U.S. Apartment Market

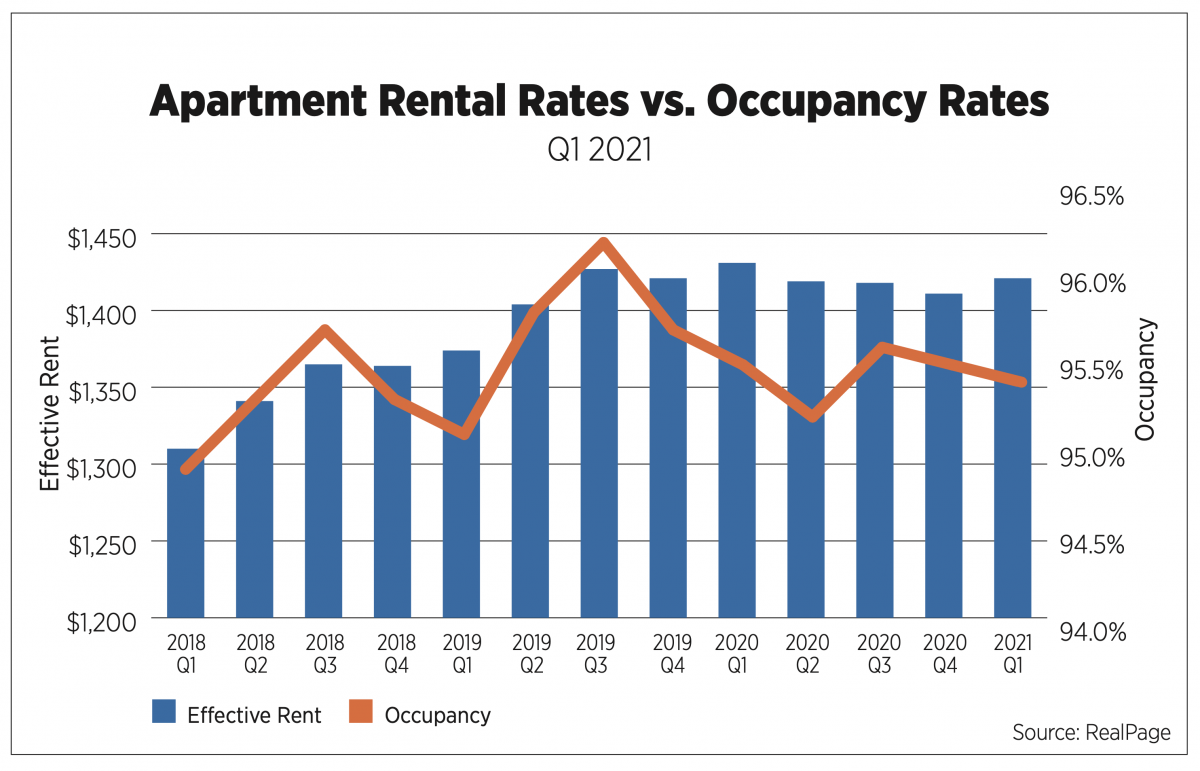

Rising rental rates and rampant leasing activity during Q1 2021 indicated that the multifamily housing market is turning a corner. Pent-up demand driven by employment growth and the widespread distribution of the coronavirus vaccine was evident. Increasingly, more renters are becoming comfortable with moving to a new apartment home. According to RealPage, effective rental rates moved from $1,411 in Q4 2020 to $1,421 during Q1 2021. Lower-cost markets with limited apartment stock continued to thrive and outperform major markets. As reported by REIS, San Bernardino, Chattanooga, Memphis, Sacramento and Lexington recorded the highest effective rent growth levels during the first quarter. While gateway markets are starting to see hints of a bottoming pattern emerging, they are still among the nation’s laggards for rent growth. San Francisco, New York City, San Jose, Washington, D.C. and Oakland posted annual rent growth declines ranging from -6.6% to -14.8%.

Despite robust demand, apartment occupancy did not see any gains. Instead, occupancy levels inched down 0.1 percentage points to 95.5%. This signals that concessions offered by apartment owners attracted more existing renters than prospective renters. Properties tracked by Entrata reported that concessions were nearly 30% higher year-over-year as of February. According to REIS, Columbia, Greenville, Salt Lake City, Albuquerque and Knoxville were the leading markets with shrinking vacancy rates year-over-year. Markets that posted the greatest increases in vacancy included Washington, D.C., Charleston, Minneapolis, Raleigh and Louisville.

