Through steady returns and robust rent growth, built-to-rent (BTR) communities have become a major aspect of the single-family rental sector. Built-to-rent or built-for-rent are communities of single-family rentals in one professionally managed development. They have developed into a sought-after asset class since the aftermath of the 2008 housing crash and are becoming increasingly attractive to institutional investors. During the past 12 months, BTR communities have seen a historical upward trajectory in rent growth and occupancy rates. The effects of the pandemic are the driving force behind record-setting fundamentals for this sector. The desire for extra space and the extremely tight for-sale housing supply at entry-level price points have proved beneficial for the BTR market.

BTR Rents are Surging

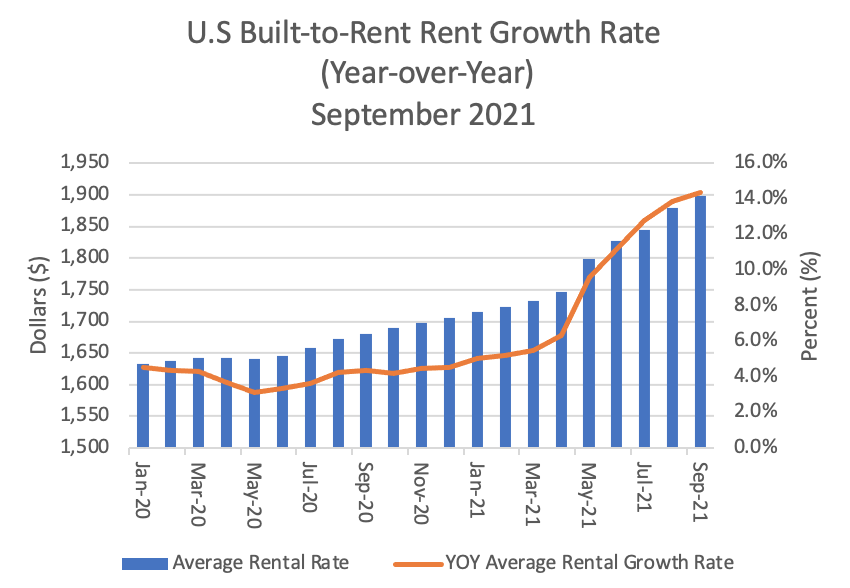

According to Yardi, BTRs average rental rate stood at $1,899 in September, increasing 14.3% year-over-year. Demand is especially strong in Sun Belt markets that are seeing a wave of in-migration. Rent growth was led by Tampa, Fla. (38.8%); Miami (32.7%); Phoenix (26.0%); Atlanta (20.9%); and Austin, Tex. (20.5%). Bottom ranking markets included Kansas City, Mo. (3.0%); Sacramento, Calif. (6.5%); Orlando, Fla. (7.5%); Portland, Ore. (8.6%); and Philadelphia (8.7%).

Experts predict that the future of remote work will have a considerable impact on BTR demand and rent growth. According to the Bureau of Labor Statistics, 11.6% of employees surveyed in October worked remotely because of the coronavirus pandemic. As employers increasingly offer permanent fully remote or hybrid work arrangements, renters will be able to move further from the urban office. According to a survey conducted by Apartment List in April, 35.4% of renters surveyed said that they plan to relocate to a more affordable market.

Source: Yardi Matrix, Single-family Built-to-rent communities of 50 homes and larger

