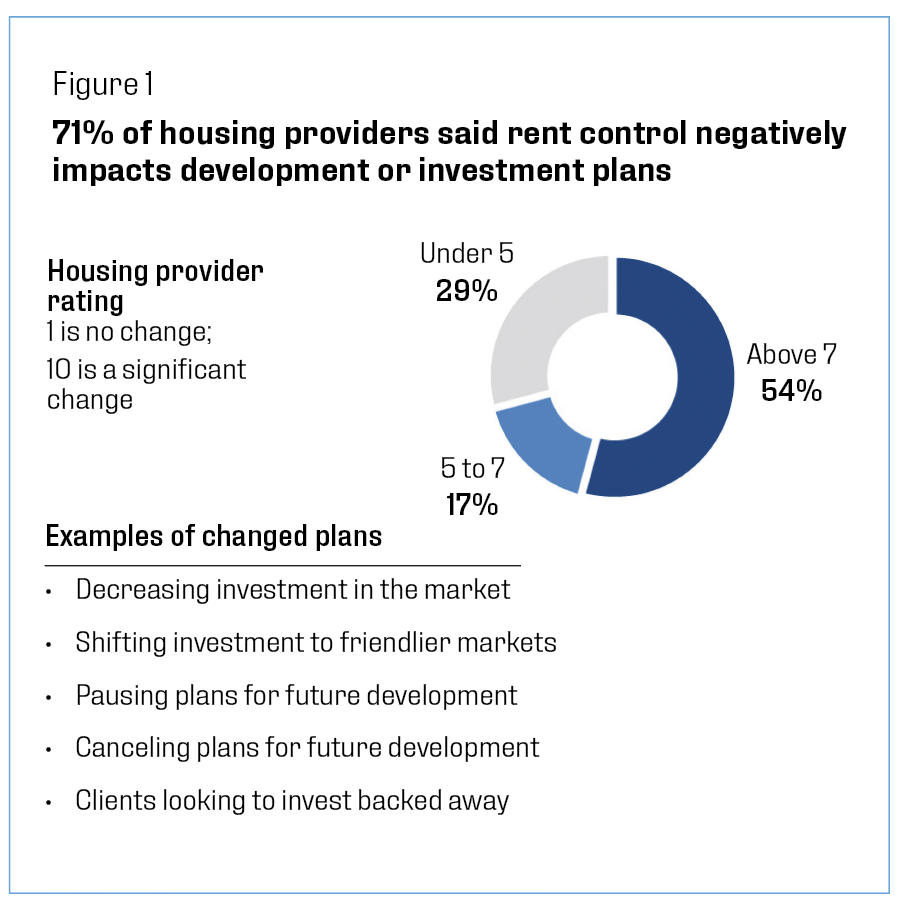

- Rent control policies reduce investment and development. Over 70% of housing providers say rent control impacts their investment and development plans; actions include reducing investments, shifting plans to other markets and canceling plans altogether.

