Investigating the relationship between staff shortages and operators’ efforts to centralize property management roles.

The way that multifamily housing companies staff their properties is changing. As outlined in the June 2022 units article, “Why Centralization is Good News for Career Paths,” (naahq.org/why-centralization-good-news-career-paths), new technology is creating opportunities for different and better career paths in property management. But technology isn’t the only factor that is changing the way people think about staffing.

Staff shortages are ubiquitous across all industries, and since the pandemic, it has become increasingly difficult to find and retain property management talent. The question then becomes: What is the relationship between staff shortages and operators’ efforts to centralize property management roles?

Staff Shortages Are Driving Decisions

February of this year saw the release of the fourth edition of 20 for 20, (20for20.com/white-paper) a survey based on 20 in-depth interviews with operational and technology leaders in the rental housing industry. One of the major findings was how staff shortages have been affecting decision-making.

It was not simply the case that people were worried about being unable to fill roles; it’s that the concern was seeping into many different areas of the way that organizations planned their year, including technology. Repeatedly heard was that leaders were looking to technology to remove friction and lower workload for property teams. And that companies were prioritizing technology projects that reduced the workload on staff.

The concurrent trend outlined in “Why Centralization is Good News for Career Paths” is the centralization of functions. Technologies that reduce workload at multifamily communities can potentially enable more radical changes in staffing models. Companies are centralizing tasks like leasing calls, bookkeeping, triaging and organizing maintenance through some combination of AI, access control and other innovative applications. It is enabling some to move beyond the classic 1-staff-to-100-units staffing model.

With uncertainty over being able to staff properties, the allure of technology that enables different staffing models is obvious. But of course, as always in residential property management, the devil is in the details.

The Art of the Possible

David Perez, President and Chief Operating Officer of Atlanta-based operator CARROLL, explains some of the realities of centralizing functions. “We know that 50 percent of prospects are satisfied with touring themselves. That helps, for example, when a leasing office is short-staffed. We can improve the customer experience by offering this option while reducing and optimizing the workload, particularly during peak times.

“There are other areas where technology reduces our exposure to staff shortages and turnover. Automatic issue detection and shut-off devices can also help us prevent damage if maintenance departments can’t get to an issue as quickly as usual.”

In describing CARROLL’s approach, Perez explained how technology insulates the operator from situations where it’s hard to be “fully” staffed in the traditional sense. Shifting and reducing the workload offers the potential to change staffing models, but structural constraints exist.

“REITs (with internalized operations) have an easier opportunity to centralize functions given the level of aggregation present in that business model and investor capital goals,” he says. “With joint venture partners or third-party management clients, you must evaluate the initiatives at scale, understand perceived conflicts and create the business case to decide what gets rolled out at each property.”