Occupancy Rates Improve Steadily

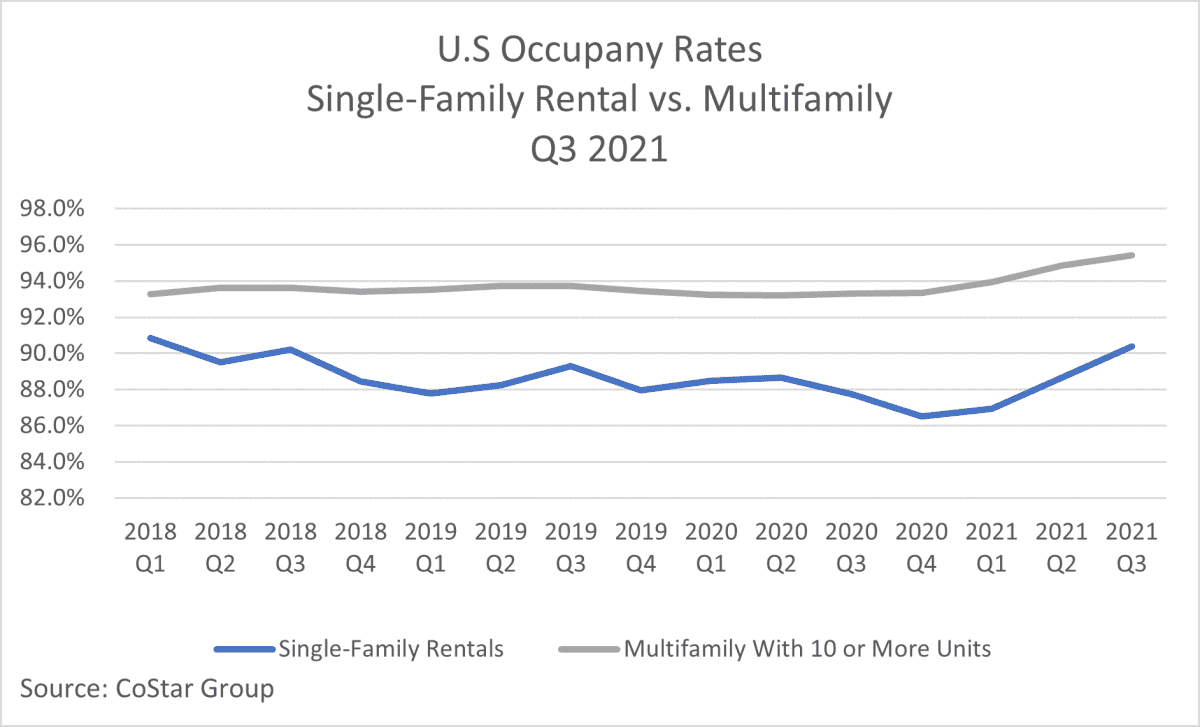

Occupancy rates have amplified significantly since Q2 2021. As measured by CoStar Group, occupancy rates across U.S Built-to-rent single-family rentals averaged 90.54% in the third quarter of 2021, up by three percentage points since Q3 2020. Rising rent increases in the BTR sector during 2021 are a result of increasing occupancy, mainly driven by employment growth.

Yardi reported Houston and San Antonio, Texas; Indianapolis; Austin, Texas; and Tampa, Fla. as leaders in occupancy growth in September. In contrast, Atlanta; Orlando; Cleveland; Pittsburgh; and Sacramento, Calif., posted declines in occupancy levels. Excluding Indianapolis, all leading markets posted at least a 5% increase in employment during September, according to the Bureau of Labor Statistics