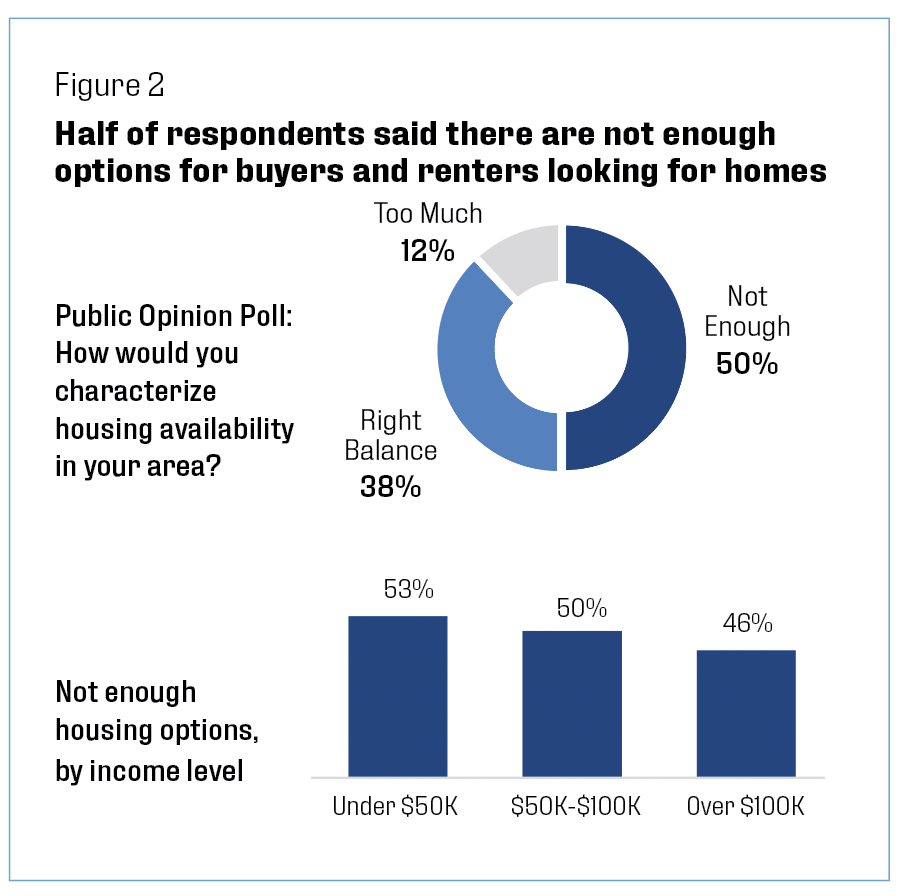

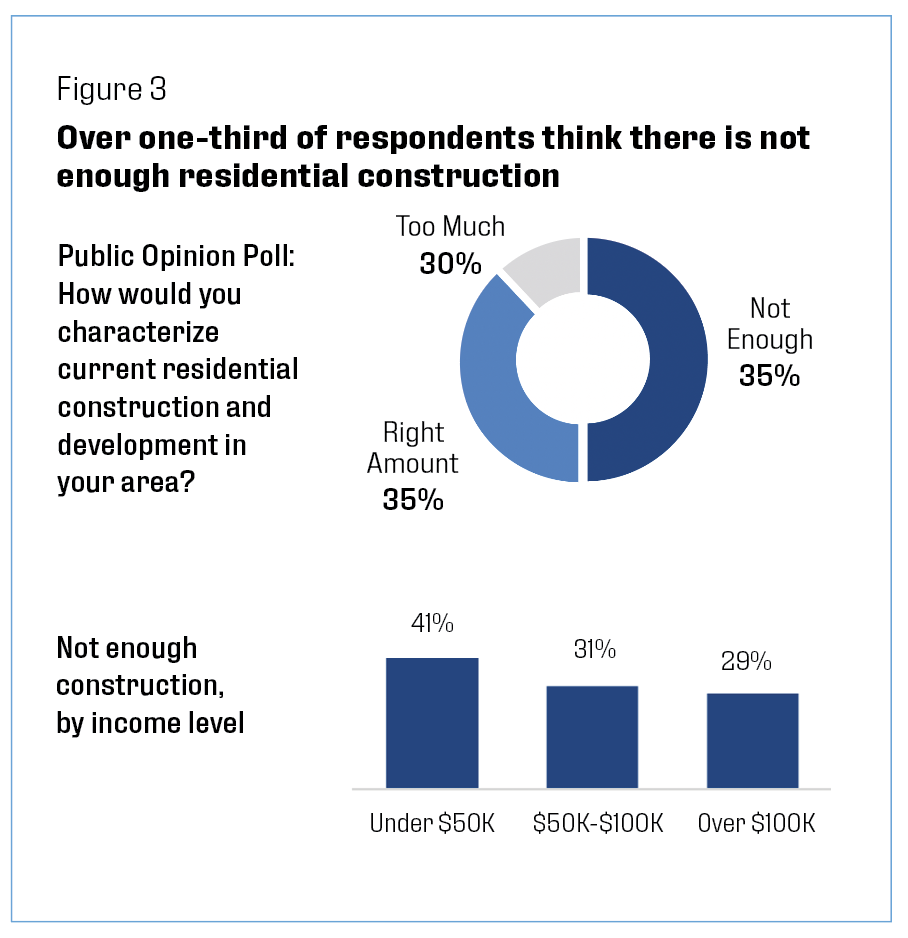

- Americans are looking for more housing options. Half of the poll respondents said there are not enough options for buyers and renters looking for homes; 35% want more residential development.