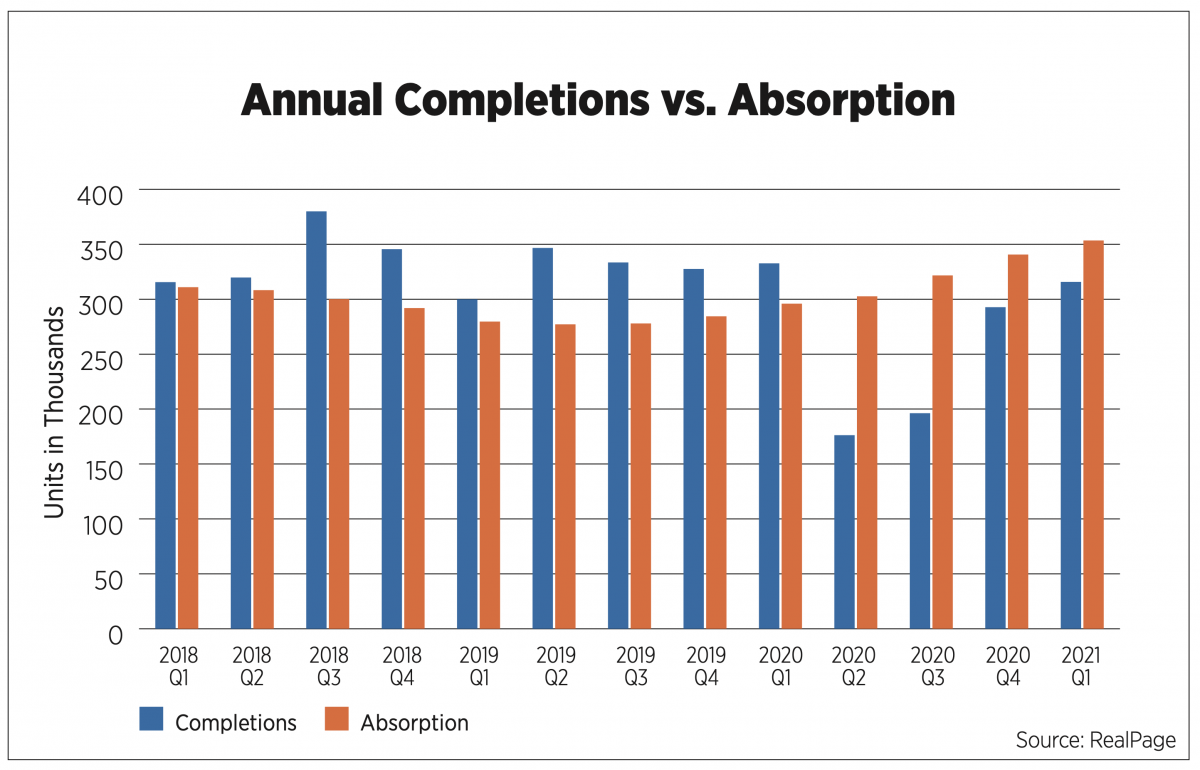

Similar to Q4 2020, apartment demand kicked off 2021 with repeated strong performance. RealPage reported that 353,453 annualized units were absorbed, far outpacing the 315,789 units that came online during Q1 2021. Sun Belt markets including Dallas (3,566 units), Miami (3,227 units), Austin (2,923 units), Orlando (2,593 units) and Phoenix (2,462 units) recorded the greatest absorption.

According to Census, the seasonally adjusted annual rate for multifamily construction starts in February 2021 amounted to 372,000 units, a decline of 27.6% percent year-over-year. Units completed increased slightly by 2.8% to 314,000 units. Multifamily building permits significantly increased by 24.1% to 495,000 units. The top-ranking markets for permits issued during February 2021 included New York (6,821 units), Austin (5,206 units), Los Angeles (3,562 units), Washington, D.C. (3,464 units) and Dallas (3,284 units). With 652,000 multifamily units in the pipeline across the U.S, competition for renters will continue to be fierce, particularly among the class A stock.