Construction Muted Amid Supply Shortages

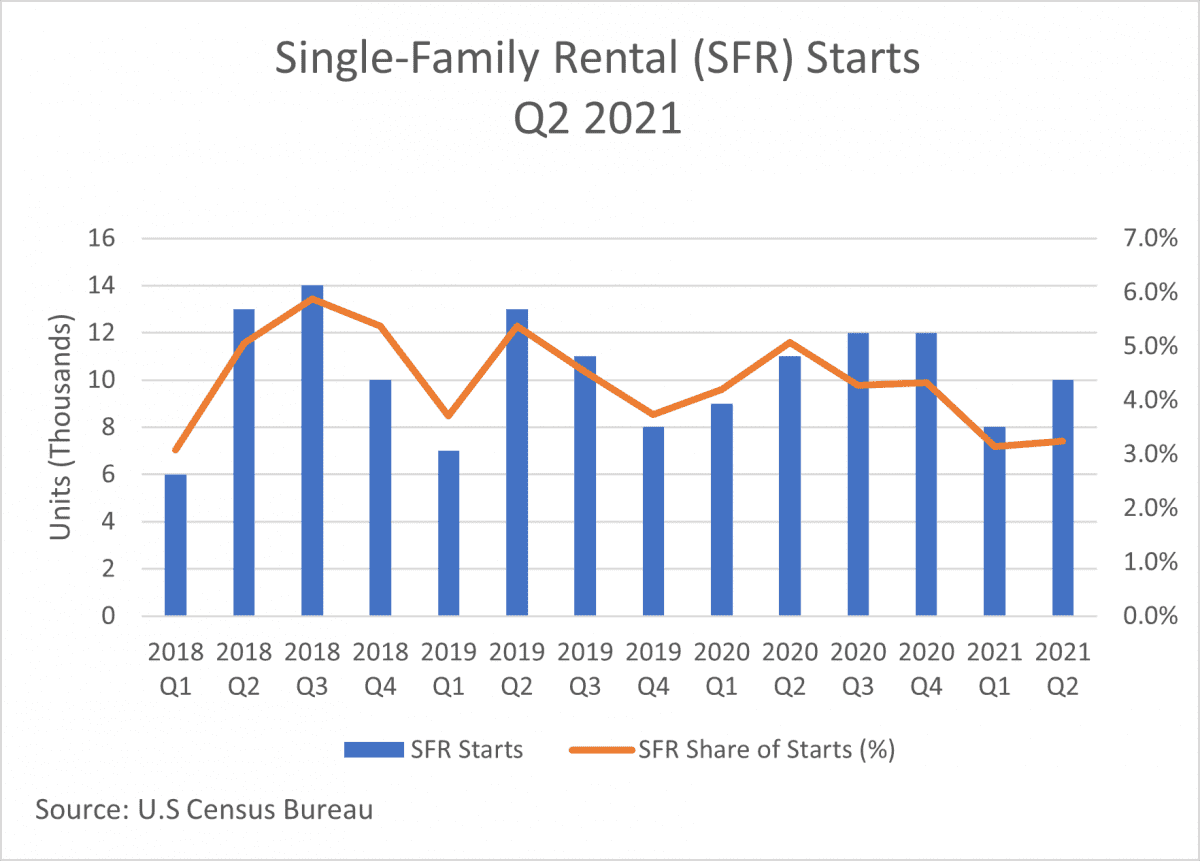

Single-family rental (SFR) construction continues to expand. According to data from the U.S Census Bureau, 10,000 single-family rental units broke ground during Q2 2021. Year-to-date 18,000 SFR units have begun construction. The share of SFR starts represented 3.2% of all single-family starts, declining by 1.8 percentage points since Q2 2020.