Structure Is Destiny

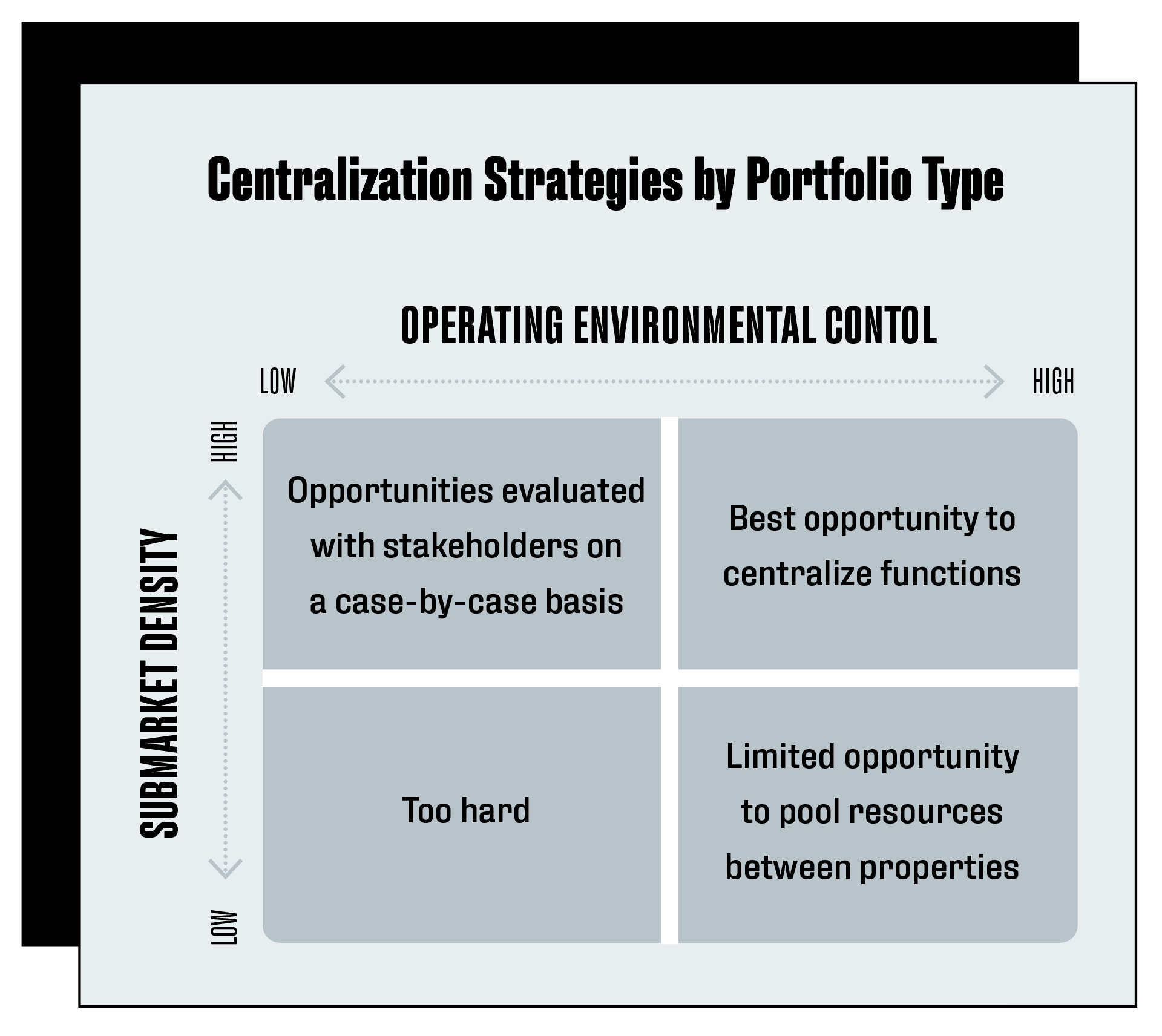

Perez’s perspective is consistent with a broader finding of 20 for 20. When asking the 20 interviewees about their plans to centralize operations, most companies (60%) were already devoting some effort to changing their staffing models, but that only tells half the story. Delving deeper into the kinds of initiatives the companies were working on, the answers varied by company type (see chart below).

The matrix diagram summarizes how the interviewees are approaching centralization. The two major determinants of each company’s opportunity are submarket density and control over the operating environment. When properties are closer together, it is easier to pool resources between them. And because centralization requires uniformity of systems and processes, decision-making control usually defines its scope.

For example, high submarket density and high control (top right) might be the reality of a public REIT, as Perez suggests, with the most natural opportunity and the highest flexibility to change staffing models. But most multifamily operators do not belong in that quadrant.

Owner-operators who control their portfolios but whose properties are not close together (bottom right) can still take activities offsite, but do not have the same opportunities to pool staff. Companies with high density but with many financial stakeholders (top left), like fee managers, must view centralization on a case-by-case basis.

Cause, Effect or Something Else?

While it’s established that operators are both experiencing staff shortages and—mostly—advancing initiatives to centralize functions, what is less clear is the extent to which staff shortages are driving centralization activities.

Cindy Clare, Chief Operating Officer of Greensboro, N.C.-based Bell Partners, Inc., describes recent history: “COVID made operators rethink everything, but as the pandemic unfolded, we saw the opportunity to make longer-term changes that made sense for our customers and our teams. The pressure of staff shortages pushed us further along a path that we were already pursuing.

“We’ve learned that when we move some functions offsite, it not only reduces workload; it also provides greater scope for team members to focus on things they like to do.”

As discussed in “Why Centralization is Good News for Career Paths,” technology-enabled centralization enables specialization and a greater variety of jobs.

“Greater specialization of roles is helpful because we can offer associates greater flexibility and career progression,” Clare says. “An assistant manager who is good at the admin side of the job could advance, for example, to be a supervisor, payroll manager or renewals manager. These roles do not have to be conducted onsite, and that flexibility can make us more competitive in a tight market for talent.”