U.S. Capital Markets

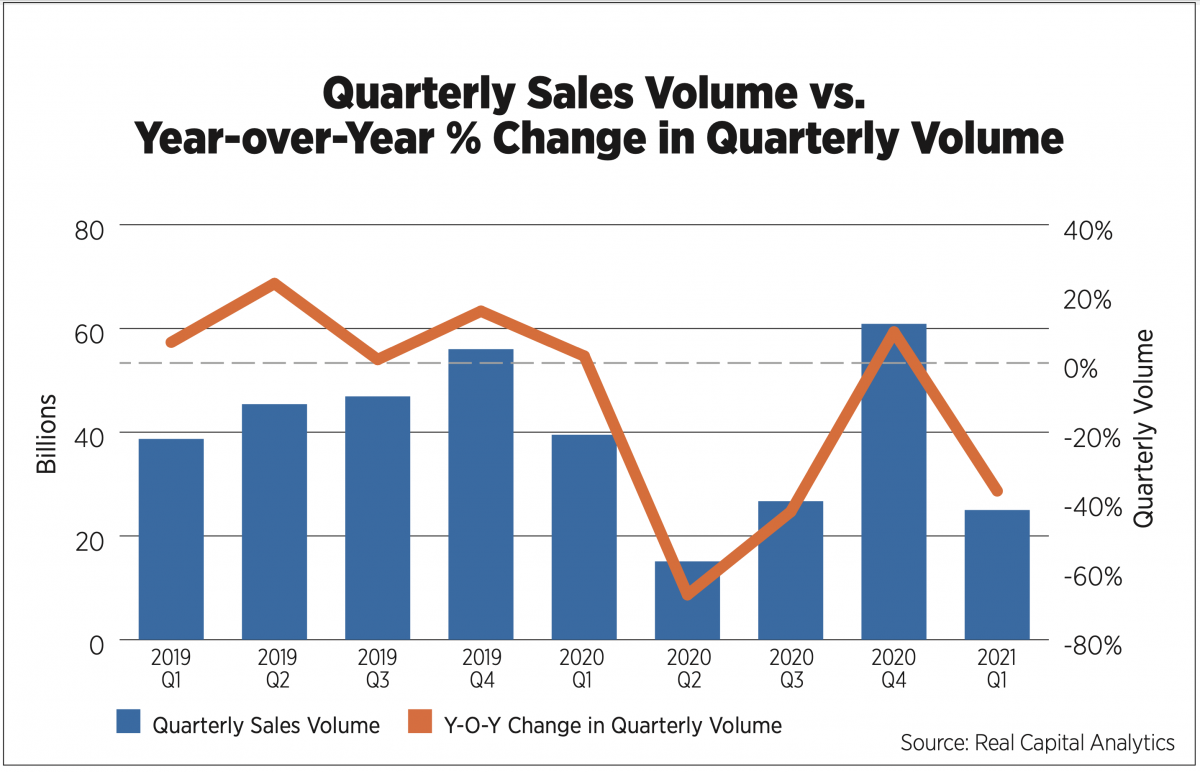

Apartment deal volume began the new year at muted levels. As reported by Real Capital Analytics, closed apartment sales transactions during Q1 2021 totaled $25.1 billion, down 36.6% from the same time last year. Investors exchanged 154,000 units, 38.2% less than February 2020. Multifamily values remained steady; the average price per unit increased to $182,300, up by 4.9%. The average cap rate was 4.9%, down by 45 basis points. Garden-style asset sales totaled $17.9 billion during Q1 2021, while mid-/high-rise properties totaled $7.9 billion. Los Angles, Phoenix, Dallas, Atlanta and New York City were the top markets for deal activity during the first quarter. Morgan Properties and Olayan Group partnered together for a massive transaction, acquiring 14,414 units in 11 states for $1.7 billion from STAR Real Estate Ventures.