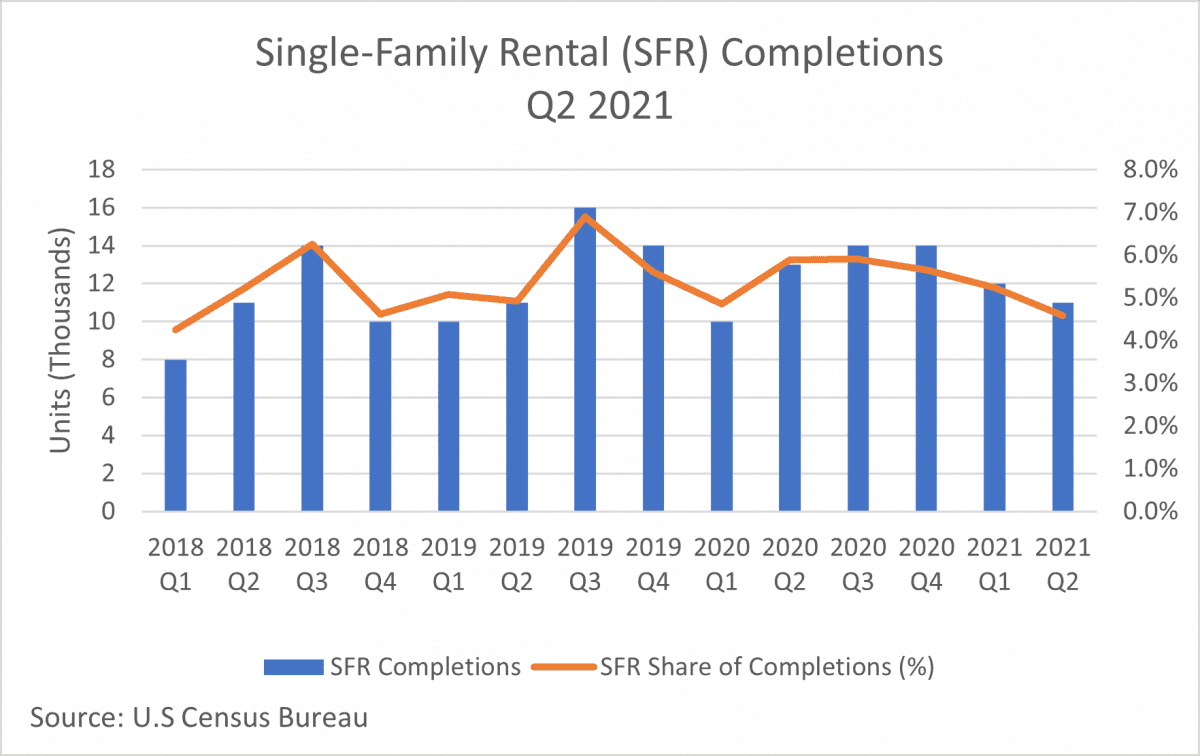

Single-family rental completions totaled 11,000 units, the lowest level since Q1 2020. The coronavirus pandemic has increased the period between when a permit is issued for SFR construction to its completion. The delay in production is a result of widespread shortages of materials and labor.

Sun Belt Metros Yield the Majority of BTR New Supply

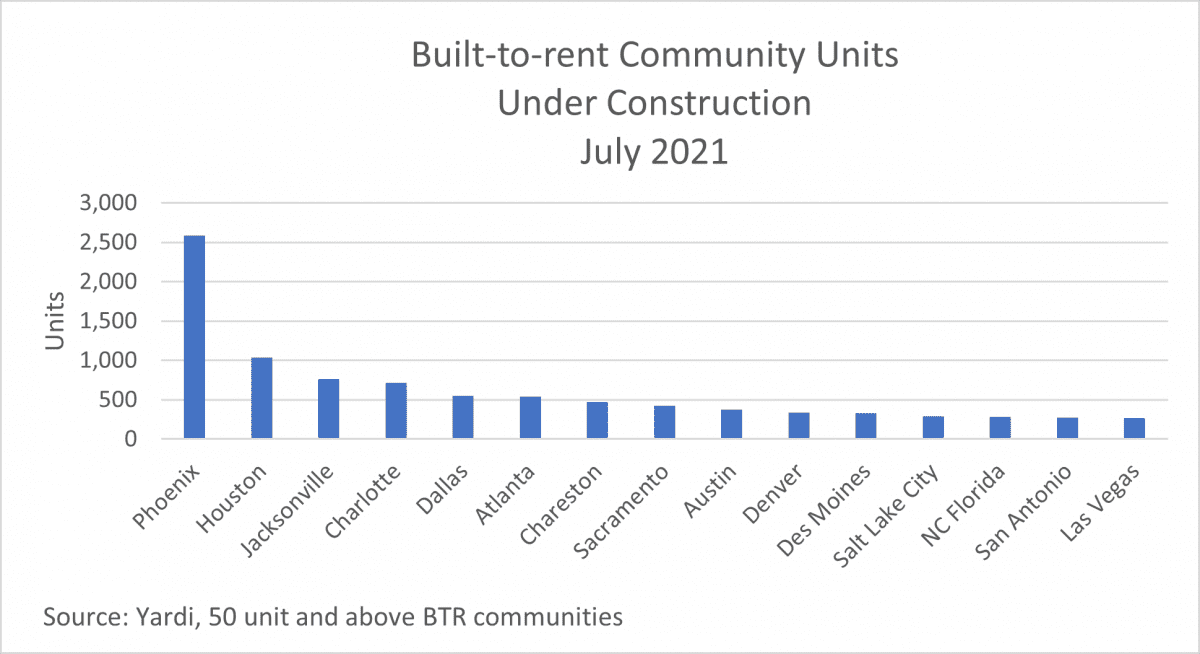

The Sun Belt region is experiencing record levels of in-migration from gateway markets resulting in rising supply and demand for housing. As a result of increasing demand and horizontal land availability, BTR communities in Sun Belt metros are attracting the bulk of new supply. According to Yardi, the Southwest (4,896 units) and Southeast (3,978 units) regions had the most units under construction in July, followed by the Midwest (1,716 units), West (1,522 units) and Northeast (134 units).

Developers leading the nation for BTR units under construction include American Homes 4 Rent (1,603 units), NexMetro Communities (1,336 units), Redwood Living (1,067 units), D.R. Horton (705 units) and Camillo Properties (644 units).