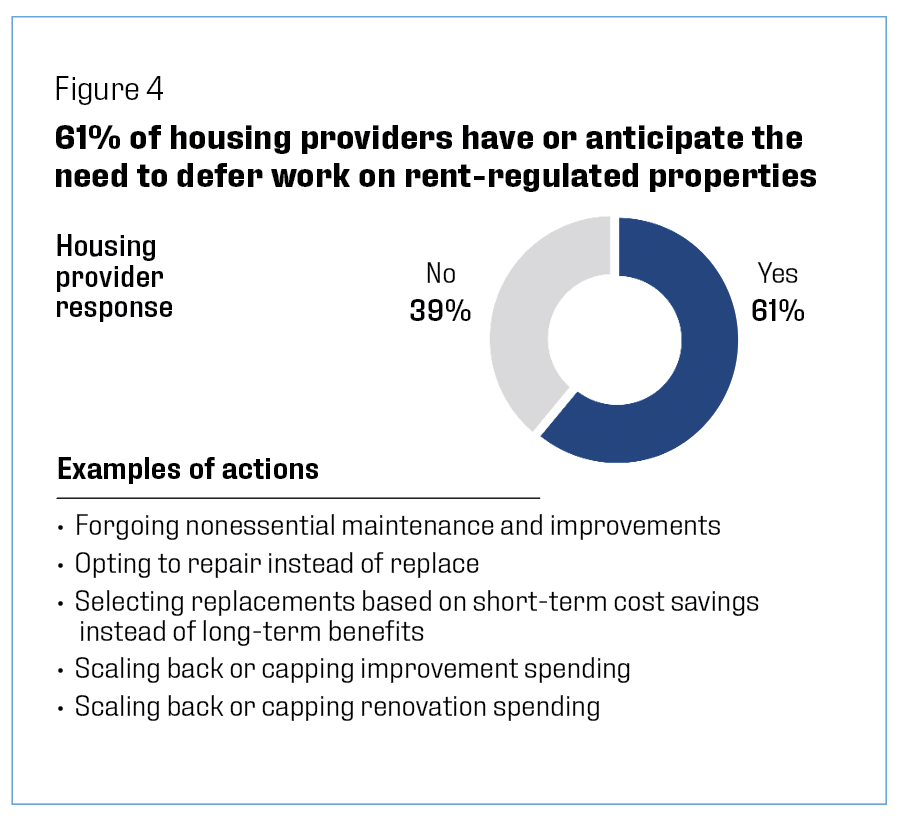

- Housing providers absorb the cost of essential maintenance and reduce investments in improvements and nonessential work due to rent control. These financial strains push housing providers to exit the market; 54% said they expect to or would consider selling some assets.