It is, of course, uncertain how long staff shortages will continue to affect the operating environment. But the changes that are being made to staffing models are largely permanent. Which again begs the question, to what extent are near-term staff shortages truly affecting long-term decision-making?

Defining the New Normal

Alison Dunavant, Vice President of Organizational Development at Houston-based Camden, said, “Our industry has never seen this level of disruption before, but we decided to turn that challenge into an opportunity. The opportunity was to re-orientate how we staff operations around people’s strengths.

“The labor market is highly competitive at the moment, but we’re inclined to see it as the new normal,” says Dunavant. “We need to account for the fact that people will leave. So, our value proposition to our associates is that we will give you the opportunities to develop in the areas where you want to grow professionally. And if you leave, we want you to come back and continue growing.”

For Camden to change its approach to staffing was no small undertaking. Dunavant described a succession of projects that played out over multiple years, starting long before COVID. First, the company invested in human capital management, which turned talent management into a cloud-based enterprise function, making it easy to match specific candidates to specific opportunities.

Camden then rolled out access control across its portfolio, which provided a foundation for streamlining property management functions like self-guided tours. “We were down the path towards self-guided tours, then the pandemic forced us to figure it out over a weekend!” says Dunavant. “The experience gave our associates a degree of comfort with different approaches to leasing.”

More recently, Camden rolled out a brand-new enterprise CRM, including AI leasing capabilities, enabling greater automation of marketing activities and a new approach to leasing that includes pooling resources between properties in the same submarkets.

Leasing office activities are one of several areas where Camden has been able to migrate traditionally property-based activities to a shared service environment. “It enabled us to distribute tasks that didn’t lean into the strengths of our team members onsite,” says Dunavant. “It also enabled us to offer more remote work positions, which further helps manage the uncertainty and staff shortages following the pandemic.”

Not All Roles Are Created Equal

There are a growing number of centralization tasks to be concentrated in leasing and property management administration, but when operators are asked where the staff shortages are the most challenging, they usually cite maintenance roles.

Recruiting and retaining maintenance teams is a source of business pain at the best of times, but in tight labor markets, the pain is acute. Yet, the progress on centralizing maintenance tasks seems to lag other property management roles.

“It’s the area where centralization could have the greatest impact, and it’s an area that we continue to explore,” says Clare. “But organizing maintenance depends very much on the physical properties you happen to be managing.”

Property type and vintage are important factors. “Garden, mid-rise or high-rise tend to have very different systems, and the skills required to maintain those systems cannot be generalized in the same way as, for example, leasing or accounting,” Clare says. The same is true of property vintage: 1980s buildings require more and different attention than newer ones.

“Specific skills matter, too: If you were trying to pool resources between properties, you could easily imagine the same skills being required for the same emergency in multiple properties simultaneously. That makes it risker to share maintenance resources between properties.

“Finally, we have to think about the cyclical nature of the work. While there are things that we can do to be more proactive in organizing maintenance, people still tend to move in and out around the beginning of the month, which means it’s hard to avoid the peaks in activity.”

Maintenance is a more complicated function to centralize, to be sure. And based on the growing selection of maintenance-related PropTech, it’s an area where technological innovation promises to drive substantial improvement. But the evolution of maintenance staffing models may be farther away than for other roles.

So... Cause or Coincidence?

Staff shortages are affecting how multifamily operators think about technology and the centralization of operations. But it is neither true to see staff shortages as causal in centralization decisions, nor to see them as coincidental.

The trend toward centralization was already underway before COVID. The pandemic and the staff shortages that followed appear to have accelerated the industry’s continuation down that path.

Companies have chosen this path for a variety of reasons. It is tempting to look straight to the most pragmatic explanations, like finding ways to handle staff shortages or increasing NOI by reducing headcount. But the professionals with whom this topic was discussed aspire to some combination of better, more flexible jobs, better customer experiences and the prospect of moving past aspects of multifamily operations that have always been suboptimal.

In the classic economic sense, technology is enabling a new era of specialization with tasks allocated to the resources that can perform them the most efficiently. That is the real story of centralization and the innovations that will continue to carry the industry toward it.

Dom Beveridge is Principal with 20 for 20, a multifamily technology consultancy.