U.S. Economy

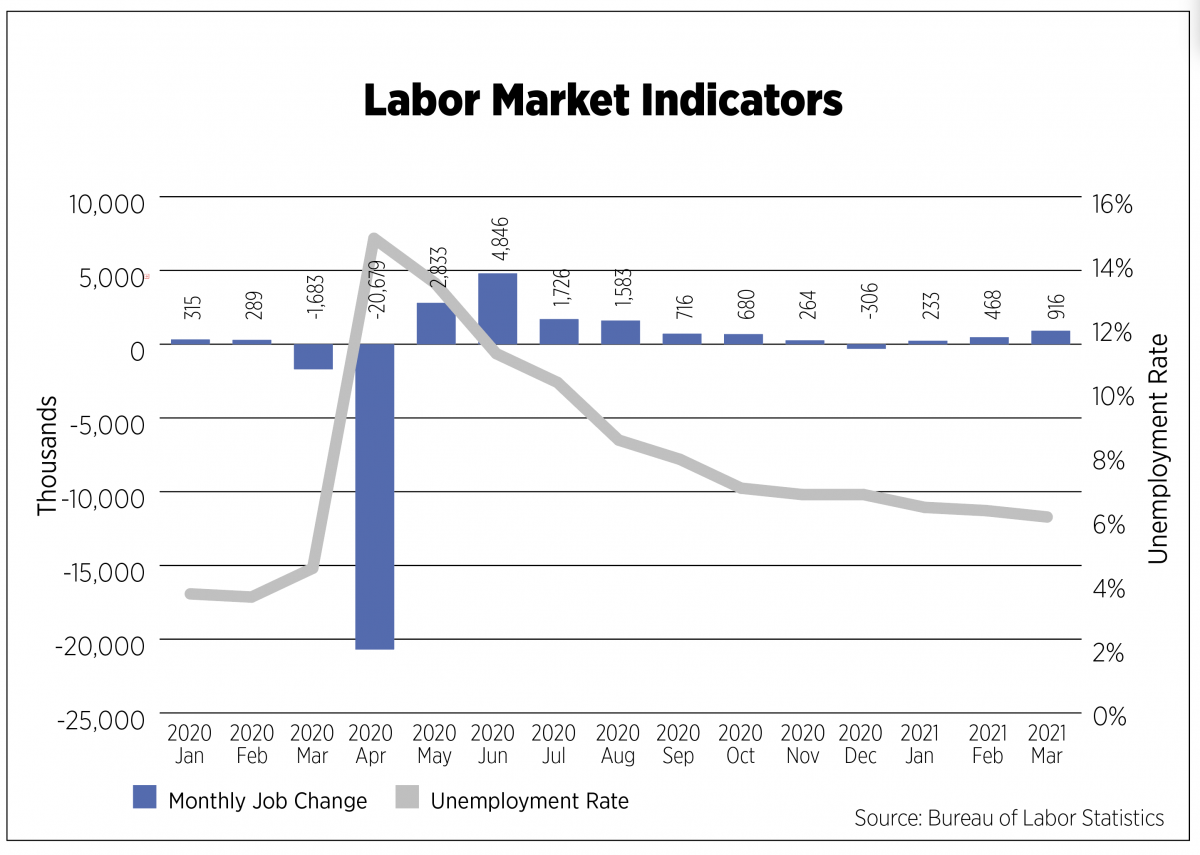

In March, the Employment Situation Report published by the Bureau of Labor Statistics (BLS) turned in its strongest performance since the height of last summer with 916,000 jobs added. Upward revisions to January and February translated into an additional 156,000-job gain. Pandemic job losses remained elevated at 8.4 million. Initial claims for unemployment also remained high by historical standards, but have begun to moderate somewhat, coming in below 750,000 for three consecutive weeks ending April 3.

BLS job openings data for February also revealed a revitalized labor market as states and jurisdictions began lifting restrictions amid increased vaccinations. Just under 7.4 million positions were available at the end of the month, a level that is in line with 2018-2019. Job openings in the healthcare and social assistance industry, as well as the leisure and hospitality sector, experienced the greatest monthly increases.