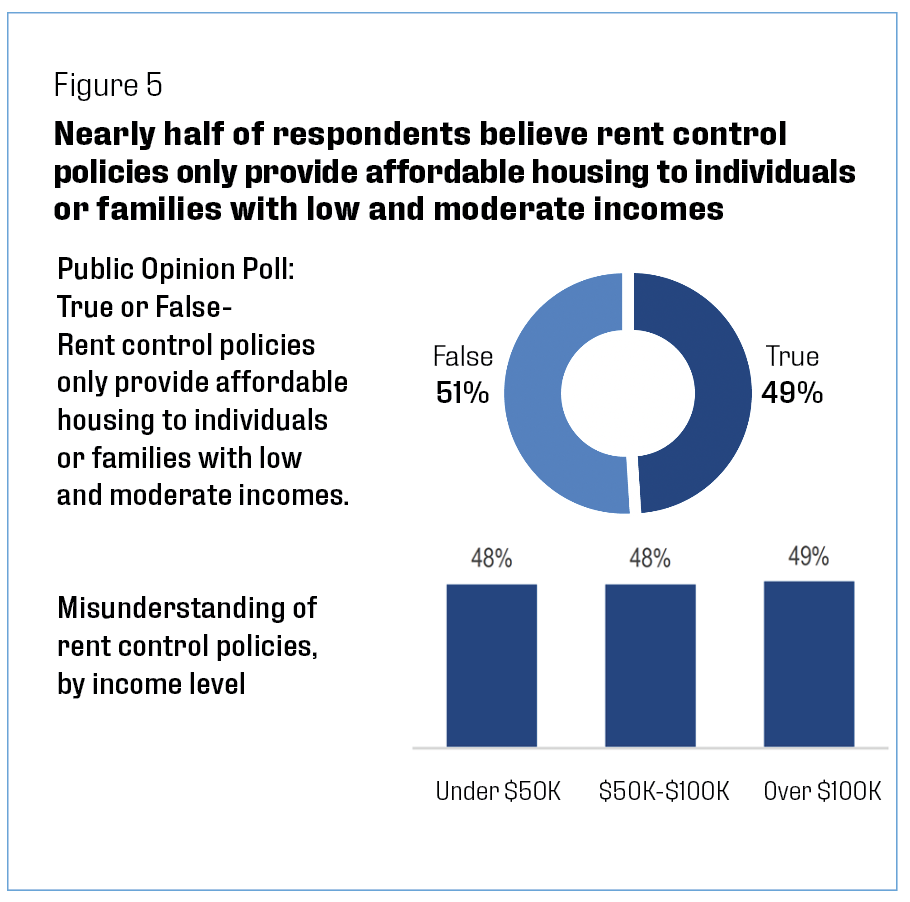

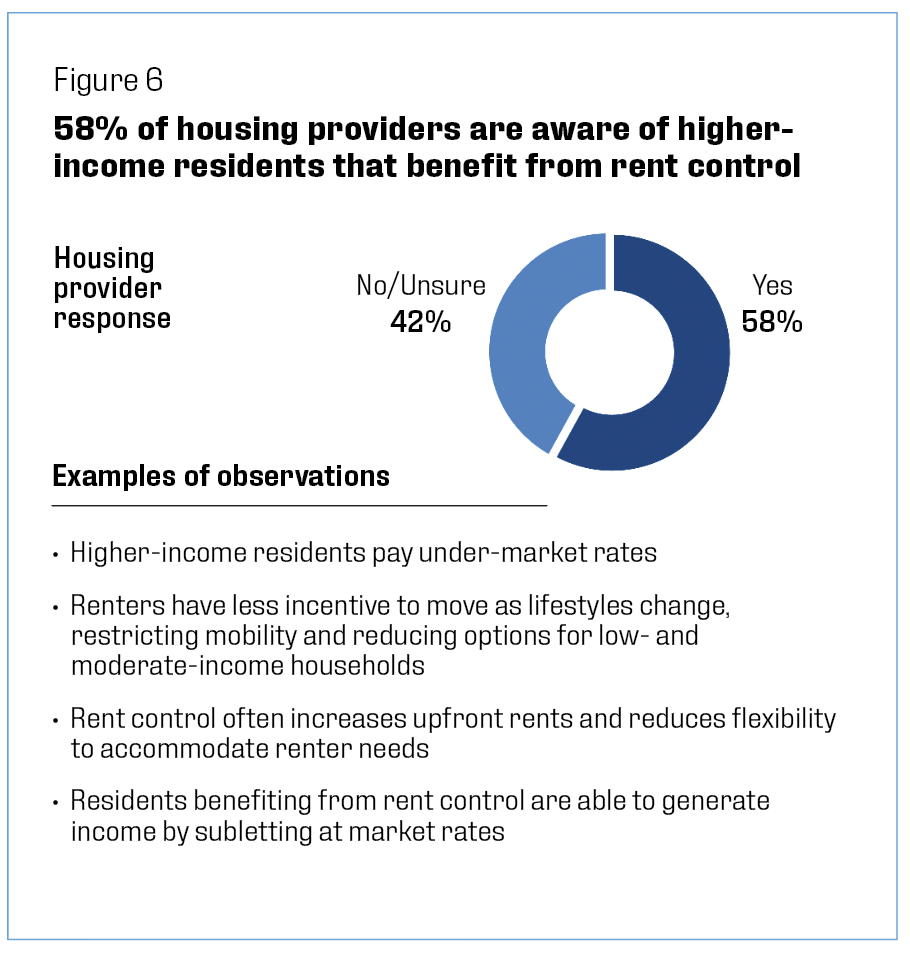

- Rent control policies are often misunderstood as helping only lower-income households, but these policies also subsidize higher-income residents. Nearly half of poll respondents incorrectly believe rent control only provides affordable housing to low- and moderate-income households. However, 58% of housing providers know of higher-income residents who benefit from these policies.

