Making the decision to enter the short-term rental marketplace and/or allow residents to use their apartment homes for short-term rentals is a big deal. Some property owners may believe that participating in this kind of marketplace is risky and creates more challenges than opportunities. Whether reserving units for short-term rentals or allowing residents to participate in short-term rental programs, property owners can mitigate risks by taking these legal and regulatory issues into consideration.

1. Remember that some municipalities may prohibit short-term rentals in their entirety.

Property owners can be subject to hefty fines if caught participating in short-term rentals. Reviewing local zoning and administrative codes is a great start. If unsure, contact the local government to determine whether (and how) they enforce short-term rentals.

2. Property owners (and/or their residents) may be required to obtain additional licenses and permits (and provide proof of such) before listing a property on a short-term rental platform.

- Hotel licenses

- Local and/or state business licenses

- Permit requirements

- You may be required to register your property and maintain official records with the local government. You may be asked to provide data on the frequency of rentals, guest identification and the like.

3. Insurance is always a big factor.

Property owners should call their insurance provider to determine if there are any additional requirements needed for short-term rental hosts. Questions to consider: Do you have the proper liability and property protections? Does your resident have the proper insurance coverage? Property owners may also want to research whether short-term rental companies offer any insurance guarantees.

4. Think about who will be responsible for screening participating guests; think about whether outsourcing guest screening is a possibility.

If a property owner is reserving apartment homes for renters, the responsibility for screening lies with the property owner. However, if a property owner is allowing a resident to rent out their unit, who will be responsible for screening participating guests? Create a checklist of ideal guest criteria and guest qualifications that all residents need to abide by when selecting short-term guests.

5. Taxes!

Property owners need to be aware of these tax categories:

- Lodging taxes and tax registration

- Hotel occupancy taxes

- Transient occupancy tax

- Rental unit business taxes

If a property owner determines that entering the short-term rental marketplace is not for them — or maybe it is prohibited in their jurisdiction — there are ways property owners can protect themselves from unlawful short-term rentals.

Property owners should ensure all lease agreements with residents specifically indicate that short-term rentals are prohibited. Property owners also can make the breach of that covenant a material breach of the lease agreement and a cause for eviction (consult local counsel to make sure that it is legal in states where only just-cause evictions are permissible).

Additionally, property owners can add a clause to lease agreements that hold the resident responsible for any damages, losses or fines that are incurred as a result of the resident’s lease violation.

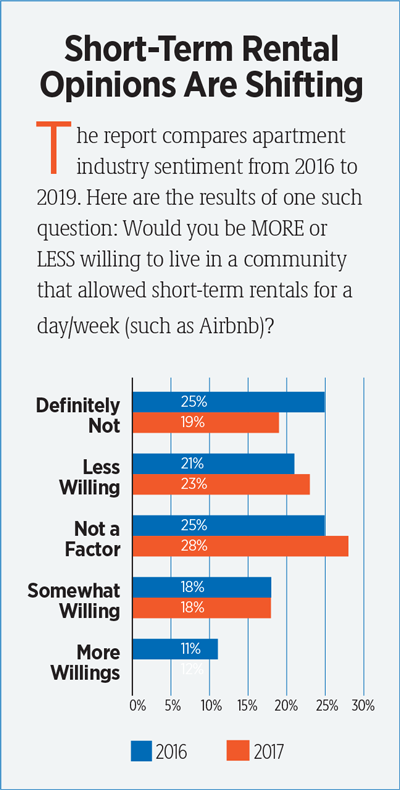

Short-Term Rental Opinions Are Shifting

Short-Term Rental Opinions Are Shifting

The report compares the apartment industry sentiment from 2016 to 2019. Here are the results of one such question: Would you be MORE or LESS willing to live in a community that allowed short-term rentals for a day/week (such as Airbnb)?

Get the Latest Short-Term Rentals Research from NAA

J Turner Research, in association with NAA, conducted an exclusive study on residents and rental housing companies’ attitudes toward short-term rentals. The study was presented at NAA’s 2019 Apartmentalize. The study is based on polling of 12,000 apartment residents and conversations with many apartment owners and managers.