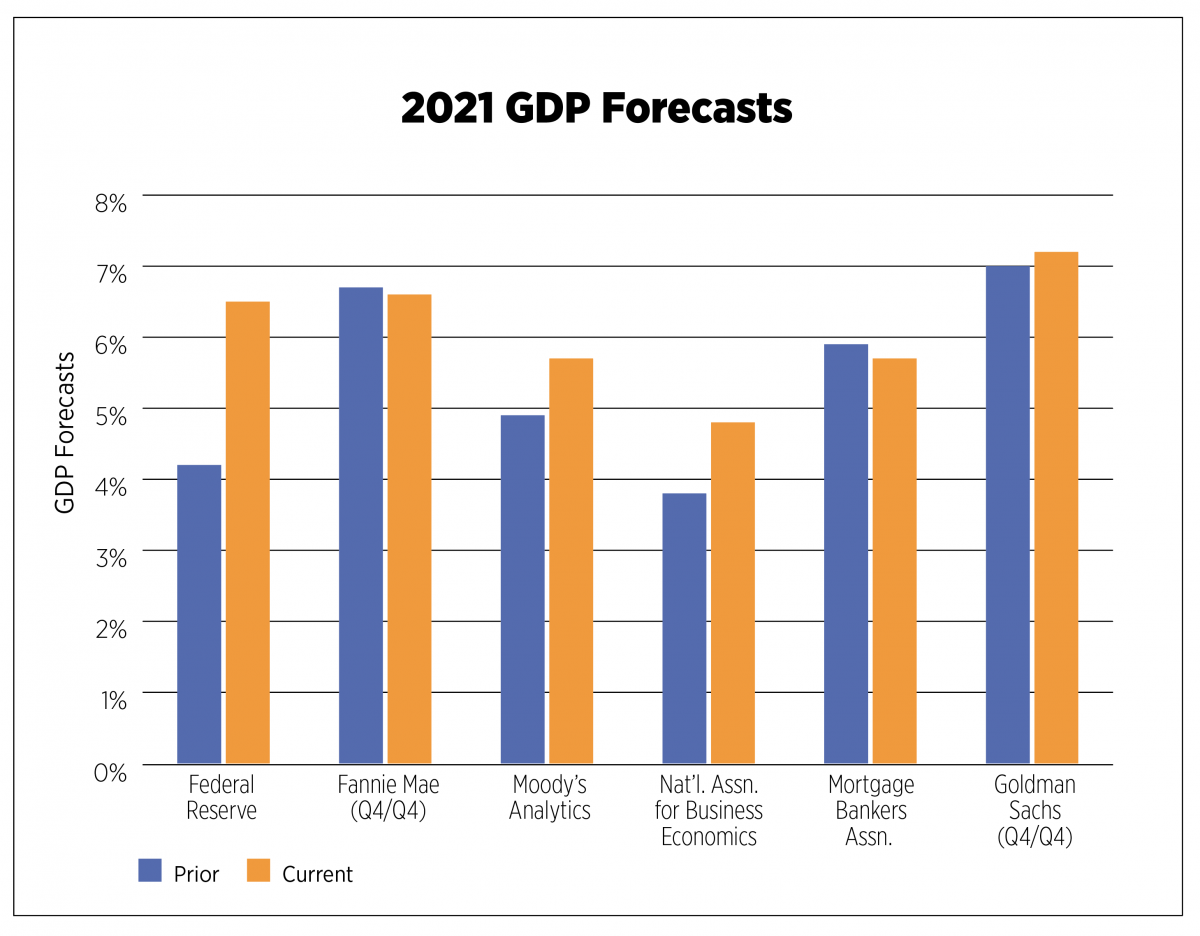

The ramp up in vaccinations, the passage of the $1.9 trillion American Rescue Plan (ARP) and other strong economic indicators caused many economists and analysts to substantially increase their employment and GDP forecasts, most of which exceed 5% in 2021. Some of the larger investment firms are forecasting 2021 GDP growth in the 8% range, a rate of growth not seen since 1950. The Federal Reserve has one of the more optimistic forecasts for the labor market with a 4.5% unemployment rate projected by the end of 2021.

The number one risk to the economy, according to the most recent outlook survey from the National Association for Business Economics (NABE), is a variant of the coronavirus against which the vaccines are ineffective. It garnered an overwhelming 67% of responses, compared to the second and third highest risks: Slow vaccine distribution and fiscal policy inaction/policy gridlock, at 10% each. It is important to note that the survey was conducted prior to the passage of the ARP and that the greatest upside risk to the economy was a large fiscal stimulus program.

Outlook

It will be a close race between vaccinations and COVID-19 infections, both of which were increasing in early-to-mid April. Even with rising cases, many jurisdictions are easing restrictions by increasing capacity at restaurants, shops and event venues and opening in-person learning to more students. The Transportation Security Administration reported the highest air passenger traffic since the pandemic began, with 9.5 million passengers passing through TSA checkpoints during the week ending April 17, 2021. Life is beginning to look more normal for many Americans and surges in optimism as well as pent-up demand are clearly revealing themselves in economic data.

As job growth becomes even stronger, an increase in household formations can be expected as younger cohorts leave family residences and workers become more mobile again. The continued run-up in house prices, low supply and increasing mortgage rates will temper the for-sale market, resulting in healthy demand for apartments, particularly in suburban locations in the South and West. While it appears that gateway cities have hit bottom, supply and demand imbalances will prolong their recoveries. And until rental assistance dollars are fully distributed, risks remain for small property owners and their residents.

Outlook

With COVID-19 cases higher in some states than they were in April and May—originally anticipated to be the peak—the pandemic is far from contained in the United States. Until consumers and businesses alike hear some good news about containment, treatments and vaccines, fits and starts can be expected to plague economic activity.

Between consumers’ savings and additional income, it should come as no surprise that rent collections being reported by several property management firms for institutional-grade properties remained strong through July. But the combination of dwindling savings and the supplemental federal unemployment insurance expiring at the end of July bodes poorly for rent collections in September and beyond.