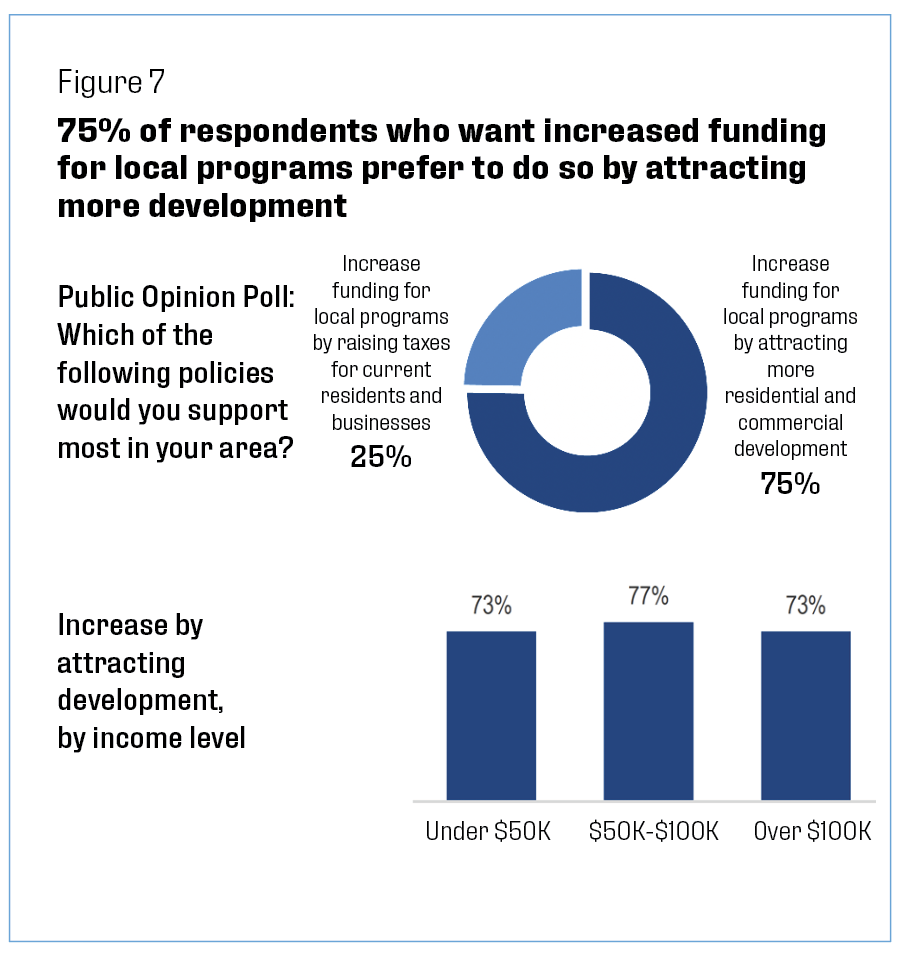

- Americans prefer policies that increase funding for local programs by attracting more business, but rent control deters investment and reduces potential tax revenue. Housing providers contribute significant tax revenue to local governments; however, rent control drives away investment. Most housing providers would not invest in a rent-controlled market again.

Finding 1. Rent control policies reduce investment and development.

While many housing providers want to expand their businesses, they are choosing to reduce or even stop investing in these markets because of rent control and other policies negatively impacting the industry. When asked to rate the negative impact of rent control on development and investment plans using a scale of 1 to 10 (10 being the most significant impact), 71% of housing providers gave a rating of at least 5 and 54% rated the impact above 7, indicating a significant negative impact on development and investment plans. Some business decisions include decreasing investments or shifting to other markets with friendlier policies, while others are pausing or canceling future development altogether (Figure 1).

Rent control deters investment and development in part because it limits the ability to keep pace with operational costs and generate revenue while also signaling a higher risk of future policy restrictions. Housing providers indicated that their business decisions are also impacted by other factors, including the safety and vitality of the community, the political environment, interest rates, operational costs and the mix of current and proposed policies by local, state and federal governments. Additionally, housing providers noted that smaller businesses are hurt most by factors like the policy environment because the complexity and cost of these regulations are difficult to manage (Table 1).