Investor Interest Remains High

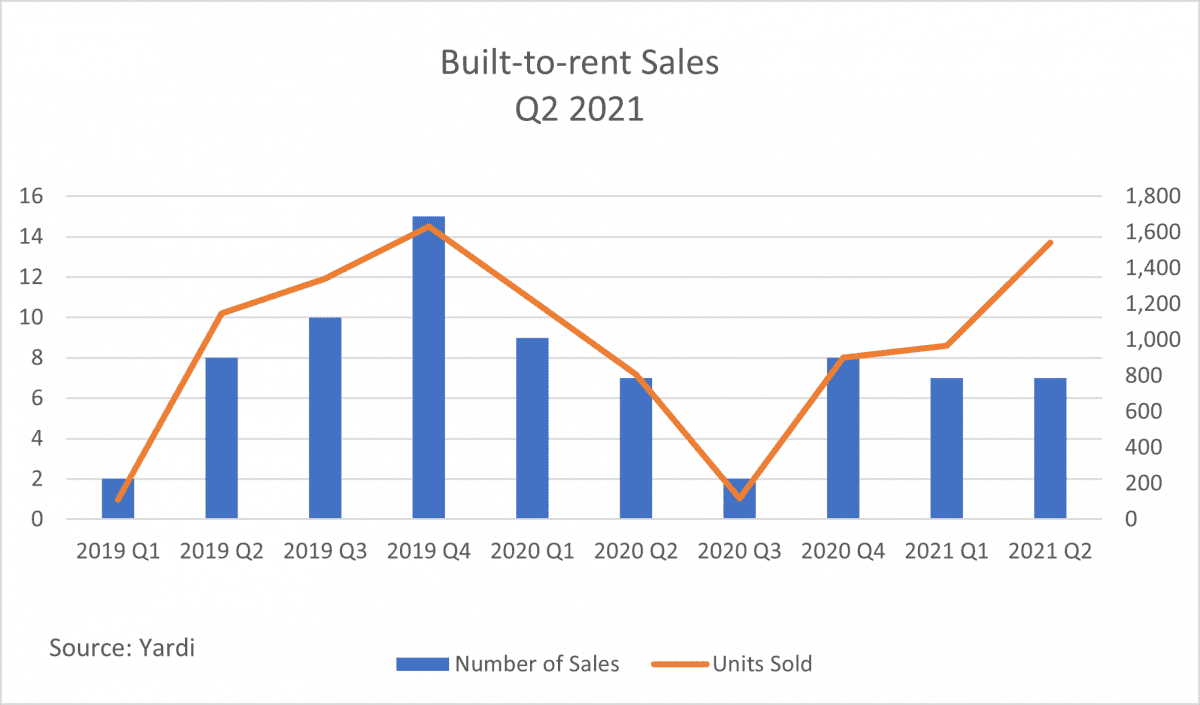

Investor interest continues to grow for the BTR sector. During Q2 2021 seven communities with 50 units or more sold and investors exchanged over 1,500 units. According to CoStar, sales volumes totaled over $116 million during the second quarter. The average price per unit sold was $243,748. Institutional buyers represented 58.0% of all sales, followed by private buyers who made up 35.0%.

According to Yardi, since 2015 total sales volumes for BTR communities ranked highest in Phoenix ($762.9M); West Palm Beach, Fla. ($180.8M); Austin, Texas ($141.9M); Tucson, Ariz. ($115M); and Long Island, N.Y ($111.8M).

As for single-family rental (SFR) investments, Redfin reported that 18.2% of single-family homes were purchased by an institution or business during Q3 2021, the highest rate dating back to Q1 2000. Furthermore, 74.4% of investor purchases were single-family homes during the third quarter. Investors purchased 90,215 single-family homes totaling $63.6 billion. The average cost per home was $438,770, increasing 5.3% year-over-year. The markets with the greatest share of homes purchased by investors included Atlanta (32.0%); Phoenix (31.7%); Charlotte, N.C (31.5%); Jacksonville, Fla. (28.3%) and Miami (28.1%).

Note: 50 unit and above communities only. Communities are built or assembled to operate as a community. Not up for individual unit sales.

Outlook

The BTR sector is well-positioned to continue to benefit from the lack of affordable for-sale product and the shift in renter preferences. Key survey findings from Gen Z renters revealed that 44% of respondents said they would prefer to live in a vibrant suburb. In addition, 43% desire to rent single-family detached properties after graduating. Build-for-rent communities are among the strongest performing property sectors, with soaring investor interest. Walker & Dunlop reports that single-family rental growth is expected to outpace multifamily, office, retail, storage and hospitality growth by 2022.